AR AR1000-DD (Formerly AR1000RC5) 2023 free printable template

Show details

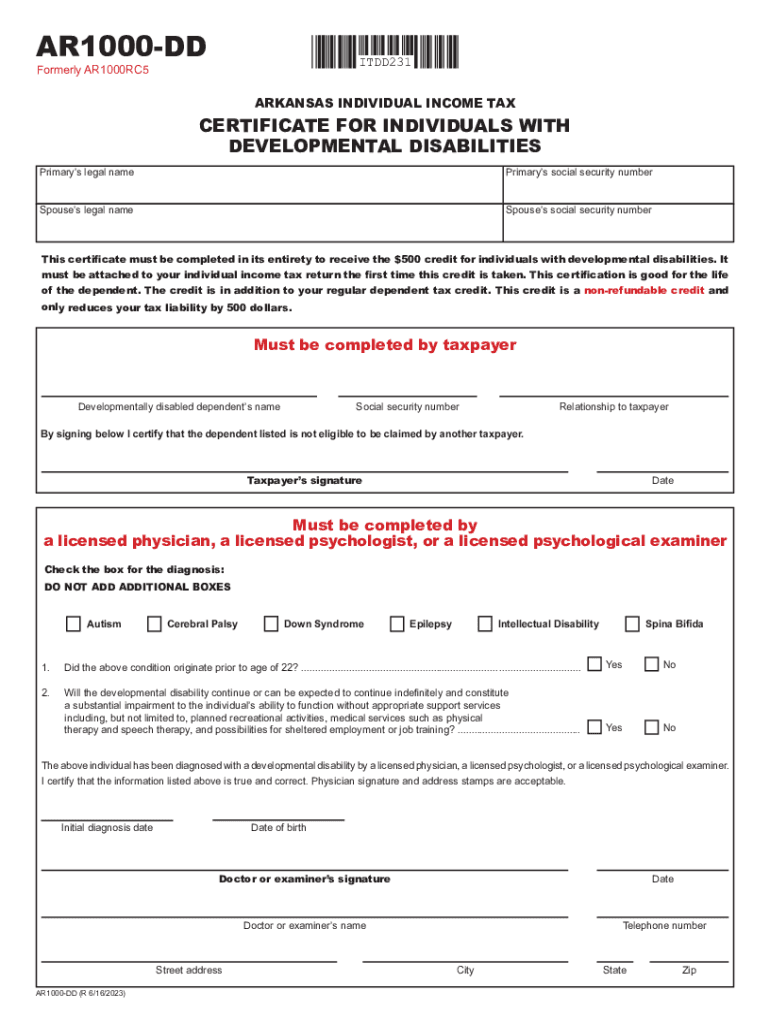

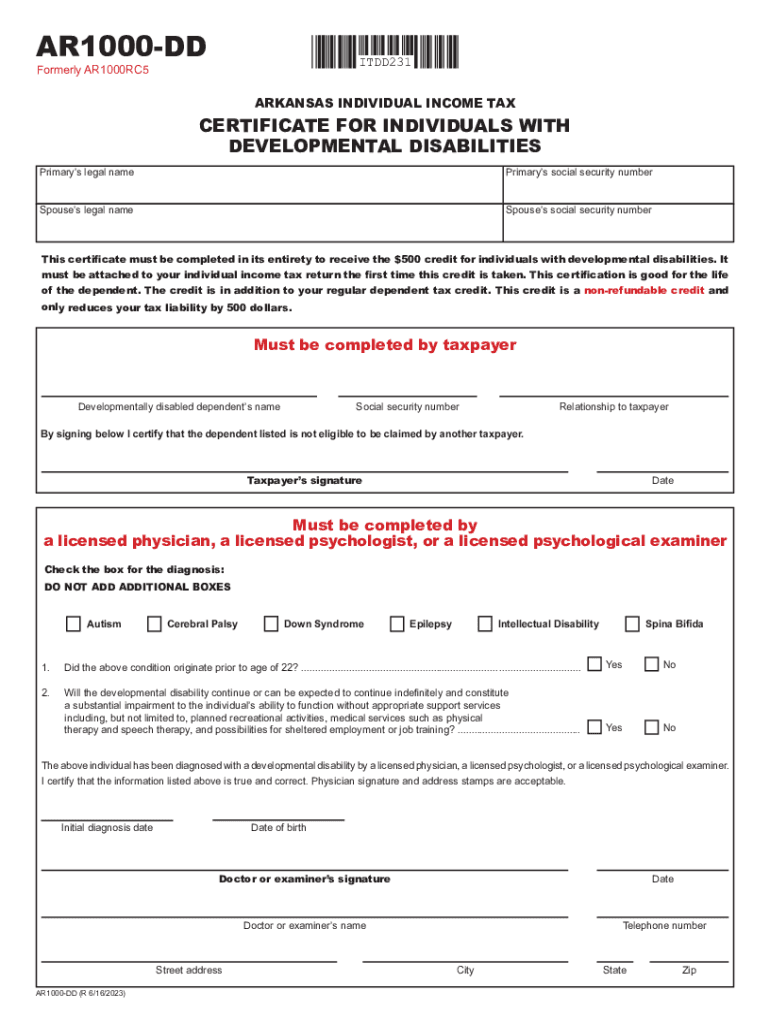

AR1000-DD PRINT FORM CLEAR FORM ITDD231 Formerly AR1000RC5 ARKANSAS INDIVIDUAL INCOME TAX CERTIFICATE FOR INDIVIDUALS WITH DEVELOPMENTAL DISABILITIES Primary s legal name Primary s social security number Spouse s legal name Spouse s social security number 7KLV FHUWL FDWH PXVW EH FRPSOHWHG LQ LWV HQWLUHW WR UHFHLYH WKH FUHGLW IRU LQGLYLGXDOV ZLWK GHYHORSPHQWDO GLVDELOLWLHV W PXVW EH DWWDFKHG WR RXU LQGLYLGXDO LQFRPH WD UHWXUQ WKH UVW WLPH WKLV FUHGLW LV WDNHQ 7KLV FHUWL FDWLRQ LV JRRG IRU WKH...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR AR1000-DD Formerly AR1000RC5

Edit your AR AR1000-DD Formerly AR1000RC5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR AR1000-DD Formerly AR1000RC5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR AR1000-DD Formerly AR1000RC5 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AR AR1000-DD Formerly AR1000RC5. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR1000-DD (Formerly AR1000RC5) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR AR1000-DD Formerly AR1000RC5

How to fill out AR AR1000-DD (Formerly AR1000RC5)

01

Gather all necessary personal and financial documentation.

02

Begin filling out the form by entering your personal information, including your name, address, and contact details.

03

Provide detailed descriptions of income sources and any deductions applicable.

04

Fill in the appropriate sections for the specific tax year you are reporting.

05

Double-check all figures for accuracy and completeness.

06

Sign and date the form before submission.

07

Submit the form electronically or by mail to the designated tax authority.

Who needs AR AR1000-DD (Formerly AR1000RC5)?

01

Individuals and businesses that are required to report their income and pay taxes in accordance with state regulations.

02

Tax professionals and accountants preparing tax returns for clients.

03

Anyone claiming specific tax credits or deductions that need to be documented.

Fill

form

: Try Risk Free

People Also Ask about

How much does a tax ID number cost in Arkansas?

Applying for an EIN for your Arkansas LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

What is the form for Arkansas state tax extension?

If you want to file specifically for a State of Arkansas Extension, you must file Arkansas form AR1055. This form must be postmarked on or before April 15.

How do I get an Arkansas tax ID number?

1. Telephone: Call the Toll-Free EIN number, 1-800-829-4933, Monday-Friday, 7:00 am – 10:00 pm to receive an EIN immediately. 2. Fax: Fax the completed Form SS-4 to (859) 669-5760 to receive an EIN within four business days.

Does Arkansas have state tax ID?

Arkansas State Income Tax ID Number You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

What is the Arkansas credit for developmentally disabled people?

The AR1000RC5 form is used by families to receive a $500 tax credit for individuals with developmental disabilities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AR AR1000-DD Formerly AR1000RC5 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your AR AR1000-DD Formerly AR1000RC5 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the AR AR1000-DD Formerly AR1000RC5 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your AR AR1000-DD Formerly AR1000RC5 in seconds.

How can I fill out AR AR1000-DD Formerly AR1000RC5 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your AR AR1000-DD Formerly AR1000RC5. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AR AR1000-DD (Formerly AR1000RC5)?

AR AR1000-DD is a tax form used for reporting specific financial information to the Arkansas Department of Finance and Administration. It is intended for certain entities or individuals who must disclose income, deductions, and other relevant tax details.

Who is required to file AR AR1000-DD (Formerly AR1000RC5)?

Entities and individuals engaged in specific business activities or who meet certain financial thresholds are required to file AR AR1000-DD. This typically includes businesses that have income sourced from Arkansas.

How to fill out AR AR1000-DD (Formerly AR1000RC5)?

To fill out AR AR1000-DD, you need to provide relevant financial information, including income, deductions, and other tax-related data as prompted in the form. It's important to follow the specific instructions provided with the form to ensure accurate reporting.

What is the purpose of AR AR1000-DD (Formerly AR1000RC5)?

The purpose of AR AR1000-DD is to ensure compliance with Arkansas tax laws by collecting necessary financial information from entities and individuals. It helps the state assess tax liabilities and administer tax collections effectively.

What information must be reported on AR AR1000-DD (Formerly AR1000RC5)?

Information that must be reported on AR AR1000-DD includes total income received, applicable deductions, tax credits claimed, and any other financial details required by the form instructions.

Fill out your AR AR1000-DD Formerly AR1000RC5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR ar1000-DD Formerly AR1000RC5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.