IRS 1120-L 2018 free printable template

Show details

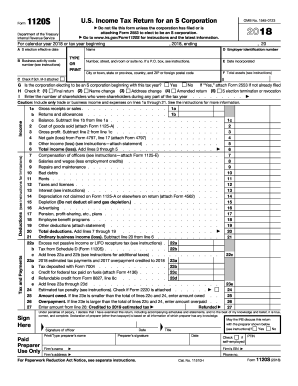

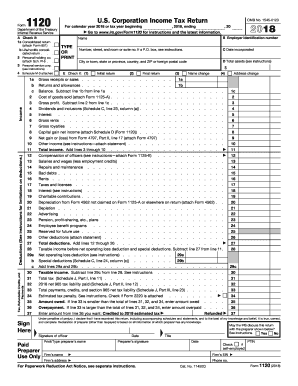

1120-L Form Department of the Treasury Internal Revenue Service A Check if Consolidated return attach Form 851. Life-nonlife consolidated return. Schedule M-3 Form 1120-L attached. Tax Refundable Credits and Payments Deductions See instructions for limitations on deductions. Income E U*S* Life Insurance Company Income Tax Return For calendar year 2018 or tax year beginning Please print or type Final return 2018 ending OMB No* 1545-0123 Go to www*irs*gov/Form1120L for instructions and the latest...information* Name B Employer identification number Number street and room or suite no. If a P. O. box see instructions. C Date incorporated City or town state or province country and ZIP or foreign postal code D Check applicable box if an election has been made under section s Name change Address change Amended return 953 c 3 C Gross premiums etc* less return premiums etc* Enter balance. Net decrease if any in reserves Schedule F line 12. Decrease in reserves under section 807 f. Investment...income Schedule B line 6 see instructions. Net capital gain Schedule D Form 1120 line 18. Income from a special loss discount account attach Form 8816 Other income attach statement. Life insurance company gross income. Add lines 1 through 7. Death benefits etc*. Deductible policyholder dividends under section 808. Assumption by another person of liabilities under insurance etc* contracts 15a Dividends reimbursable by taxpayer. Interest b Less tax-exempt interest expense. c Bal 15c Reserved for...future use. Other deductions see instructions attach statement. Add lines 9 through 18. 21a Subtotal* Subtract line 19 from line 8. Dividends-received and other special deductions Schedule A line 22. Plus b. Net operating loss deduction see instructions attach statement. 21b Gain or loss from operations. Subtract line 21c from line 20. Phased inclusion of balance of policyholders surplus account see instructions. Taxable income. Add lines 23 and 24 see instructions. Total tax. Schedule K line...10. 2018 Net 965 tax liability paid from Form 965-B Part II column k line 2 28a b c 2017 overpayment credited to 2018. Prior year s special estimated tax payments to be applied Estimated tax penalty. Check if Form 2220 is attached. Amount owed* If line 28k is smaller than the total of lines 26 27 and 29 enter amount owed. Overpayment. If line 28k is larger than the total of lines 26 27 and 29 enter amount overpaid. 2018 estimated tax payments Less 2018 refund applied for on Form 4466. 28d Tax...deposited with Form 7004. Credits 1 Form 2439 2 Form 4136 28e 28f 28g h i j U*S* income tax paid or withheld at source attach Form 1042-S. Refundable credit from Form 8827 line 8c. 21c 28b 28c d f g 28h 28i 28j 28k Enter amount from line 31 Credited to 2019 estimated tax Refunded Under penalties of perjury I declare that I have examined this return including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Declaration of...preparer other than taxpayer is based on all information of which preparer has any knowledge.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

To edit the IRS 1120-L form, access the PDF version of the form using a PDF editor. You can change text fields, fill in any necessary information, and adjust any calculations directly within the document. Utilize tools such as pdfFiller for an efficient editing experience that supports easy form correction before submission.

How to fill out IRS 1120-L

Filling out the IRS 1120-L form requires careful attention to detail. Begin by downloading the form from the IRS website or using a reliable form service. Gather all necessary financial documents, such as income statements and deductions relevant to your insurance activities. Follow these steps:

01

Enter your company’s legal name and address in the designated sections.

02

Provide the Employer Identification Number (EIN) to identify your tax account.

03

Report the amount of total income from premium collections and other receipts.

04

List allowable deductions to arrive at taxable income.

05

Calculate tax liability based on the provided tax rate.

About IRS 1120-L 2018 previous version

What is IRS 1120-L?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-L 2018 previous version

What is IRS 1120-L?

IRS 1120-L is the U.S. federal tax form used exclusively by life insurance companies. It reports the company's income, expenses, and tax liability applicable to business operations. The form provides the IRS with critical information regarding the financial status of life insurers, helping ensure compliance with federal tax laws.

What is the purpose of this form?

The primary purpose of Form 1120-L is to calculate and report the federal income tax liability of life insurance companies. It aids in maintaining transparency and accountability in the insurance sector, allowing the IRS to assess tax responsibilities accurately based on company income and allowable deductions.

Who needs the form?

Life insurance companies that engage in the business of insurance are required to file Form 1120-L. This includes corporations and other taxable entities that provide life insurance coverage. If a company operates under a different insurance line, it must use other appropriate tax forms.

When am I exempt from filling out this form?

Entities that do not qualify as life insurance companies under the Internal Revenue Code are exempt from filing Form 1120-L. Additionally, companies that operate exclusively as mutual insurers or that do not have taxable income may not be required to file.

Components of the form

The IRS 1120-L form comprises several key sections that include the company's basic information, income and deduction schedules, and tax computation. Other integral components include the tax calculation section, details regarding tax liability, and any applicable credits or payments already made by the company for the tax period.

What are the penalties for not issuing the form?

Failing to file Form 1120-L on time can result in penalties imposed by the IRS. These penalties may include a failure-to-file penalty, which can be calculated based on the tax due. Additionally, interest may accrue on any unpaid taxes, leading to increased amounts owed over time.

What information do you need when you file the form?

When filing the IRS 1120-L form, it is essential to have comprehensive financial records. Important information includes the total income from premiums received, operational expenses, investment income, and any deductions specific to the insurance sector. Accurate financial statements and prior year returns can also facilitate the completion of the form.

Is the form accompanied by other forms?

Form 1120-L typically needs to be filed in conjunction with additional schedules and attachments that provide a complete picture of the insurer's financial status. Commonly required attachments include a Balance Sheet and a detailed report of deductions claimed during the tax period. It is crucial to review IRS guidelines to ensure all necessary forms are included.

Where do I send the form?

Completed IRS 1120-L forms must be sent to the address designated by the IRS, which can vary based on the location and specific tax situation of the filing entity. Typically, form submissions should be directed to the appropriate Service Center listed in the IRS instructions for the form, or they can be checked through the IRS website for the latest filing addresses.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.