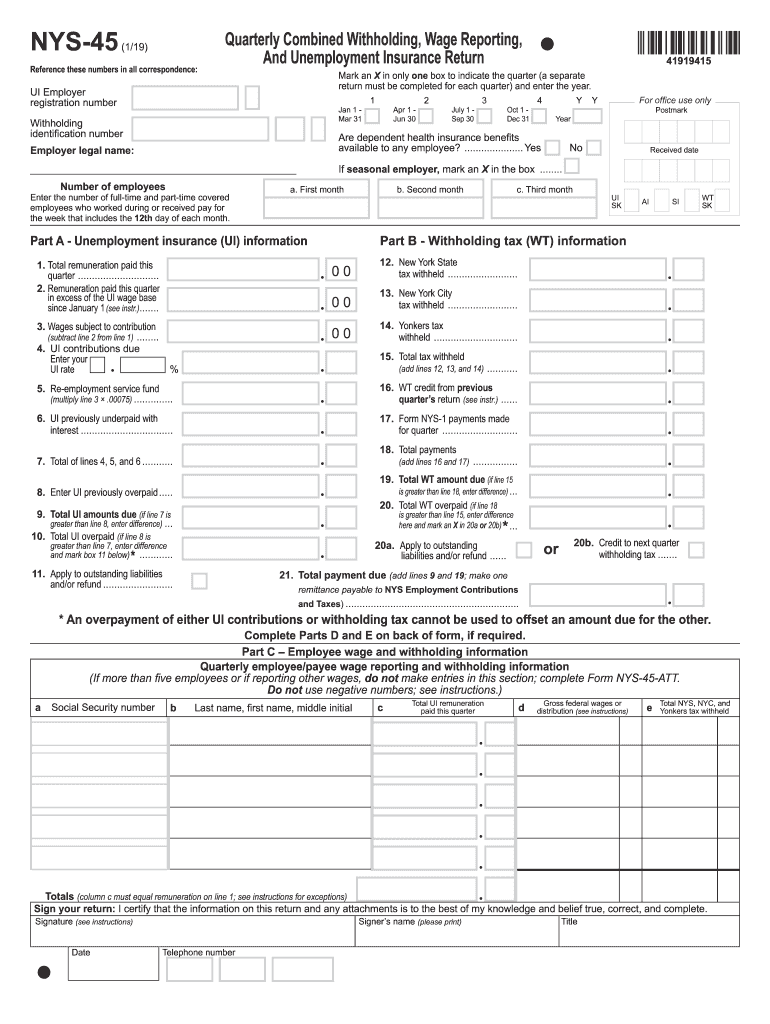

Who needs a Form NYS-45?

New York State employers who have to pay withholding tax and/or unemployment insurance contributions must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return.

What is Form NYS-45 for?

The purposes of the Form are the following:

- (a) reporting quarterly unemployment insurance information and contribution amounts due;

- (b) reconciling the withholding tax payments for the quarter;

- (c) reporting quarterly employee wage information and employee annual wage and withholding totals;

- (d) correction of the withholding information reported on NYS-1 form; and

- (e) reporting certain changes of business information.

Is Form NYS-45 accompanied by other forms?

An employer who operates more than one establishment in New York State may be requested to submit Form BLS 3020, Multiple Worksite Report, listing payroll data by industry and place of employment.

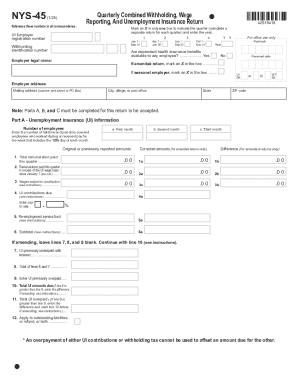

An employer must use Form NYS-45-ATT if : (1) the employer is reporting more than five employees; in this case no entries should be made in Part C of Form NYS-45; and (2) if the employer is reporting “other wages”.

When is Form NYS-45 due?

The due dates for Form NYS-45 returns are as follows:

|

Quarter |

Due date |

|

January 1 to March 31 |

April 30 |

|

April 1 to June 30 |

July 31 |

|

July 1 to September 30 |

October 31 |

|

October 1 to December 31 |

January 31 |

When the actual due date falls on a Saturday, Sunday, or legal holiday, New York State Tax Law permits you to file on the next business day.

How do I fill out Form NYS-45?

You may find very detailed instructions on how to fill the Form on the official website of the New York State Department of Taxation and Finance1

Where do I send Form NYS-45?

You must electronically file the Form NYS-45 to the New York State Department of Taxation and Finance using its online services2.

For more detailed instructions on electronic reporting of Form NYS-45, please visit this page3.

1check the link — https://www.tax.ny.gov/pdf/current_forms/wt/nys45i.pdf

2check the link — www.tax.ny.gov

3check the link — https://www.tax.ny.gov/pdf/publications/withholding/pub72.pdf