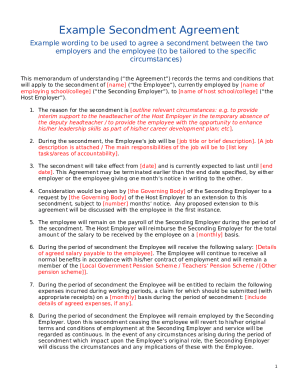

Get the free Loan Application Checklist - bluestone.com.au

Show details

Loan Application Checklist Application Documents Forms Signed Blue stone privacy consent form Signed Blue stone declarations form Statements 6 months mortgage & rental statements for owner occupied

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan application checklist

Edit your loan application checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan application checklist online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan application checklist. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan application checklist

How to fill out loan application checklist

01

Start by gathering all the required documents such as proof of income, employment details, identification documents, and bank statements.

02

Check the loan application form and determine what information is required. This may include personal details, financial information, and loan purpose.

03

Review the checklist provided by the lender or financial institution to ensure you have all the necessary documentation.

04

Fill out the loan application form carefully and accurately. Provide the requested information and double-check for any errors or omissions.

05

Attach the required supporting documents to the application form. Make sure all the documents are in the right format and are legible.

06

Once you have completed the application form and attached the necessary documents, review everything one final time to ensure nothing is missing or incorrect.

07

Submit the loan application along with the checklist and supporting documents to the lender. Follow their instructions for submission, whether it's online, in-person, or by mail.

08

Keep a copy of the completed loan application, checklist, and supporting documents for your own records.

09

Follow up with the lender periodically to check the status of your application and provide any additional information or documentation they may request.

10

Wait for the lender to review your application and make a decision. They will inform you of their decision and any next steps to take.

Who needs loan application checklist?

01

Anyone who is planning to apply for a loan needs a loan application checklist.

02

Banks and financial institutions often require borrowers to provide a checklist along with their loan application.

03

Individuals who want to ensure they have all the necessary documents and information before applying for a loan should use a loan application checklist.

04

Using a checklist can help borrowers avoid delays and increase the chances of their loan application being approved.

Fill

form

: Try Risk Free

People Also Ask about

What is the loan application form?

A loan application form is a document used by individuals or businesses (especially new businesses) to request a loan from a lender such as a bank or credit union.

How do I write a loan application form?

Tips For Loan Request Letter Describe the reason for the loan in detail. Be brief and include the relevant details of applying for the loan. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader.

What is needed for a complete loan application?

This initial application will often ask for your personal information, such as your name, contact information, date of birth, and Social Security number. You may also be required to state your desired loan amount and purpose as well as additional financial details like your gross monthly income or mortgage payment.

What is the importance of loan application form?

The form typically requests personal, financial, and employment information from the applicant, as well as information about the loan amount, purpose, and repayment terms. The lender uses the information provided to assess the applicant's creditworthiness and determine whether to approve or deny the loan request.

What is loan application approval?

Loan Approval means an approval for a loan given by the Originator to a prospective Borrower and includes an approval for the sale of an Approved Mortgage to the Trustee.

Is bluestone the same as basalt?

Bluestone is a commercial name for building stone, which is often basalt, a volcanic rock. It is very hard, durable, non slip and looks great.

What is Bluestone Australia?

In Australia, bluestone is a type of basalt and is characterised by its blue-grey colour tones. One of the key characteristics of bluestone is the naturally occurring cat's paws. These markings are formed from gas extrusions during the stone formation millions of years ago.

Where does Australian bluestone come from?

Our premium quality Australian bluestone is quarried and sourced from a volcanic flow that runs from inland Mount Rouse at Penshurst to the sea at Port Fairy in south western Victoria.

What is bluestone made of?

In the U.S. it is usually a kind of sandstone. It is deep blue in colour, but in other areas of the U.S ,it is a variety of limestone that was formed in deep water and had less subjection to light. Because of this the rock eventually fades from a deep blue to a light grey after it has been exposed to the sun.

What is special about bluestone?

Bluestone is durable and will last many years. Its natural earth-tone colors are gracious and attractive and complement almost any landscape. Its rough surface also means that it rarely gets slick or slippery.

What are the steps involved in taking a loan?

From documents required to how to apply for a Personal Loan, we have all the angles covered: Step 1: Determine your requirement. Figure out why you need a Personal Loan and how much you need. Step 2: Check loan eligibility. Step 3: Calculate monthly instalments. Step 4: Approach the bank. Step 5: Submit documents.

What 4 things do lenders look at?

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

What are collateral documents for loans?

Collateral documents include any documents granting a security interest in collateral by the borrower, parent or subsidiary in favor of the lender and all other documents required to be executed or delivered pursuant to those documents. Collateral documents do not include guaranties.

What is the loan documentation?

Loan documents are documents provided and requested by lenders for the purpose of providing a loan. They are typically statements of personal and financial information of the borrower to approve a loan. These documents are used by the lenders to evaluate whether or not they will provide you with a loan.

What is a loan application form?

A loan application form is a document used by individuals or businesses (especially new businesses) to request a loan from a lender such as a bank or credit union.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get loan application checklist?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the loan application checklist in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit loan application checklist online?

With pdfFiller, it's easy to make changes. Open your loan application checklist in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete loan application checklist on an Android device?

Complete loan application checklist and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is loan application checklist?

The loan application checklist is a list of documents and information that a borrower must gather and submit when applying for a loan.

Who is required to file loan application checklist?

Any individual or entity seeking a loan from a financial institution may be required to file a loan application checklist.

How to fill out loan application checklist?

To fill out a loan application checklist, the borrower must gather all required documents and information, such as proof of income, credit history, and personal identification, and submit them to the lender.

What is the purpose of loan application checklist?

The purpose of the loan application checklist is to ensure that the borrower provides all necessary information and documentation for the lender to evaluate the loan application.

What information must be reported on loan application checklist?

The information reported on a loan application checklist may vary depending on the lender, but generally includes personal identification, income verification, credit history, and details of the loan being requested.

Fill out your loan application checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Application Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.