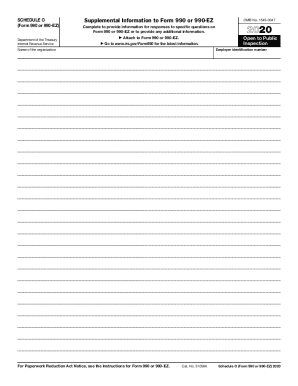

IRS 990 - Schedule O 2019 free printable template

Instructions and Help about IRS 990 - Schedule O

How to edit IRS 990 - Schedule O

How to fill out IRS 990 - Schedule O

About IRS 990 - Schedule O 2019 previous version

What is IRS 990 - Schedule O?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

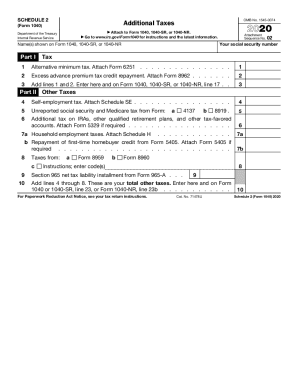

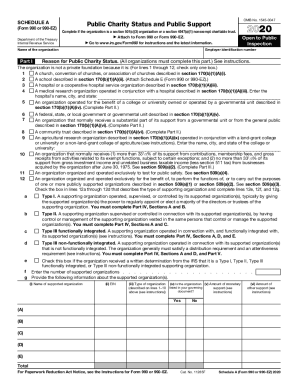

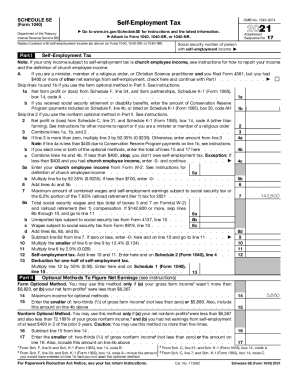

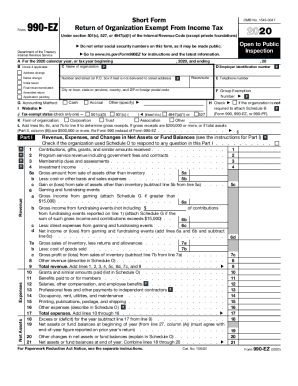

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule O

What should I do if I realize I've made a mistake after submitting IRS 990 - Schedule O?

If you've submitted IRS 990 - Schedule O and discover an error, you can file an amended return. Follow the IRS guidelines on how to submit corrections to ensure proper processing. It's important to make these adjustments promptly to maintain compliance.

How can I track the status of my submitted IRS 990 - Schedule O?

To verify the processing and receipt of your IRS 990 - Schedule O submission, you can use the IRS e-file tracking system. This tool helps you check whether your form has been received and provides updates if there are any issues, such as rejection codes.

What are common errors on IRS 990 - Schedule O that I should watch out for?

Common errors on IRS 990 - Schedule O often include incorrect information about amendments, misclassified items in financial reporting, or inaccuracies in organizational details. To avoid these mistakes, double-check all entries and ensure they align with your primary IRS 990 form.

How do I respond to a notice or audit from the IRS regarding my IRS 990 - Schedule O?

If you receive a notice or audit related to IRS 990 - Schedule O, it's crucial to respond promptly. Prepare the necessary documentation requested in the notice and consult with a tax professional for guidance on formulating your response effectively.

What are the technical requirements for e-filing IRS 990 - Schedule O?

When e-filing IRS 990 - Schedule O, ensure your software meets the IRS specifications and is compatible with the latest browser versions. Check the technical requirements on the IRS website to ensure a smooth e-filing process without any hiccups.

See what our users say