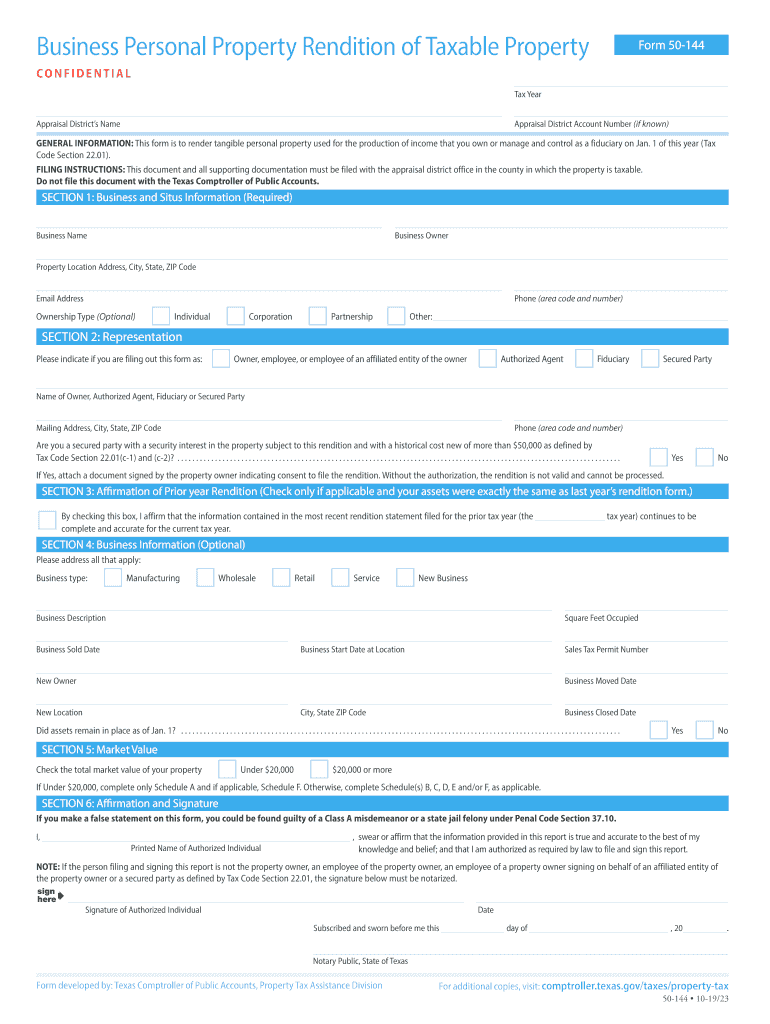

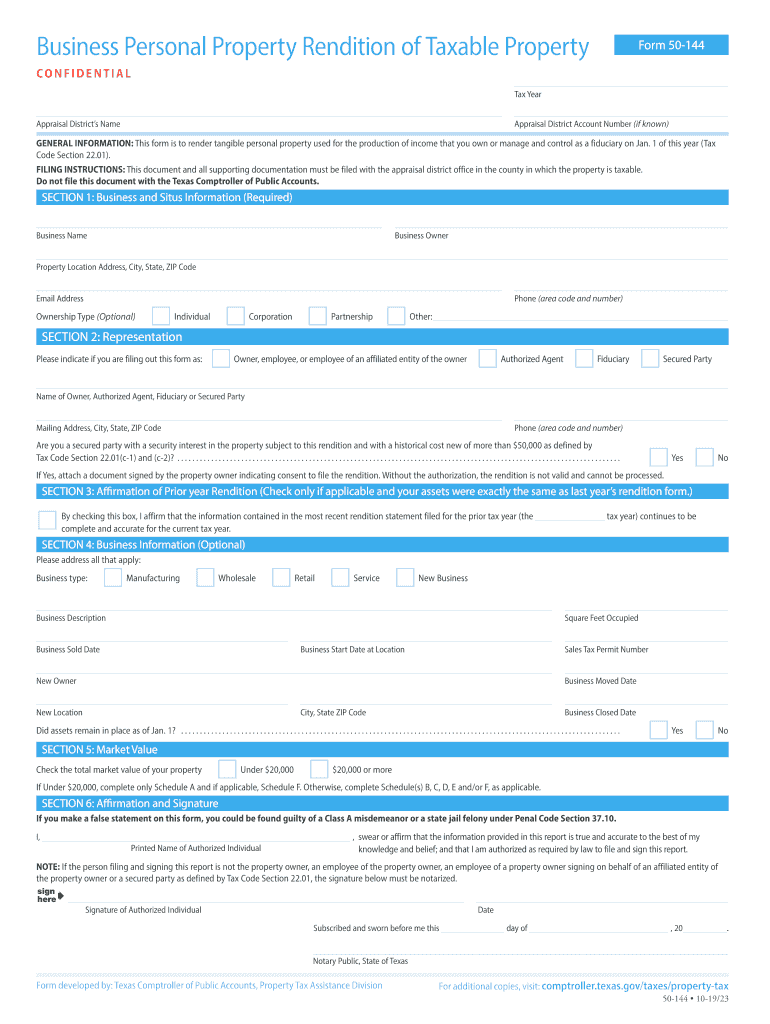

TX Comptroller 50-144 2019 free printable template

Get, Create, Make and Sign form 50 144 2020

How to edit form 50 144 2020 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller 50-144 Form Versions

How to fill out form 50 144 2020

How to fill out TX Comptroller 50-144

Who needs TX Comptroller 50-144?

Instructions and Help about form 50 144 2020

In this video were going to talk about how to reduce fractions in the simplest form so lets go ahead and begin lets start with a fraction 810 so what would you do to reduce it in the simplest form the first thing I would do is look at the two numbers if they're both even divided by 2 8 and 10 are both even numbers so what is 8 divided by 2 what is half of 8 half of 8 is 4 half of 10 or 10 divided by 2 is 5, so the reduced form is 45 so go ahead and work on these examples try 14 over 22 and 36 over 20 feel free to pause the video and reduce these fractions once you have your answer unpause it and see if you have the right solution so lets go ahead and begin 14 and 22 are both even so let's divide by 2 14 divided by 2 is 7 22 divided by 2 is 11 and so that's the answer for the first one 7 over 11 now for the next one 36 and 20 are both even numbers so lets divide by 2 half of 36 is 18 half of 20 is 10 but now if we look at our answer 18 in center both even so we could divide by 2 again half of 18 is 9 half of 10 is 5, so the final answer is 9 divided by 5 now lets try a harder example try this one 120 over 48 go ahead and reduce it so once again we can see that both numbers are even so lets divide both numbers by 2 half of 120 is 60 and 48 divided by 2 that's 24, so both numbers are still even which means that we could divide by 2 again half of 60 is 30 24 over 2 is 12, and then we could divide by 2 again this technique is very useful its simple, but it may take some time, but it works 30 divided by 2 is 15 12 divided by 2 is 6 now notice that we have an odd number if you have an odd number try dividing it by 3 see if that works notice that 6 and 15 are both divisible by 3 15 divided by 3 is 5 6 divided by 3 is 2, so the final answer is 5 over 2 lets try some more examples with odd numbers try these to reduce 12 over 21 and 18 over 27 so take a minute and work on those so 21 is an odd number lets check to see if it's divisible by 3 12 divided by 3 is equal to 4 21 divided by 3 is 7 since they're both divisible by 3 you can do it, so the final answer is 4 over 7 we can't reduce that any further now 18 and 27 are both divisible by 3 18 divided by 3 is 6 27 divided by 3 is 9 now 6 & 9 are both multiples of 3, so you could divide it by 3 again if you want to which you should 6 divided by 3 that's 2 and 9 divided by 3 is 3, so the final answer here is 2 over 3 try this one reduce 30 divided by 48, so both numbers are even, so we can start dividing 2 by 2 just to keep things simple and so were going to get 15 over 24 now 15 and 24 both multiples of student so knowing that you can divide by 3 plus whenever you see an odd number its good to try 2 divided by 3 15 divided by 3 is 5 and 24 divided by 3 is 8 and so here we have the final answer 58 now let's work on a different example what would you do if you see a fraction that looks like this 25 over 45 whenever a number contains a 5 at the end that means that it's divisible by 5 so in this example we want...

People Also Ask about

How to protest property taxes and win Texas?

Does a tax sale wipe out a mortgage in Texas?

At what age can you stop paying property taxes in Texas?

How can I reduce my property taxes in Texas?

How to fill out business personal property rendition in Texas?

What is the 10 percent property tax rule in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 50 144 2020 in Gmail?

How do I make edits in form 50 144 2020 without leaving Chrome?

How do I fill out the form 50 144 2020 form on my smartphone?

What is TX Comptroller 50-144?

Who is required to file TX Comptroller 50-144?

How to fill out TX Comptroller 50-144?

What is the purpose of TX Comptroller 50-144?

What information must be reported on TX Comptroller 50-144?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.