TX Comptroller 50-144 2020 free printable template

Show details

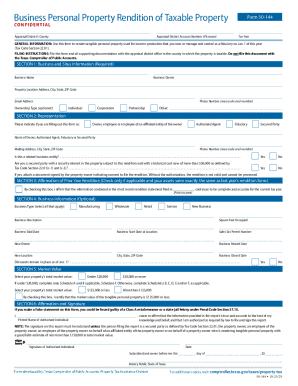

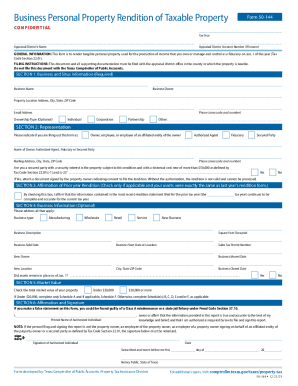

Business Personal Property Rendition of Taxable Property CONFIDENTIALForm 50144 Tax Year Appraisal Districts Name Appraisal District Account Number (if known)GENERAL INFORMATION: This form is to render

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-144

Edit your TX Comptroller 50-144 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-144 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-144 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 50-144. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-144 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-144

How to fill out TX Comptroller 50-144

01

Obtain a copy of the TX Comptroller 50-144 form from the Texas Comptroller's website.

02

Fill in the taxpayer's name and address in the designated fields at the top of the form.

03

Indicate the reason for the exemption in the appropriate section.

04

Complete the property details, including the property description and location.

05

Provide the ownership details, including the names of all owners and their contact information.

06

Sign and date the form to certify the information is accurate.

07

Submit the completed form to the local appraisal district by the specified deadline.

Who needs TX Comptroller 50-144?

01

Property owners in Texas who wish to apply for an exemption from property taxes can benefit from filing the TX Comptroller 50-144 form.

02

Entities such as nonprofits, religious organizations, and educational institutions may need this form to claim their tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from property taxes in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How can I reduce my property taxes in Texas?

The steps below will show you how to lower property taxes in Texas, so you can move forward with your appeal. File a notice of protest. Prepare information for hearing. Attend an informal hearing at the Appraisal District office. Attend an Appraisal Review Board hearing. Appeal through district court or arbitration.

What is the 10 percent property tax rule in Texas?

The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

At what age can you stop paying property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

How to fill out business personal property rendition in Texas?

Write a brief description of the business and the square feet occupied. Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX Comptroller 50-144?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the TX Comptroller 50-144 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in TX Comptroller 50-144 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX Comptroller 50-144 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the TX Comptroller 50-144 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your TX Comptroller 50-144 in minutes.

What is TX Comptroller 50-144?

TX Comptroller 50-144 is a form used by property owners in Texas to report information related to property tax exemptions, specifically for properties owned by certain non-profit organizations.

Who is required to file TX Comptroller 50-144?

Non-profit organizations that own property and wish to claim a property tax exemption must file TX Comptroller 50-144.

How to fill out TX Comptroller 50-144?

To fill out TX Comptroller 50-144, applicants should provide accurate property details, the organization's information, and any necessary documentation that supports the exemption claim.

What is the purpose of TX Comptroller 50-144?

The purpose of TX Comptroller 50-144 is to formally request a property tax exemption for qualifying non-profit organizations in Texas, ensuring compliance with state tax regulations.

What information must be reported on TX Comptroller 50-144?

The information that must be reported includes the name of the organization, address of the property, type of exemption sought, and any additional details necessary to support the exemption claim.

Fill out your TX Comptroller 50-144 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-144 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.