TX Comptroller 50-144 2016 free printable template

Show details

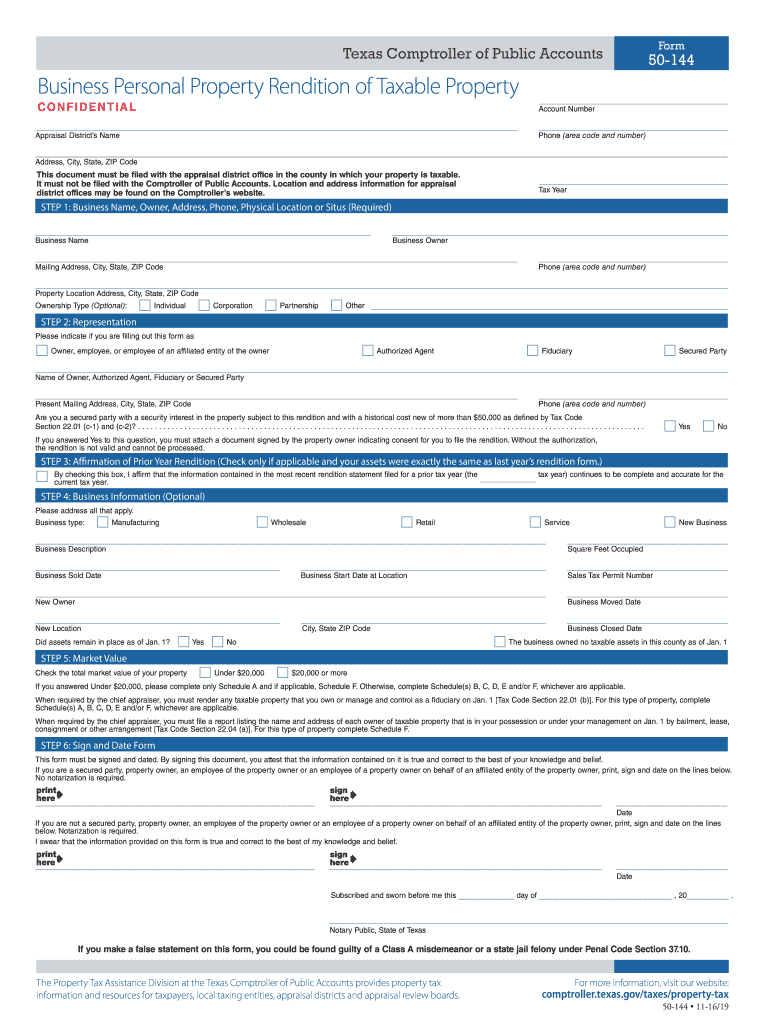

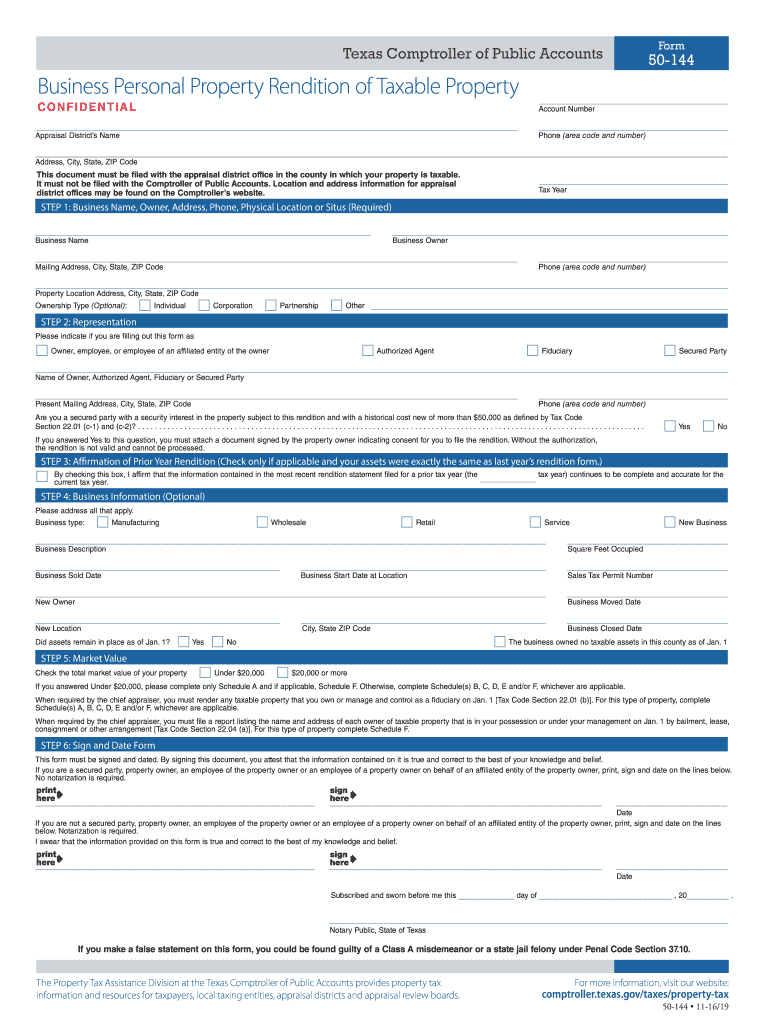

Notary Public, State of Texas. Texas Comptroller of Public Accounts. Form. 50

144. Business Personal Property Rendition of Taxable Property. CONFIDENTIAL.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas form 50 144

Edit your texas form 50 144 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas form 50 144 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas form 50 144 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas form 50 144. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-144 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas form 50 144

How to fill out TX Comptroller 50-144

01

Obtain TX Comptroller Form 50-144 from the Texas Comptroller's website or your local tax office.

02

Fill out the entity name and contact information at the top of the form.

03

Provide details about the property, including its location, type, and value.

04

Indicate whether the property is exempt and specify the reason for the exemption.

05

If applicable, include information about any prior tax exemptions for the property.

06

Review the information for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate appraisal district by the deadline.

Who needs TX Comptroller 50-144?

01

Property owners in Texas seeking tax exemptions for their properties need TX Comptroller Form 50-144.

02

Non-profit organizations claiming exemption from property taxes also require this form.

Fill

form

: Try Risk Free

People Also Ask about

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

Should I protest my property taxes in Texas?

Consequently, as a homeowner, you're likely to pay more taxes than what is fair at some point. That's a reason to protest your tax appraisal in Texas. Statistics from Dallas County in Texas reveal that about 50% of tax protests are usually successful and that those who protest typically save an average of $600.

What is the best way to protest property taxes in Texas?

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest (PDF) with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered — whichever date is later.

What is a business personal property tax rendition in Texas?

What is a rendition for Business Personal Property? A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. The District uses the information to help estimate the market value of your property for taxation purposes.

How to fill out business personal property rendition in Texas?

Write a brief description of the business and the square feet occupied. Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address.

Is it worth protesting property taxes in Texas?

Rarely are assessed values raised at the Appraisal Review Board hearing. In fact, property taxes are only raised about once in every 10,000 Appraisal Review Board hearings. That is less than 1% of the time! While there's little risk your property taxes will increase, we do not advise you protest yourself.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit texas form 50 144 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including texas form 50 144, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in texas form 50 144?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your texas form 50 144 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the texas form 50 144 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your texas form 50 144 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is TX Comptroller 50-144?

TX Comptroller 50-144 is a form used by property owners in Texas to report certain information to the Texas Comptroller's office regarding property that is eligible for an exemption or special valuation.

Who is required to file TX Comptroller 50-144?

Property owners who are seeking to claim an exemption for their property, such as an agricultural or timber exemption, are required to file TX Comptroller 50-144.

How to fill out TX Comptroller 50-144?

To fill out TX Comptroller 50-144, property owners need to provide information such as their name, property details, the type of exemption being claimed, and any supporting documentation required by the form.

What is the purpose of TX Comptroller 50-144?

The purpose of TX Comptroller 50-144 is to facilitate the reporting and claiming of property exemptions, ensuring that property owners provide necessary information for the assessment and validation of their exemption status.

What information must be reported on TX Comptroller 50-144?

The information that must be reported on TX Comptroller 50-144 includes property owner details, property identification, the specific exemption being applied for, and any related financial data that supports the exemption claim.

Fill out your texas form 50 144 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Form 50 144 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.