TX Comptroller 50-144 2014 free printable template

Show details

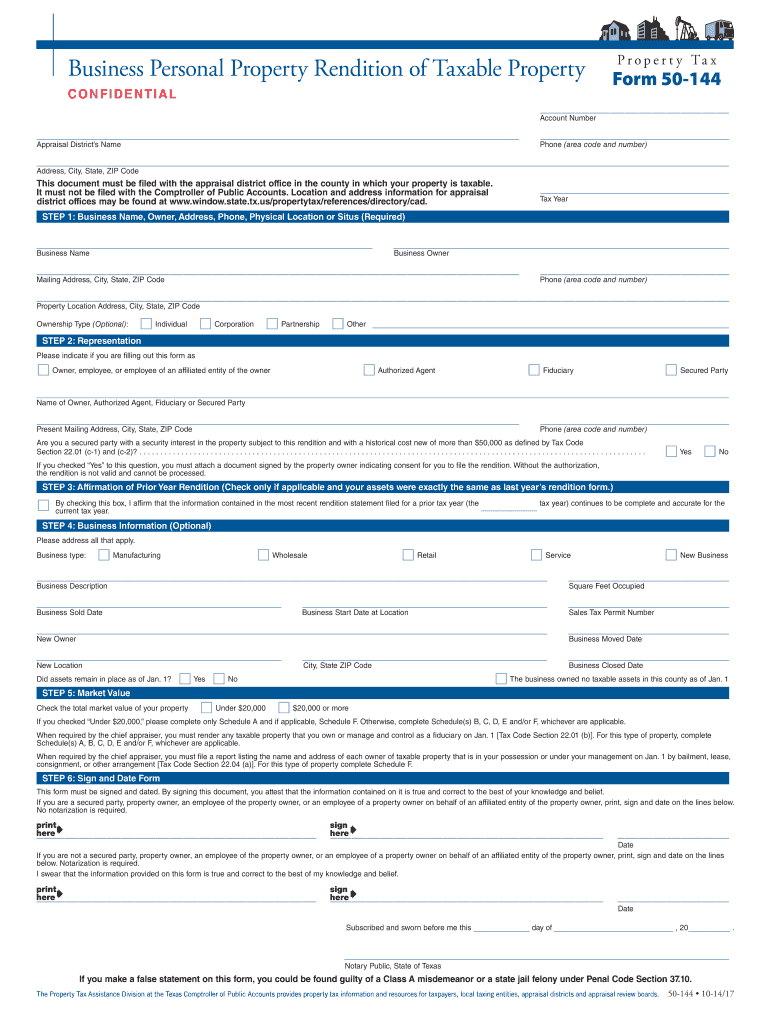

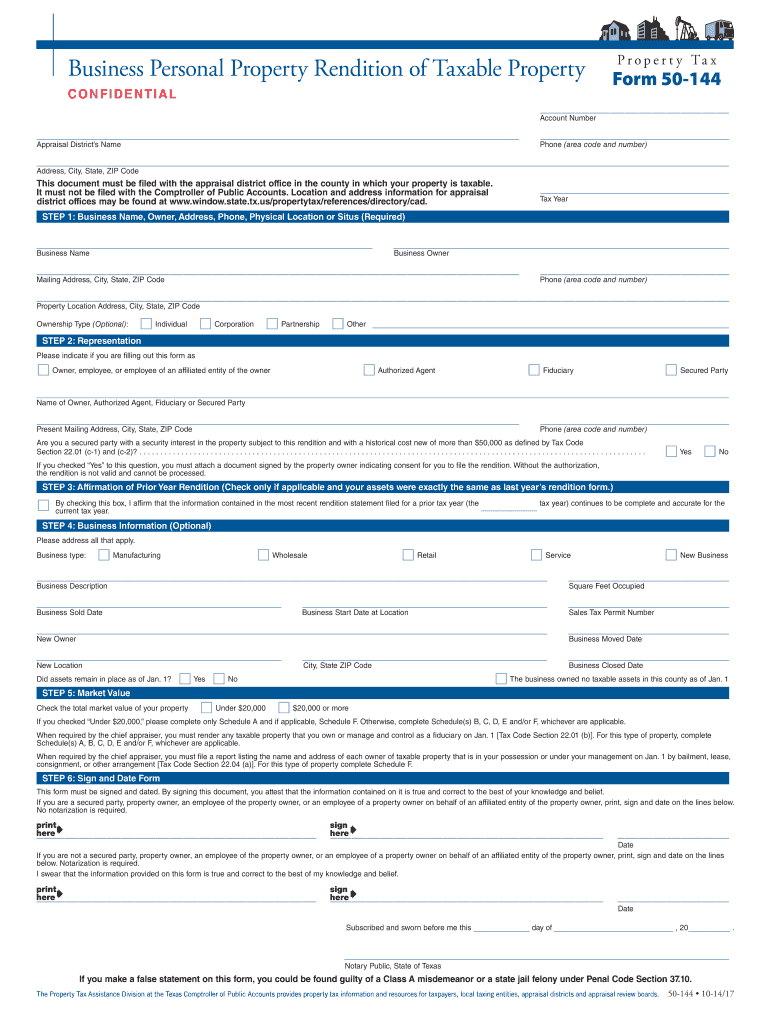

Business Personal Property Rendition of Taxable Property P r o p e r t y Ta x Form 50-144 CONFIDENTIAL Account Number Appraisal District s Name Phone (area code and number) Address, City, State, ZIP

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas form 50 144

Edit your texas form 50 144 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas form 50 144 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas form 50 144 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit texas form 50 144. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-144 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas form 50 144

How to fill out TX Comptroller 50-144

01

Obtain the TX Comptroller 50-144 form from the Texas Comptroller's website or local office.

02

Fill in the property owner's name and contact information at the top of the form.

03

Provide the property identification number, which can usually be found on tax statements.

04

Indicate the type of property (residential, commercial, etc.) by selecting the appropriate option.

05

Complete the section detailing the property's current use and any special characteristics.

06

If claiming exemption, check the appropriate box and provide any required documentation.

07

Sign and date the form at the bottom to validate your submission.

08

Submit the completed form to the appropriate local appraisal district office by the specified deadline.

Who needs TX Comptroller 50-144?

01

Individuals or businesses seeking to apply for a property tax exemption in Texas.

02

Property owners who wish to report changes in property use that may affect taxation.

03

Taxpayers needing to correct previous filings or update information related to their property.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from paying property taxes in Texas?

To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in the home as his or her principal residence.

What is the over 65 property tax exemption in Texas?

Age 65 & disabled exemption Homeowners qualify for a $10,000 homestead exemption in addition to the $25,000 for school districts.

Do seniors get a tax break in Texas?

Homestead Exemption for Seniors Homestead exemptions are at least a $25,000 property value reduction. Seniors qualify for an additional $10,000 reduction in most cases. Taxing districts can also offer up to 20% reduction in a homestead value with reductions starting at $5,000.

When did appraisal districts start in Texas?

Appraisal districts were formed by the Texas Legislature in 1979 as part of a sweeping change designed to standardize the administration of local property taxes. Senate Bill 621, or the “Peveto Bill”, was named for Rep. Wayne Peveto from Orange, Texas and formed the foundation of our current property tax system.

Do you need appointment for Harris County Appraisal District?

Appointments are not required for making property tax payments. All tax office branch locations are open for walk-in property tax payments.

Why was the appraisal district created in Texas?

In 1979, the 66th Texas Legislature, reacting to a chronic and growing problem of inequitable and unfair taxation, passed new legislation in Senate Bill 621 requiring that a centralized agency is established in each county for the purpose of appraising property for ad valorem tax purposes.

What is the Appraisal District in Harris County?

The Harris County Appraisal District is a political subdivision of the State of Texas created by the legislature through enactment of Subchapter A, Chapter 6, Tax Code.

What are appraisal districts in Texas?

Appraisal districts are responsible for appraising property for property tax purposes for each taxing unit that imposes property taxes on property in the appraisal district. An appraisal district is established in each county and has the same boundaries as the county's boundaries.

At what age do you stop paying school taxes in Texas?

Sometimes called the “senior freeze,” property owners 65 and over reach what is known as the homestead tax celling. This tax ceiling states that once you reach the age of 65, your school district taxes on a resident homestead cannot increase.

What is an appraisal district in Texas?

Appraisal districts are responsible for appraising property for property tax purposes for each taxing unit that imposes property taxes on property in the appraisal district. An appraisal district is established in each county and has the same boundaries as the county's boundaries.

Who regulates appraisal districts in Texas?

(a) The appraisal district is governed by a board of directors. Five directors are appointed by the taxing units that participate in the district as provided by this section. If the county assessor-collector is not appointed to the board, the county assessor-collector serves as a nonvoting director.

How many appraisal districts are in Texas?

Property tax consulting services available in all 254 Texas Appraisal Districts including Harris County Appraisal District, Fort Bend Appraisal District, Brazoria Appraisal District, Galveston Appraisal District, Montgomery Appraisal District, Dallas Appraisal District, Tarrant Appraisal District, Collin Appraisal

At what age do you stop paying property taxes in Texas?

Property Tax and Appraisals For many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

How much can the appraisal district increase in Texas?

The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my texas form 50 144 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your texas form 50 144 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit texas form 50 144 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your texas form 50 144 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the texas form 50 144 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your texas form 50 144.

What is TX Comptroller 50-144?

TX Comptroller 50-144 is a form used in Texas for reporting information regarding property tax exemptions for certain types of property.

Who is required to file TX Comptroller 50-144?

Entities that own property seeking an exemption from property taxes are required to file TX Comptroller 50-144.

How to fill out TX Comptroller 50-144?

To fill out TX Comptroller 50-144, one must provide accurate details about the property, the exemption being sought, and any relevant supporting documentation.

What is the purpose of TX Comptroller 50-144?

The purpose of TX Comptroller 50-144 is to facilitate the assessment and determination of property tax exemptions in Texas.

What information must be reported on TX Comptroller 50-144?

Reported information on TX Comptroller 50-144 includes the property owner's details, property description, exemption type, and any supporting evidence for the exemption request.

Fill out your texas form 50 144 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Form 50 144 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.