KS DoR CR-16 2019 free printable template

Show details

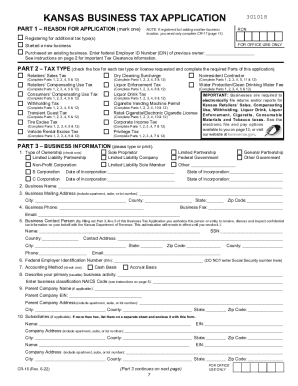

Have you or any member of your firm previously held a Kansas tax registration number or name of business Part 3 continues on next page CR-16 Rev. 9-18 No Yes If yes list previous number FOR OFFICE USE ONLY OR ENTER YOUR EIN SSN PART 3 continued 12. KANSAS BUSINESS TAX APPLICATION PART 1 REASON FOR APPLICATION mark one 311018 RCN NOTE If registered but adding another business location you need only complete CR-17 page 15. Complete and submit an application MF-53 for each retail location....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR CR-16

Edit your KS DoR CR-16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR CR-16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR CR-16 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KS DoR CR-16. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR CR-16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR CR-16

How to fill out KS DoR CR-16

01

Obtain the KS DoR CR-16 form from the Kansas Department of Revenue website or office.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate the type of application you are submitting (e.g., new license, renewal, etc.).

04

Provide any required identification numbers, such as Social Security number or tax ID.

05

Complete the specific sections relevant to your application type, following instructions on the form.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the form along with any required fees or supporting documentation to the appropriate address.

Who needs KS DoR CR-16?

01

Individuals applying for a new driver's license or renewing an existing one.

02

Persons needing to update their personal information on their driver's license.

03

Applicants seeking to change their driving status or obtain a special permit.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a Kansas tax ID?

Kansas State Tax ID Number You'll need it if you're hiring employees in Kansas, if you're selling taxable goods and services in the state, or if you're going to owe excise taxes on regulated goods like alcohol or tobacco.

How do you set up sales tax?

Formula: Item or service cost x sales tax (in decimal form) = total sales tax. Once you've calculated sales tax, make sure to add it to the original cost to get the total cost. If the total sales tax is $5 and your original item cost was $100, your total cost will be $105.

Who needs an annual report?

Annual report filing requirements One requirement imposed by the state corporation and LLC statutes is for corporations and LLCs to file an annual report in the formation state and every state where they are qualified or registered to do business.

How do I set up sales tax in Kansas?

How to File and Pay Sales Tax in Kansas File online – File online at the Kansas Department of Revenue. File by mail – You can use Form ST-16 for single jurisdiction filers or Form ST-36 for multiple jurisdiction filers and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

How do I file a foreign entity in Kansas?

To register a foreign corporation in Kansas, you must file a Kansas Foreign Corporation Application with the Kansas Secretary of State. You can submit this document by mail, by fax, or in person. The Foreign Corporation Application for a foreign Kansas corporation costs $115 to file.

How do I get proof of Kansas withholding?

For assistance, call the Kansas Department of Revenue at 785-368-8222. withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources.

How do I register a foreign LLC in the US?

How to Register a Foreign LLC in California Obtain a Certificate of Good Standing. You will need a Certificate of Good Standing from your home state in order to register a foreign LLC in California. Determine Your LLC Name for Use in California. Submit Application to Register Foreign LLC. File Statement of Information.

How do I get a KS sales tax number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

Does a foreign LLC have to register in Kansas?

If an out-of-state business entity is “doing business” in Kansas, it must file an application for authority. Please refer to K.S.A. 17-7932, which defines “doing business” in the state of Kansas.

How do I file a foreign LLC in Kansas?

To register a foreign LLC in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. You can submit this document by mail, fax, or in person. The application costs $165 to file. (Add $20 if filing by fax.)

Do all companies need an annual report?

In general, most states require corporations and other businesses with shareholders to file annual reports. If they fail to do so, they may lose their corporate designation and the tax advantages that go with that designation.

Who Must File KS annual report?

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

What is Kansas state tax registration number?

1) Your Kansas State Identification Number is your sales tax license number with the prefix of either 004 or 005 as the first 3 digits, depending on the type of return that you need to file. (The prefix is based on whether you need to file Sales Tax or Retailer's Compensating Use Tax.)

Do I need to register for sales tax in Kansas?

If you have sales tax nexus in Kansas, you're required to register with the Kansas DOR and to charge, collect, and remit the appropriate tax to the state.

Who has to file an annual report in Kansas?

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

Does Kansas have a state withholding form?

The Kansas Form K-4 should be completed as soon as an employee is hired or taxable payments begin. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual.

How do I register for Kansas withholding?

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

How do I get a Kansas state tax ID number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

Who files an annual report?

Businesses typically file annual reports electronically, in many cases using a registered agent who can complete the required documents on the company's behalf.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KS DoR CR-16 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like KS DoR CR-16, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the KS DoR CR-16 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign KS DoR CR-16. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out KS DoR CR-16 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your KS DoR CR-16. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is KS DoR CR-16?

KS DoR CR-16 is a tax form used in Kansas for reporting certain financial information to the Kansas Department of Revenue.

Who is required to file KS DoR CR-16?

Individuals or entities engaged in specific activities subject to taxation in the state of Kansas are required to file KS DoR CR-16.

How to fill out KS DoR CR-16?

To fill out KS DoR CR-16, gather necessary financial documentation, complete the form with accurate information, and submit it by the designated deadline.

What is the purpose of KS DoR CR-16?

The purpose of KS DoR CR-16 is to collect information for tax assessment and compliance purposes by the Kansas Department of Revenue.

What information must be reported on KS DoR CR-16?

The information that must be reported on KS DoR CR-16 includes income, deductions, and any applicable credits relevant to the entity's financial activities.

Fill out your KS DoR CR-16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR CR-16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.