KS DoR CR-16 2020 free printable template

Show details

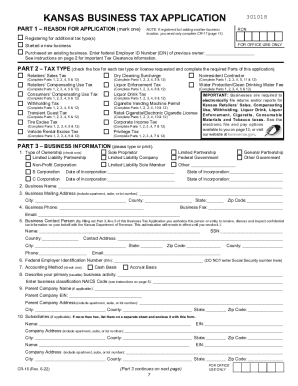

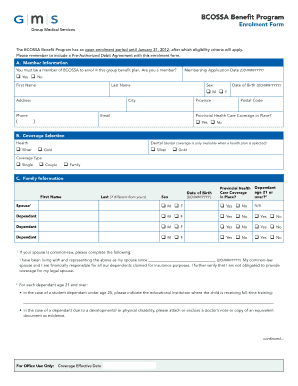

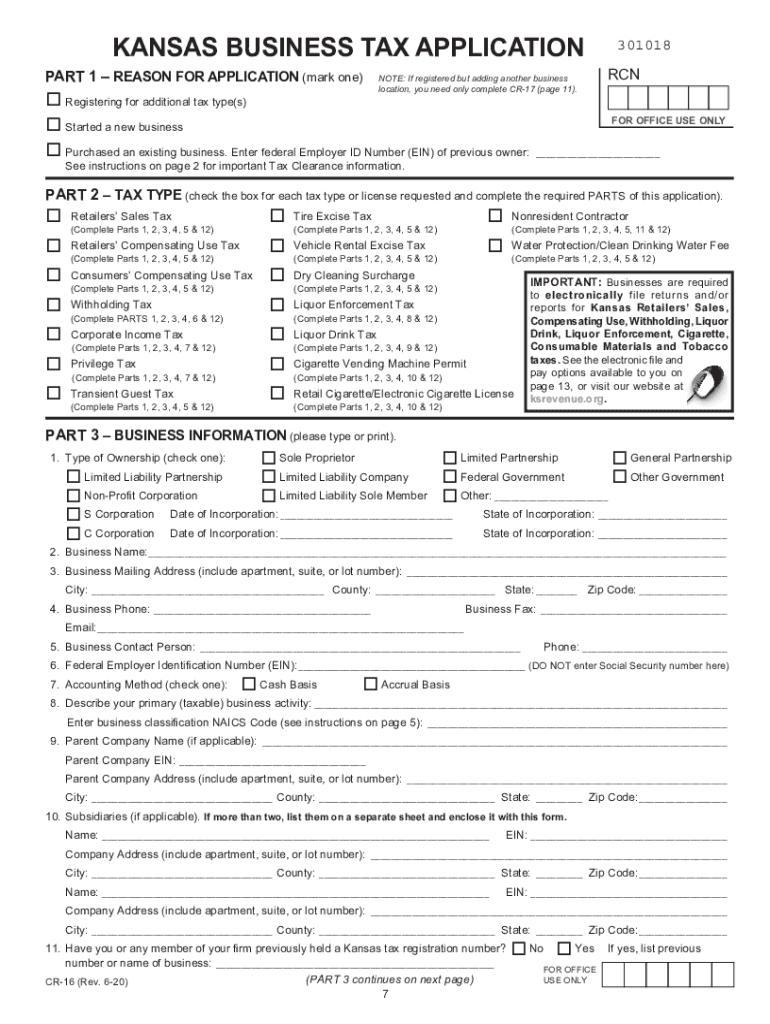

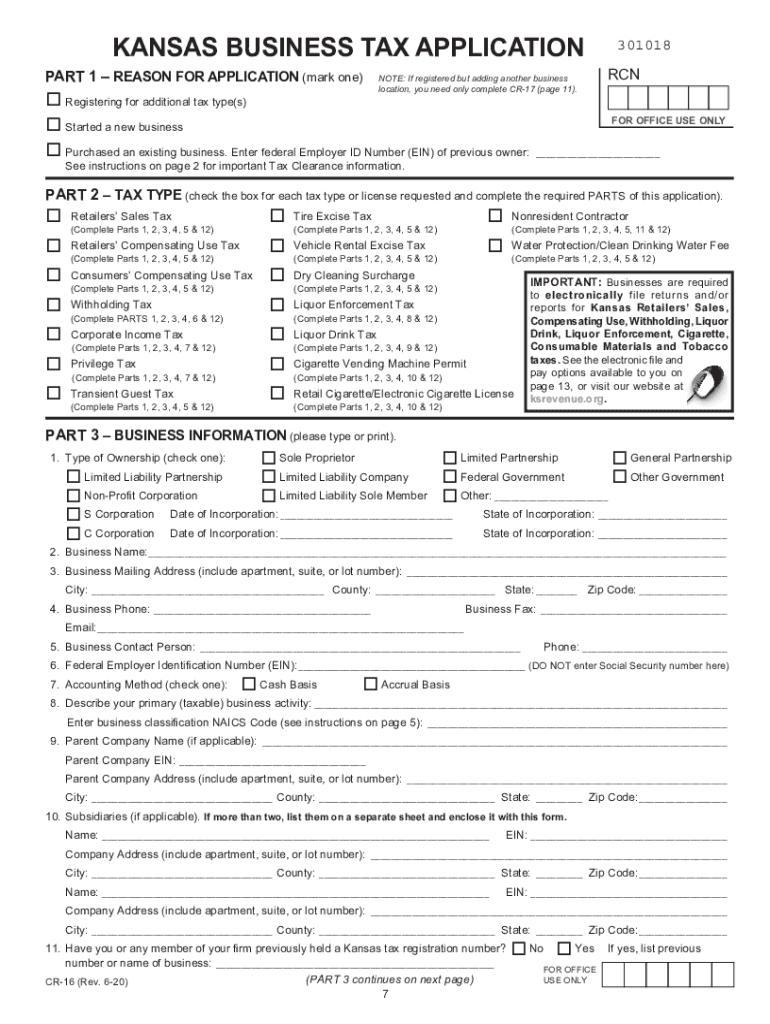

Have you or any member of your firm previously held a Kansas tax registration number or name of business Part 3 continues on next page CR-16 Rev. 9-18 No Yes If yes list previous number FOR OFFICE USE ONLY OR ENTER YOUR EIN SSN PART 3 continued 12. KANSAS BUSINESS TAX APPLICATION PART 1 REASON FOR APPLICATION mark one 311018 RCN NOTE If registered but adding another business location you need only complete CR-17 page 15. Complete and submit an application MF-53 for each retail location....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR CR-16

Edit your KS DoR CR-16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR CR-16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR CR-16 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KS DoR CR-16. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR CR-16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR CR-16

How to fill out KS DoR CR-16

01

Obtain the KS DoR CR-16 form from the Kansas Department of Revenue website or local office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including name, address, and contact details in the designated fields.

04

Provide any required identification numbers, such as your Social Security Number or Employer Identification Number, as applicable.

05

Complete the relevant sections based on the purpose of the form, ensuring all details are accurate and consistent.

06

Review the filled-out form for any errors or missing information.

07

Attach any necessary documentation that may support your application or submission.

08

Sign and date the form at the bottom where indicated.

09

Submit the form either electronically, by mail, or in person as directed in the instructions.

Who needs KS DoR CR-16?

01

Individuals or businesses applying for a specific request or adjustment related to Kansas taxation or revenue matters.

02

Taxpayers who need to report changes or provide additional information to the Kansas Department of Revenue.

03

Anyone fulfilling certain obligations or requirements set forth by Kansas Revenue laws.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a sales tax certificate in Kansas?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

How do I get a Kansas tax ID number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

How much does it cost to get a tax ID number in Kansas?

Plus, getting an EIN is free and takes just 10 minutes online.

How do you set up sales tax?

Formula: Item or service cost x sales tax (in decimal form) = total sales tax. Once you've calculated sales tax, make sure to add it to the original cost to get the total cost. If the total sales tax is $5 and your original item cost was $100, your total cost will be $105.

How much does it cost to get an EIN in Kansas?

Keep in mind that you will also have to get a state tax ID number from the Kansas Department of Revenue. How much does it cost to get an EIN in Kansas? EINs are provided by the IRS free of charge. If you apply online, you can get your company's EIN in about five minutes.

Does Kansas require resale certificate?

Kansas does not require registration with the state for a resale certificate.

How do I get a Kansas withholding tax account?

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

Does Kansas have state withholding tax?

INTRODUCTION TO WITHHOLDING TAX. Kansas has a state income tax on personal income. Kansas withholding tax is the money that is required to be withheld from wages and other taxable payments to help prepay the Kansas income tax of the recipient.

Do I need to collect sales tax in Kansas?

Do you need to collect sales tax in Kansas? You'll need to collect sales tax in Kansas if you have nexus there. There are two ways that sellers can be tied to a state when it comes to nexus: physical or economic.

How do I get a tax ID for my business in Kansas?

If applying online isn't an option, you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935. You can even get an EIN over the phone if the company was formed outside the U.S. by calling 267-941-1099. If filing by phone, note that it isn't a toll-free number.

How do I get a Kansas tax account number?

Kansas Withholding Account Number & Filing Frequency Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

How does sales tax work in Kansas?

What is the sales tax rate in Kansas? The state rate is 6.50%. However, various cities and counties in Kansas have an additional local sales tax. You can see the entire listing of local sales tax rates in the Local Sales Tax Rates by Jurisdiction (KS-1700).

Do I need a Kansas tax ID?

Kansas State Tax ID Number You'll need it if you're hiring employees in Kansas, if you're selling taxable goods and services in the state, or if you're going to owe excise taxes on regulated goods like alcohol or tobacco.

Do I need to register for sales tax in Kansas?

If you have sales tax nexus in Kansas, you're required to register with the Kansas DOR and to charge, collect, and remit the appropriate tax to the state.

How do I get a tax ID number in Kansas?

Kansas New Employer Registration Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

How do I pay withholding tax in Kansas?

Withholding Tax. KW-5 Deposit Reports can be made using the Kansas Department of Revenue Customer Service Center. After connecting to your Withholding account, simply click the “Make an EFT Payment” link to complete your filing and payment.

How do I set up sales tax in Kansas?

How to File and Pay Sales Tax in Kansas File online – File online at the Kansas Department of Revenue. File by mail – You can use Form ST-16 for single jurisdiction filers or Form ST-36 for multiple jurisdiction filers and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS DoR CR-16 to be eSigned by others?

When you're ready to share your KS DoR CR-16, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the KS DoR CR-16 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit KS DoR CR-16 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing KS DoR CR-16, you need to install and log in to the app.

What is KS DoR CR-16?

KS DoR CR-16 is a form used by the Kansas Department of Revenue to report certain tax-related information.

Who is required to file KS DoR CR-16?

Individuals and businesses in Kansas who are subject to specific tax reporting requirements must file KS DoR CR-16.

How to fill out KS DoR CR-16?

To fill out KS DoR CR-16, you need to provide your identifying information, report relevant income, deductions, and any applicable tax credits as per the instructions provided with the form.

What is the purpose of KS DoR CR-16?

The purpose of KS DoR CR-16 is to provide the Kansas Department of Revenue with the necessary information for tax assessment and compliance purposes.

What information must be reported on KS DoR CR-16?

Information that must be reported on KS DoR CR-16 includes taxpayer identification details, income from various sources, applicable deductions, tax credits, and any other relevant financial data as specified in the form instructions.

Fill out your KS DoR CR-16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR CR-16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.