KS DoR CR-16 2021 free printable template

Show details

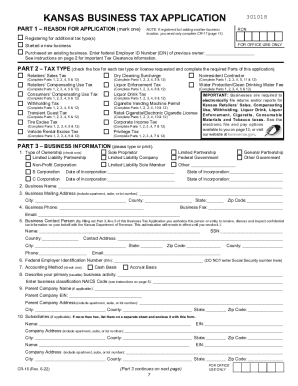

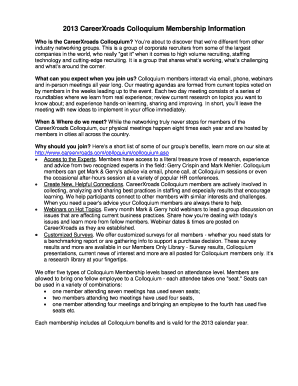

KANSAS BUSINESS TAX APPLICATIONPART 1 REASON FOR APPLICATION (mark one)NOTE: If registered but adding another business location, you need only complete CR17 (page 11). Registering for additional tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR CR-16

Edit your KS DoR CR-16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR CR-16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR CR-16 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS DoR CR-16. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR CR-16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR CR-16

How to fill out KS DoR CR-16

01

Obtain the KS DoR CR-16 form from the Kansas Department of Revenue website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information including your name, address, and Social Security number.

04

Indicate the purpose of the form and provide any necessary details as prompted.

05

Include any required supporting documents as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form through the method outlined in the instructions, whether by mail or electronically.

Who needs KS DoR CR-16?

01

Individuals who are filing for tax credit or refund related to motor vehicle taxes.

02

Businesses involved in the registration of motor vehicles and require adjustments.

03

Anyone seeking clarification or resolution regarding motor vehicle sales or use tax issues.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to register a business name in Kansas?

Kansas LLC Formation Filing Fee: $165. Kansas Annual Report Fee: $55. Kansas Registered Agent Fee. Kansas State Business License Fee.

Who do you file your annual report with each year in the state of Kansas by April 15th?

Kansas Secretary of State 10th Ave. Due Date: Annually by the 15th day of the 4th month after the close of your fiscal year. $55 by mail.

Do I need to do an annual report?

Annual report filing requirements One requirement imposed by the state corporation and LLC statutes is for corporations and LLCs to file an annual report in the formation state and every state where they are qualified or registered to do business.

Who needs to file KS annual report?

All for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period. An annual report may be filed beginning January 1 but must be filed by April 15.

How do I get a KS sales tax number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS DoR CR-16 for eSignature?

KS DoR CR-16 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute KS DoR CR-16 online?

Easy online KS DoR CR-16 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit KS DoR CR-16 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign KS DoR CR-16 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is KS DoR CR-16?

KS DoR CR-16 is a form used by the Kansas Department of Revenue for reporting certain tax-related information, usually pertaining to income or sales tax.

Who is required to file KS DoR CR-16?

Individuals and businesses that meet specific criteria for income or sales tax obligations in Kansas are required to file KS DoR CR-16.

How to fill out KS DoR CR-16?

To fill out KS DoR CR-16, taxpayers must provide their identifying information, report income or sales figures, and follow any specific instructions given in the form guidelines.

What is the purpose of KS DoR CR-16?

The purpose of KS DoR CR-16 is to ensure that taxpayers accurately report their income or sales for tax purposes, allowing the state to assess taxes properly.

What information must be reported on KS DoR CR-16?

KS DoR CR-16 requires reporting of income or sales amounts, taxpayer identification details, and any applicable deductions or credits.

Fill out your KS DoR CR-16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR CR-16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.