KS DoR CR-16 2012 free printable template

Show details

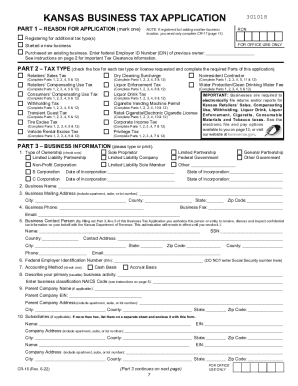

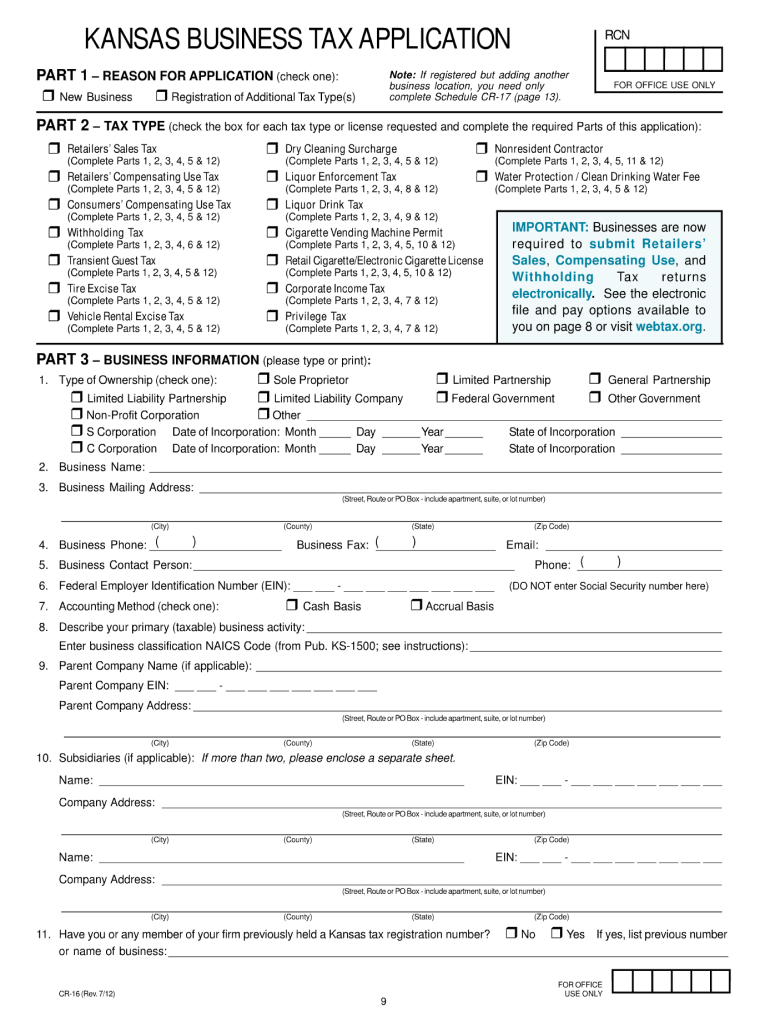

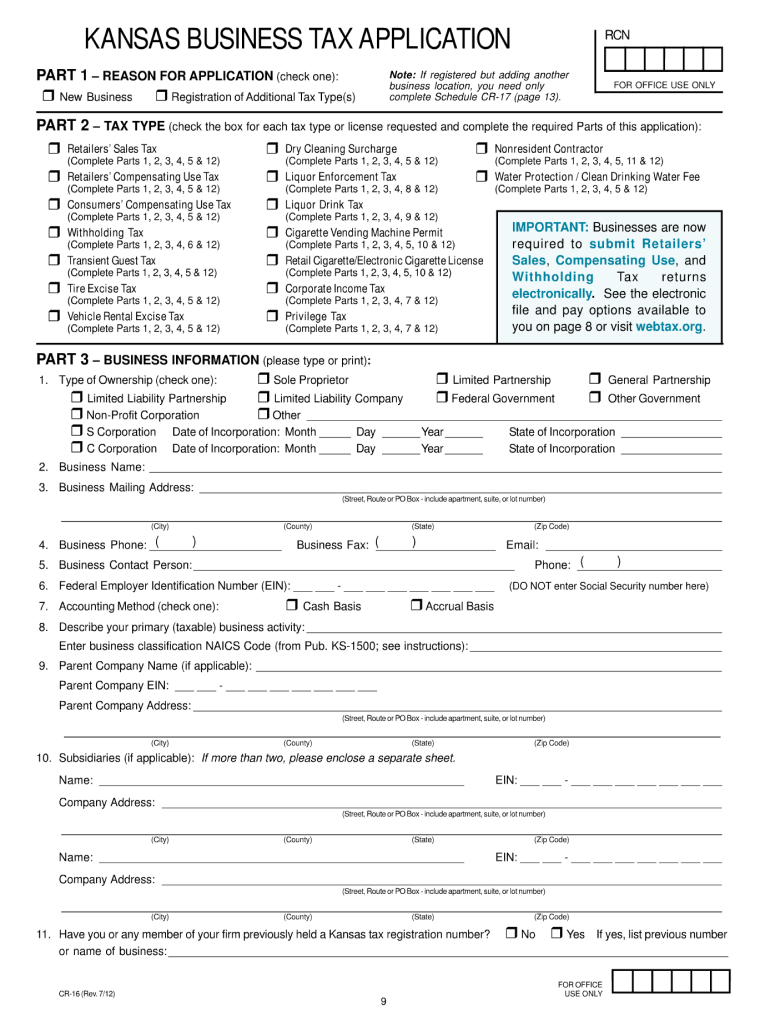

KANSAS BUSINESS TAX APPLICATION PART 1 REASON FOR APPLICATION (check one): New Business Registration of Additional Tax Type(s) Note: If registered but adding another business location, you need only

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR CR-16

Edit your KS DoR CR-16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR CR-16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS DoR CR-16 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS DoR CR-16. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR CR-16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR CR-16

How to fill out KS DoR CR-16

01

Obtain the KS DoR CR-16 form from the Kansas Department of Revenue website or local office.

02

Fill in your personal information at the top, including your name, address, and contact details.

03

Provide your vehicle's details such as the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of filing the form, such as registration or titling.

05

Complete any required sections related to lienholders or previous owners.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form along with any required fees to the appropriate Kansas Department of Revenue office.

Who needs KS DoR CR-16?

01

Individuals registering a vehicle in Kansas for the first time.

02

People transferring ownership of a vehicle in Kansas.

03

Those seeking to obtain a title for a vehicle in Kansas.

04

Vehicle owners who have changed their address or personal information and need to update records.

Fill

form

: Try Risk Free

People Also Ask about

What is the Kansas state income tax reform?

One Kansas Senate-passed bill, S.B. 169, would move Kansas from a graduated-rate to a single-rate individual income tax structure beginning in 2024, which would make Kansas the sixth state to enact legislation converting to a flat individual income tax structure in the past two years alone.

What is the tax elimination in Kansas?

The House plan establishes a flat 5.25% tax rate for all personal income higher than $6,150 and reduces the corporate tax rate to 3%. The bill also reduces taxes on Social Security benefits and eliminates the sales tax on food on July 1. Republicans framed the plan as a compromise with Democratic Gov.

What is K 19 form?

Kansas Form K 19 is an income tax form for those with Kansas taxable income. This is a widely used form throughout the state.

What is form K-40 SVR?

The Senior or Disabled Veteran (SVR) property tax refund claim (K-40SVR) allows a refund of property tax for senior citizens or disabled veterans. The refund amount is the difference between the current and base year property tax amount.

What is a form K 40C in Kansas?

Kansas uses Form K-40C to file a composite return on behalf of non-resident shareholders. Open the federal tab Shareholders > Shareholder Information. Enter the code for the shareholder's resident state in the column titled State or Resident State Code.

What is the Kansas experiment 2012?

The Kansas experiment refers to Kansas Senate Bill Substitute HB 2117, a bill signed into law in May 2012 by Kansas state Governor Sam Brownback, and its impact on Kansas. It was one of the largest income tax cuts in the state's history.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my KS DoR CR-16 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your KS DoR CR-16 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find KS DoR CR-16?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific KS DoR CR-16 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete KS DoR CR-16 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your KS DoR CR-16 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is KS DoR CR-16?

KS DoR CR-16 is a form used for state tax reporting in Kansas, specifically for individuals and businesses to report certain types of income and tax obligations.

Who is required to file KS DoR CR-16?

Individuals and businesses who earn income in Kansas and are subject to the state's tax requirements are required to file KS DoR CR-16.

How to fill out KS DoR CR-16?

To fill out KS DoR CR-16, provide your personal information, including name and address, report your income, calculate the tax due, and sign the form before submitting it to the Kansas Department of Revenue.

What is the purpose of KS DoR CR-16?

The purpose of KS DoR CR-16 is to ensure compliance with Kansas state tax laws by collecting information on income earned and taxes owed by taxpayers.

What information must be reported on KS DoR CR-16?

KS DoR CR-16 requires reporting personal identification information, types and amounts of income, deductions, credits claimed, and any other relevant tax-related data.

Fill out your KS DoR CR-16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR CR-16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.