IRS 1120-REIT 2019 free printable template

Show details

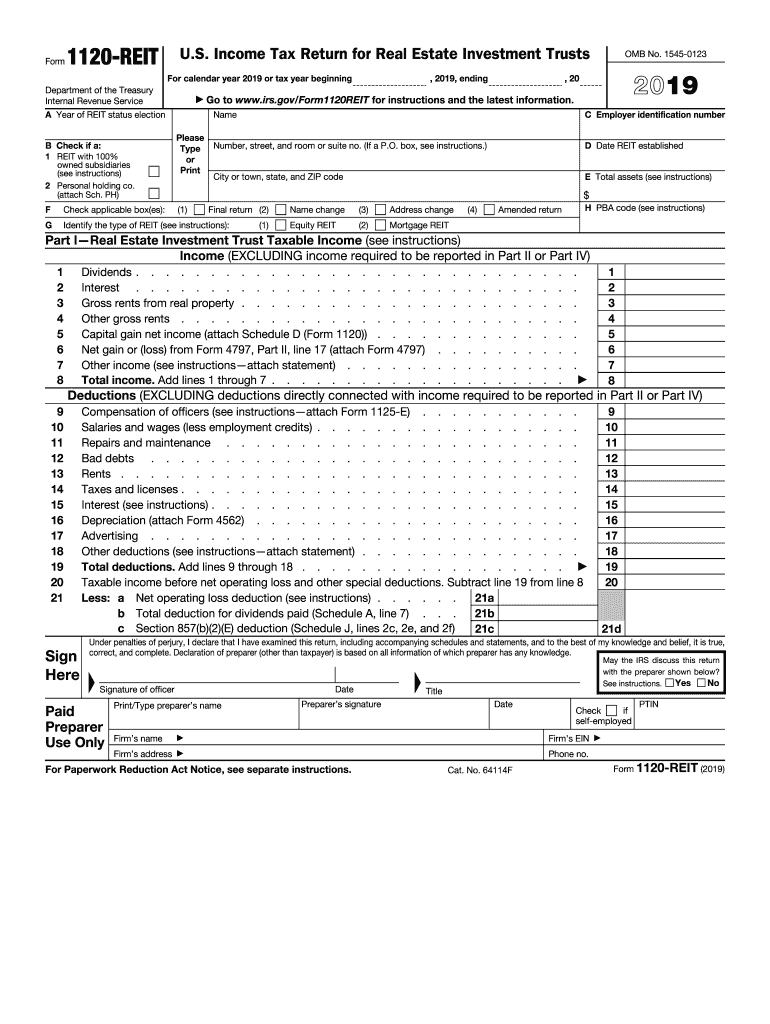

Form1120REITU. S. Income Tax Return for Real Estate Investment Trusts

For calendar year 2019 or tax year beginningDepartment of the Treasury

Internal Revenue Service

A Year of REIT status election

B

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-REIT

How to edit IRS 1120-REIT

How to fill out IRS 1120-REIT

Instructions and Help about IRS 1120-REIT

How to edit IRS 1120-REIT

Editing the IRS 1120-REIT can be done using tools that support PDF editing. You can import the existing form, make the necessary changes, and save your updated document. Software like pdfFiller allows users to input data, correct errors, or update sections directly, streamlining the editing process prior to filing.

How to fill out IRS 1120-REIT

Filling out the IRS 1120-REIT involves several critical steps to ensure accuracy. Follow these steps to complete your form:

01

Gather all required financial documents and records.

02

Start by entering your organization’s name and address in the header section.

03

Fill in each section with relevant information about your real estate investment trust (REIT).

04

Calculate your income, expenses, and tax liabilities accurately before submitting.

Ensure all entries are consistent and that you have reviewed the guidelines provided by the IRS to avoid mistakes.

About IRS 1120-REIT 2019 previous version

What is IRS 1120-REIT?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-REIT 2019 previous version

What is IRS 1120-REIT?

The IRS 1120-REIT is a tax form specifically designed for real estate investment trusts (REITs) to report their income, deductions, and credits. This form helps determine the taxes owed by the REIT based on its qualifying income and expenses as defined by the IRS.

What is the purpose of this form?

The purpose of the IRS 1120-REIT is to allow REITs to report their financial activity to the IRS while adhering to the tax regulations governing these entities. It is essential for compliance and ensures that REITs can claim any necessary deductions and report income accurately.

Who needs the form?

Any entity classified as a real estate investment trust under IRS rules is required to file the IRS 1120-REIT. This includes publicly traded REITs and private REITs that wish to benefit from tax exemptions on certain income, provided they meet the eligibility criteria set by the IRS.

When am I exempt from filling out this form?

Exemptions from filing the IRS 1120-REIT generally apply to organizations that do not qualify as REITs under IRS guidelines. Additionally, certain tax-exempt entities do not need to file this form. It is recommended to consult with a tax professional for clarity on specific exemptions.

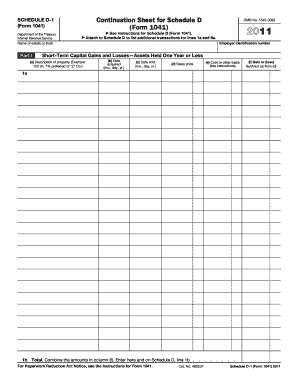

Components of the form

The IRS 1120-REIT consists of various sections that include details about revenue, expenses, distributions, and tax calculations. Key components typically include:

01

Identification information of the REIT.

02

Income from property investments.

03

Deductions related to expenses incurred by the REIT.

04

Tax liabilities and credits.

Understanding each component is crucial for accurate filing and compliance with tax obligations.

Due date

The due date for filing the IRS 1120-REIT is usually the 15th day of the 4th month following the end of the REIT's tax year. For entities with a fiscal year ending December 31, the deadline would be April 15 of the following year. Timely submission ensures compliance and avoids penalties.

What payments and purchases are reported?

The IRS 1120-REIT requires the reporting of various payments related to property investments and expenses incurred during the tax year. This includes rental income, property sales income, and expenses for maintaining properties. An accurate overview of these transactions is essential for tax reporting purposes.

How many copies of the form should I complete?

Typically, you need to submit one original copy of the IRS 1120-REIT to the IRS. However, it is advisable to keep additional copies for your records. This practice ensures that you have documented evidence of your filing in case of audits or any discrepancies.

What are the penalties for not issuing the form?

Failing to file the IRS 1120-REIT can result in significant penalties, including monetary fines. The exact penalty can vary based on how late the form is filed and the circumstances surrounding the failure to file. Continuous non-compliance might also lead to further scrutiny by the IRS.

What information do you need when you file the form?

When filing the IRS 1120-REIT, you will need comprehensive financial information such as income statements, a balance sheet, and records of distributions. Additionally, specific details about operational expenses, property holdings, and prior year tax filings should be readily available to ensure accurate reporting.

Is the form accompanied by other forms?

Typically, the IRS 1120-REIT may need to be submitted alongside other forms, depending on the specific tax circumstances of the REIT. Commonly included forms are schedules for income and deductions, which help provide a complete picture of financial activities and obligations.

Where do I send the form?

The completed IRS 1120-REIT should be mailed to the address specified in the form instructions. Generally, this is based on the REIT’s principal business location or the specific IRS processing center designated for such filings. Always check the latest IRS guidelines to ensure you’re mailing your form to the correct location.

See what our users say