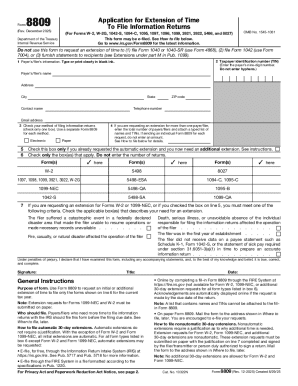

IRS 8809 2020 free printable template

Instructions and Help about IRS 8809

How to edit IRS 8809

How to fill out IRS 8809

Latest updates to IRS 8809

About IRS 8 previous version

What is IRS 8809?

Who needs the form?

What are the penalties for not issuing the form?

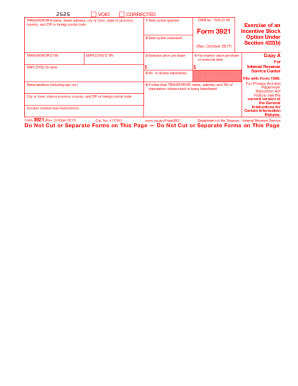

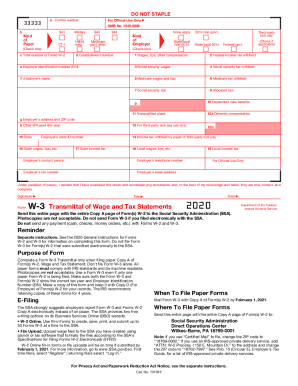

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

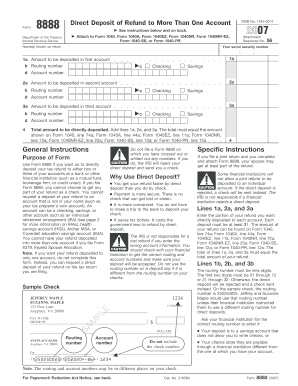

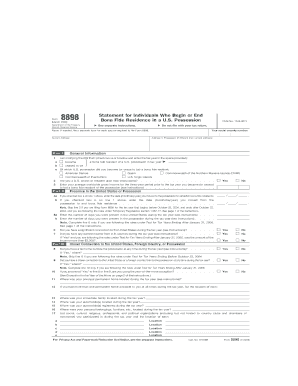

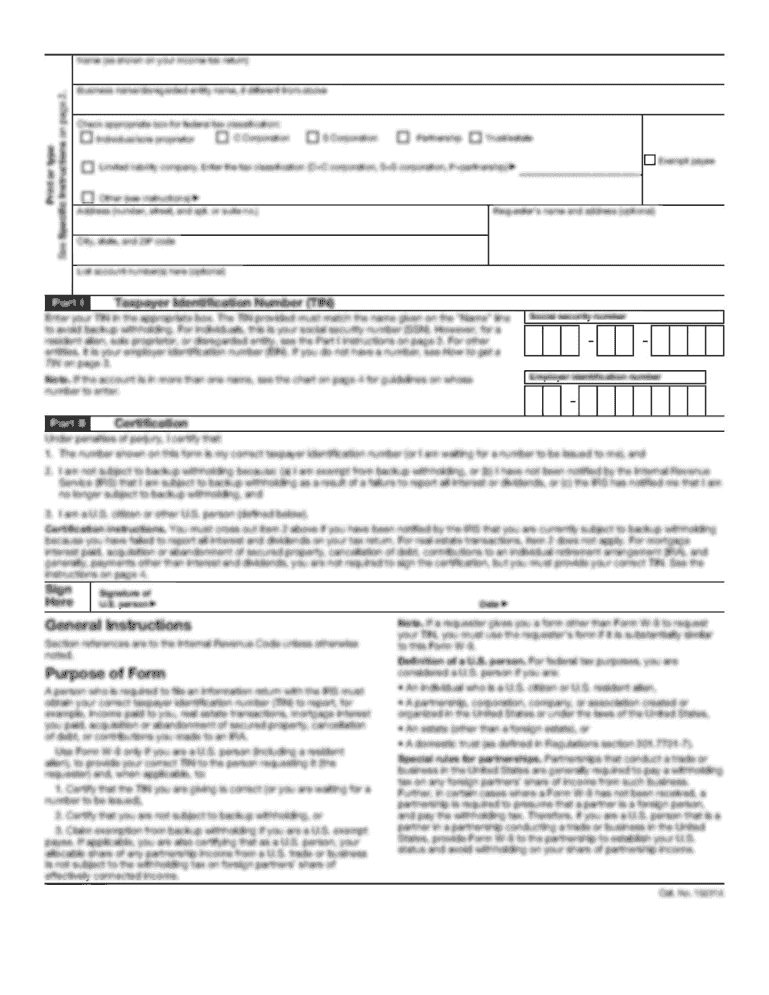

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8809

What should I do if I realize I made an error after submitting the IRS 8809?

If you've submitted an incorrect IRS 8809, you can file for a corrected submission. Make sure to clearly indicate that it is an amendment. Additionally, retaining a copy of your original submission can help clarify any discrepancies during the review.

How can I verify if my IRS 8809 has been received and processed?

You can track the status of your IRS 8809 submission by contacting the IRS or using their online services. Be prepared with details such as your submission date and identification numbers to speed up the process.

Are there privacy concerns I should be mindful of when filing the IRS 8809 electronically?

Yes, it’s crucial to ensure that any software or service you use for e-filing the IRS 8809 is secure and compliant with data protection regulations. Always review the service's privacy policy to understand how your data will be handled.

What common mistakes should I avoid when filing the IRS 8809?

Common errors include incorrect identification numbers and failing to check the eligibility for e-filing. Double-checking all entries and ensuring that you are following the latest guidance can help minimize these mistakes.

See what our users say