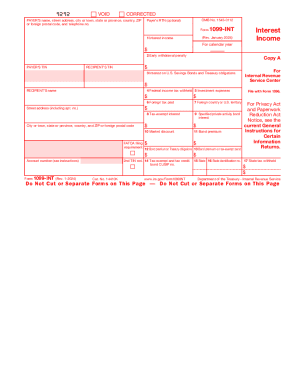

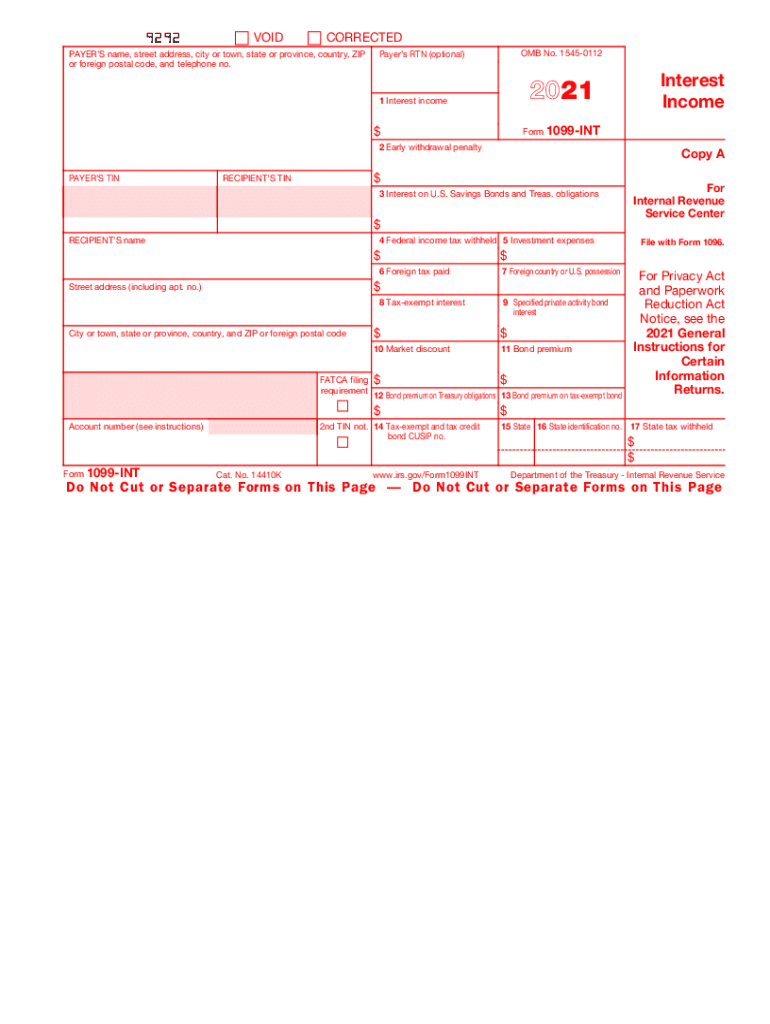

IRS 1099-INT 2021 free printable template

Instructions and Help about IRS 1099-INT

How to edit IRS 1099-INT

How to fill out IRS 1099-INT

About IRS 1099-INT 2021 previous version

What is IRS 1099-INT?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-INT

What should I do if I realize I made a mistake on my IRS 1099-INT after filing?

If you discover an error after submitting your IRS 1099-INT, you should file a corrected form with the IRS as soon as possible. It's advisable to use Form 1099-INT for the correction and indicate that it's a corrected version. Keep in mind that you may also need to notify the recipient of the corrected form.

How can I track the status of my submitted IRS 1099-INT?

To track the status of your submitted IRS 1099-INT, you can use the IRS 'Where's My Refund?' tool if you e-filed, or reference your e-filing service's tracking system. Be aware of common e-file rejection codes and ensure accurate information to reduce the chances of rejections.

What are some common mistakes to avoid when filing an IRS 1099-INT?

Common mistakes to avoid when filing an IRS 1099-INT include misspelling names, incorrect taxpayer identification numbers (TIN), and failing to report interest payments accurately. Always double-check all information before submitting to prevent delays and complications.

Can I file my IRS 1099-INT electronically, and are there fees associated?

Yes, you can file your IRS 1099-INT electronically through various e-filing services, which may charge a service fee. Be sure to verify compatibility with your software or mobile device, as different providers may have specific technical requirements.

What should I do if I receive an IRS notice regarding my filed 1099-INT?

If you receive an IRS notice concerning your filed IRS 1099-INT, carefully review the notice to understand the issue. Prepare the necessary documentation and respond promptly to the IRS, ensuring you have all required information to support your case.

See what our users say