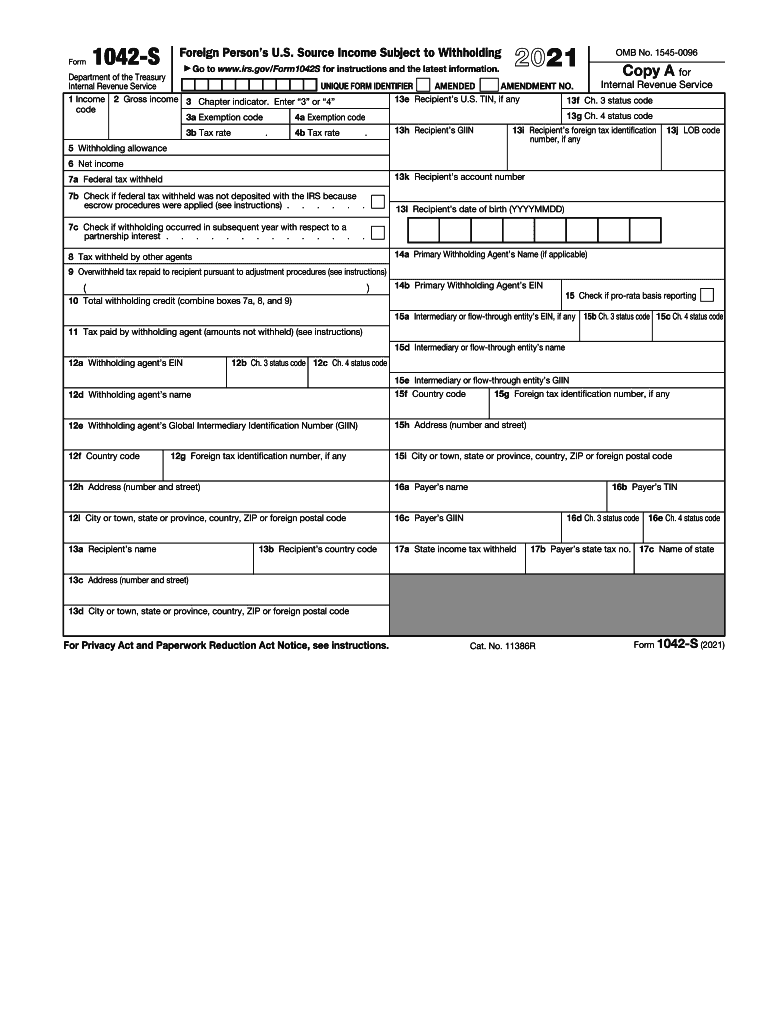

Who needs an IRS form 1042-S?

Internal Revenue Service requests form 1042-S from any non-resident alien individual, non-resident fiduciary or alien corporation that conducted business and received income in the territory of the United States.

What is form 1042-S for?

This form is called the Foreign Person’s U.S. Source Income Subject to Withholding. This is an annual form for all alien taxpayers who run their businesses in the USA. With this form taxpayers inform IRS of their business activity and about income they acquired over the tax year. IRS officials in turn verify this information and provide legal approval for individuals and corporations to run their business on the U.S. territory during the next year.

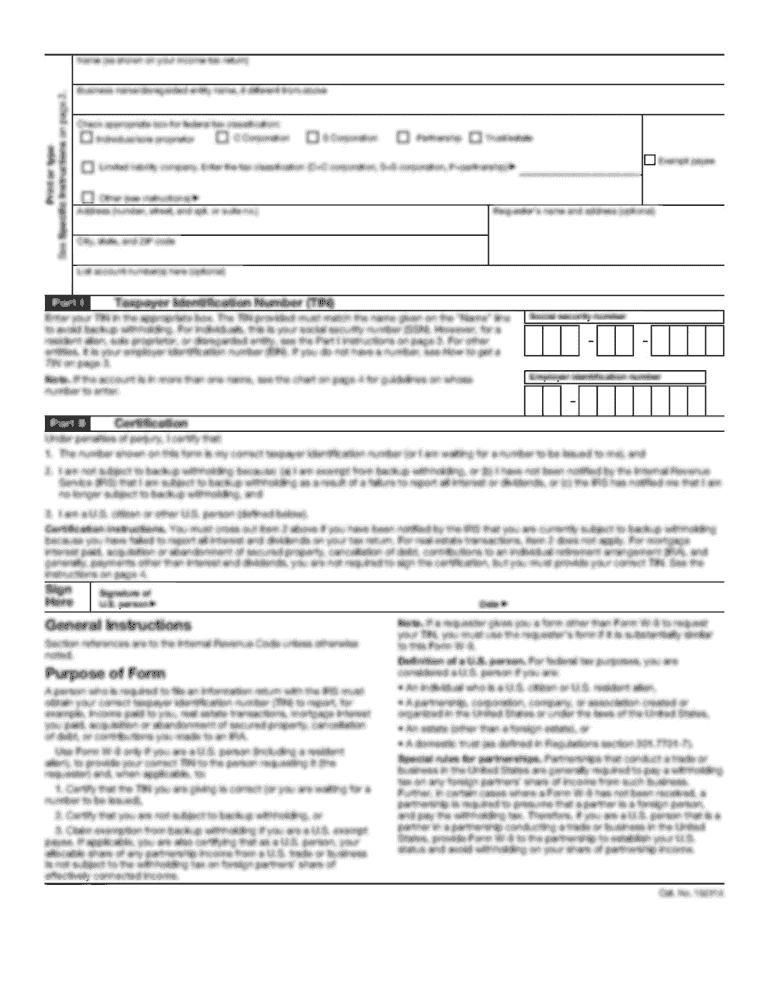

Is it accompanied by other forms?

It should not be accompanied by other forms. However, it is important to know, that if a non-resident individual, fiduciary or alien corporation has already filed form 1040NR (1040 NR-EZ) or form 1120-F, and they did not conduct business over the tax year, they should not file form 1042-S at all.

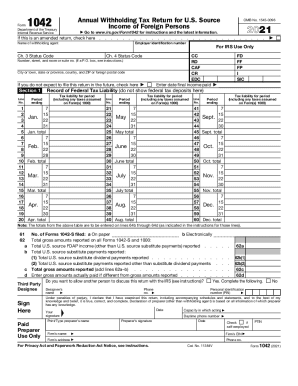

When is form 1042-S due?

Non-resident taxpayers must file this form with the Internal Revenue Service by March 15, 2017. The recipient of the income reported on the form must also obtain their copy of the filled out 1042-S by the same due date.

How do I fill out an IRS form 1042-S?

There are three copies to fill out. First, taxpayers must provide one copy to the IRS, keep one copy to their own records and send one copy to the Withholding Agent. There are several copies to complete and attach to any state tax return taxpayers are going to submit.

Where do I send it?

Taxpayers must file this return with Internal Revenue Service electronically or by mail. The mailing address is:

Internal Revenue Service

1201 N. Mitsubishi Freeway,

Bloomington, IL 61705-6613