IRS 1041-ES 2021 free printable template

Show details

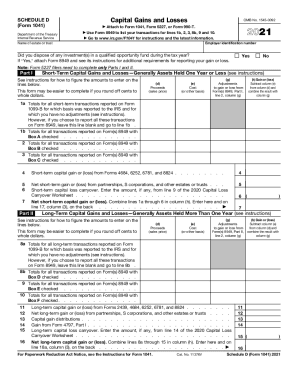

00 24 12 500 1 839. 00 35 ------ 3 011. 50 37 Record of Estimated Tax Payments Payment no. Form Total. Write the estate s or trust s EIN and money order. Do not include any balance due on the 2017 Form 1041 with the check for 2018 estimated tax. The 15 rate thresholds. Purpose of Form Use this package to figure and pay estimated tax for an estate or trust. For details see Electing Small Business Trusts in the 2017 Instructions for Form 1041. Note. For 2018 the highest income tax rate for...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1041-ES

Edit your IRS 1041-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1041-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1041-ES online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 1041-ES. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1041-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1041-ES

How to fill out IRS 1041-ES

01

Obtain IRS Form 1041-ES from the IRS website or your tax professional.

02

Identify the estate or trust for which you are filing the form.

03

Calculate the expected income for the estate or trust for the current year.

04

Determine the tax liability based on the estimated income.

05

Fill out the payment voucher on Form 1041-ES with the calculated estimated tax.

06

Make copies of the completed voucher for your records.

07

Submit the voucher along with your payment to the IRS by the due date.

Who needs IRS 1041-ES?

01

Estates and trusts that expect to owe tax of $1,000 or more during the year need to file IRS 1041-ES.

02

Fiduciaries managing estates or trusts that generate income are also required to use Form 1041-ES for estimated tax payments.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Form 1041 A?

The trustee must file Form 1041-A for a trust that claims a charitable or other deduction under section 642(c) unless an exception applies. Electing small business trusts (ESBTs) described in section 641(c). File Form 1041-A by April 15 following the close of the calendar year.

Do all trusts file 1041?

Grantor trust status can apply to either a revocable or an irrevocable trust, and there can be multiple deemed owners of a single trust. The general rule is that all grantor trusts must file a Form 1041, which contains only the trust's name, address, and tax identification number (TIN) (see Regs. Sec.

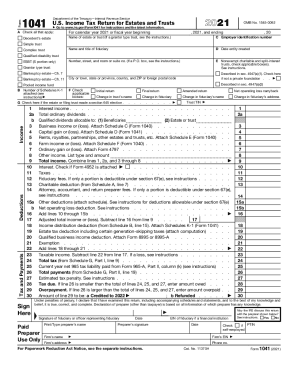

What is Form 1041 US income tax return for estates and trusts?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do I need to file 1041 if no income?

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

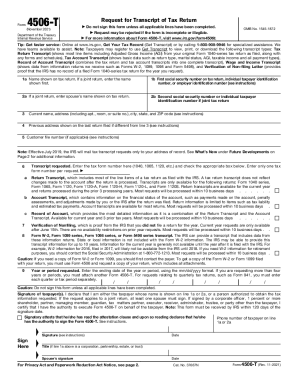

Can Form 1041 be filed electronically?

Form 1041 was added to the Modernized e-File (MeF) platform on January 2014. MeF can accept the current and prior two tax years. In Processing Year 2022, MeF will accept Form 1041 Tax Years 2019, 2020, and 2021.

Who must file Form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS 1041-ES in Gmail?

Create your eSignature using pdfFiller and then eSign your IRS 1041-ES immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out IRS 1041-ES using my mobile device?

Use the pdfFiller mobile app to fill out and sign IRS 1041-ES. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete IRS 1041-ES on an Android device?

Complete IRS 1041-ES and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 1041-ES?

IRS 1041-ES is a form used to report estimated tax payments for estates and trusts. It is specifically designed for fiduciaries to pay expected income tax on behalf of the estate or trust.

Who is required to file IRS 1041-ES?

Fiduciaries managing estates or trusts that expect to owe $1,000 or more in tax will need to file IRS 1041-ES to make estimated tax payments.

How to fill out IRS 1041-ES?

To fill out IRS 1041-ES, you need to provide the estate or trust's name, address, and taxpayer identification number (TIN). You will also need to estimate the income for the year and calculate the expected tax liability to determine the amount of estimated payments.

What is the purpose of IRS 1041-ES?

The purpose of IRS 1041-ES is to allow fiduciaries to make timely estimated tax payments on the income generated by estates or trusts to avoid underpayment penalties.

What information must be reported on IRS 1041-ES?

Form IRS 1041-ES must report the estate or trust's name, address, TIN, estimated income, expected tax liability, and the amount of each estimated payment being made.

Fill out your IRS 1041-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1041-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.