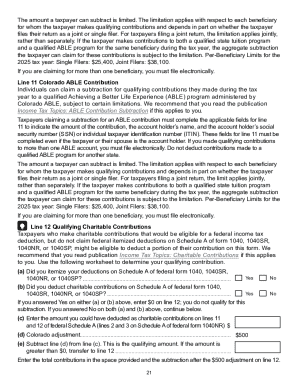

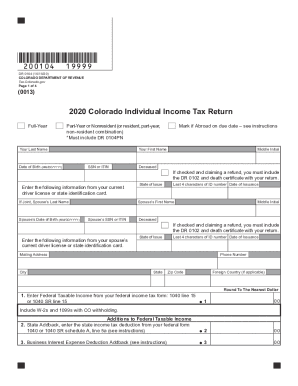

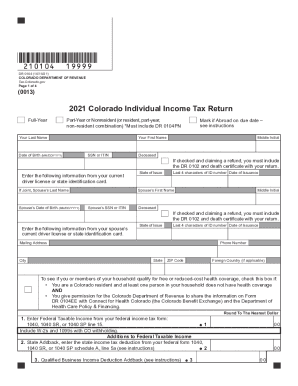

CO Income Tax Filing Guide 2019 free printable template

Instructions and Help about CO Income Tax Filing Guide

How to edit CO Income Tax Filing Guide

How to fill out CO Income Tax Filing Guide

About CO Income Tax Filing Guide 2019 previous version

What is CO Income Tax Filing Guide?

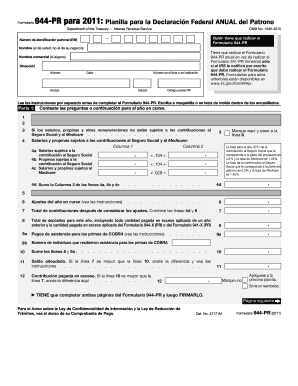

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about CO Income Tax Filing Guide

What should I do if I need to correct my Colorado state tax forms after filing?

If you discover an error on your Colorado state tax forms after submission, you need to file an amended return. Use the designated form for amendments and ensure that you provide clear explanations of the changes made. It's important to track the processing of your amended form to confirm that it has been received and accepted.

How can I verify the status of my filed Colorado state tax forms?

To verify the status of your Colorado state tax forms, you can use the state’s online tracking system, which allows you to check the receipt and processing status of your submission. Make sure to have your details handy for a smooth inquiry process.

What are some common errors people make when filing Colorado state tax forms?

Common errors when filing Colorado state tax forms include incorrect social security numbers, mismatching names, and mathematical mistakes. To minimize these errors, double-check all entry fields and ensure consistent information throughout your tax documents.

What should you do if you receive a notice or audit letter regarding your Colorado state tax forms?

Upon receiving a notice or audit letter related to your Colorado state tax forms, carefully read the communication and gather the necessary documentation for your defense. Respond promptly, providing the requested information or addressing the raised issues to avoid further complications.