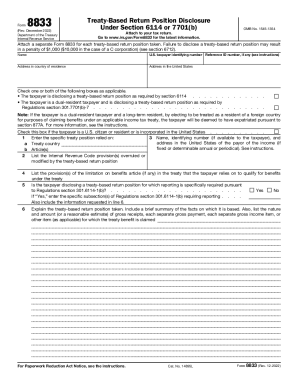

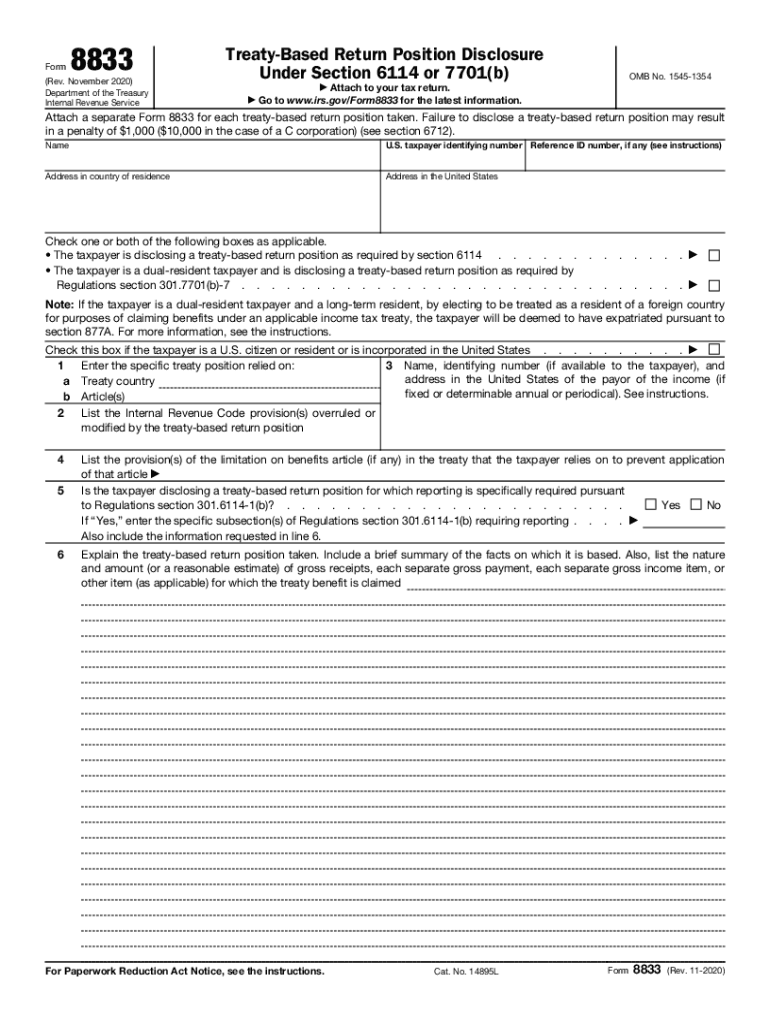

IRS 8833 2020 free printable template

Instructions and Help about IRS 8833

How to edit IRS 8833

How to fill out IRS 8833

About IRS 8 previous version

What is IRS 8833?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8833

What should I do if I realize I've made a mistake on my IRS 8833 after submission?

If you discover an error after submitting your IRS 8833, you should file an amended form to correct the mistake. Make sure to provide clear explanations of the changes made, and include relevant documentation if necessary. Filing a corrected IRS 8833 can help avoid potential issues with your tax filings.

How can I verify if my IRS 8833 has been received and processed by the IRS?

To verify the status of your IRS 8833, you can use the IRS online tools that track submissions or reach out directly to the IRS for confirmation. Be prepared to provide your details, including the submission method, to facilitate the tracking process. Checking the status can help ensure that your form is in good standing.

What are some common errors filers make with IRS 8833 and how can they avoid them?

Common errors with IRS 8833 include incorrect identification numbers, missing signatures, and incomplete information fields. To avoid these mistakes, double-check all entries before submission, follow the form instructions carefully, and consider using tax software that can help guide you through the process. Taking these precautions can help minimize issues.

What should I do if I receive a notice or letter from the IRS regarding my IRS 8833?

If you receive a notice from the IRS concerning your IRS 8833, it is critical to read it carefully and determine the nature of the inquiry. Respond promptly if action is required, and gather any requested documentation to support your case. Timely and clear communication with the IRS can help resolve the matter effectively.

Can I use e-signatures when filing IRS 8833 electronically and what should I consider?

Yes, you can use e-signatures when filing IRS 8833 electronically, but it's essential to ensure that your chosen electronic filing software accepts them. Additionally, maintain records for your e-signature in case the IRS requires further verification. Understanding the e-signature process can streamline your filing experience.