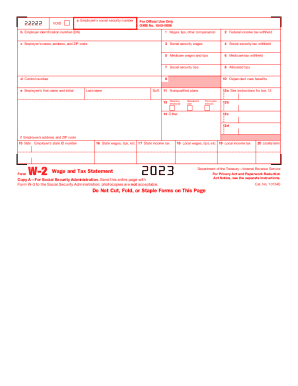

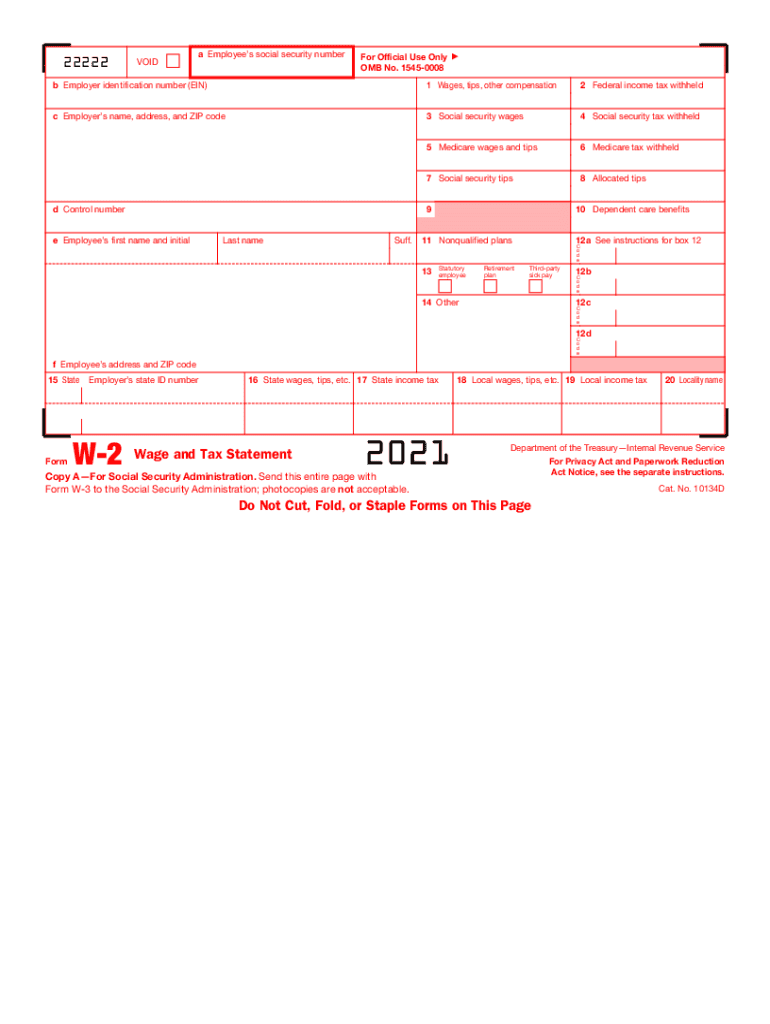

IRS W-2 2021 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2021 previous version

What is IRS W-2?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2

What should I do if I find an error on my IRS W-2?

If you discover an error on your IRS W-2 after it has been issued, you should contact your employer immediately to request a corrected form. The employer can issue a Form W-2c, which corrects the mistakes. Ensure you keep thorough records of the communications and any documentation supporting the correction, as you may need to reference them in future tax filings.

How can I verify the status of my filed IRS W-2?

To check the status of your filed IRS W-2, you can contact the IRS directly or use their online tools if you e-filed. Be prepared to provide your identification details and any relevant information. If your e-filed form is rejected, you'll receive an error code, which you must address before resubmitting.

What are the record retention requirements for IRS W-2 forms?

Typically, taxpayers should retain their IRS W-2 forms and associated records for at least three years from the date the tax return was filed. This retention period is crucial for addressing any potential audits or discrepancies regarding your income and taxes. Always store these documents securely to protect your personal data.

What if I need to file an IRS W-2 for a foreign payee?

When filing an IRS W-2 for a foreign payee, it’s essential to ensure compliance with IRS regulations regarding withholding taxes. Nonresident alien status can complicate the process, so consult tax professionals or IRS guidelines regarding how to correctly report payments and fulfill any additional withholding obligations.

How can software help avoid common errors when filing IRS W-2 forms?

Utilizing tax software can significantly reduce the likelihood of errors when filing IRS W-2 forms. Most software programs validate information automatically and provide guidance to identify common mistakes. Additionally, they streamline the e-filing process, making it easier to file accurately and on time, thus avoiding potential penalties.

See what our users say