AL ADoR PPT 2021 free printable template

Show details

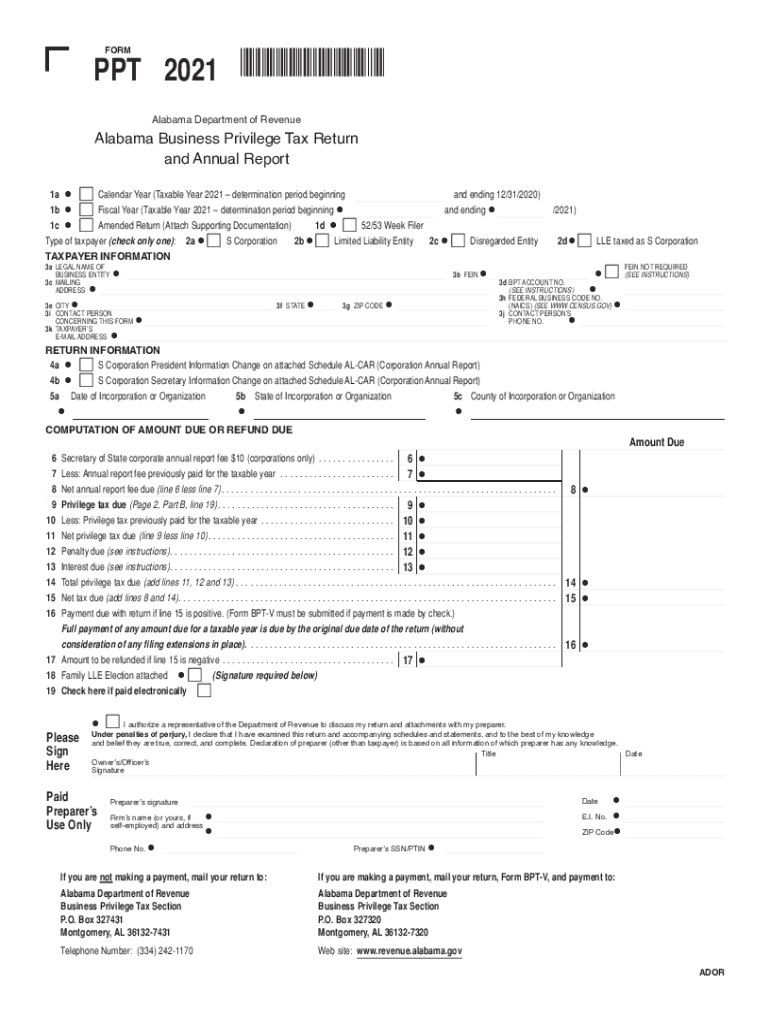

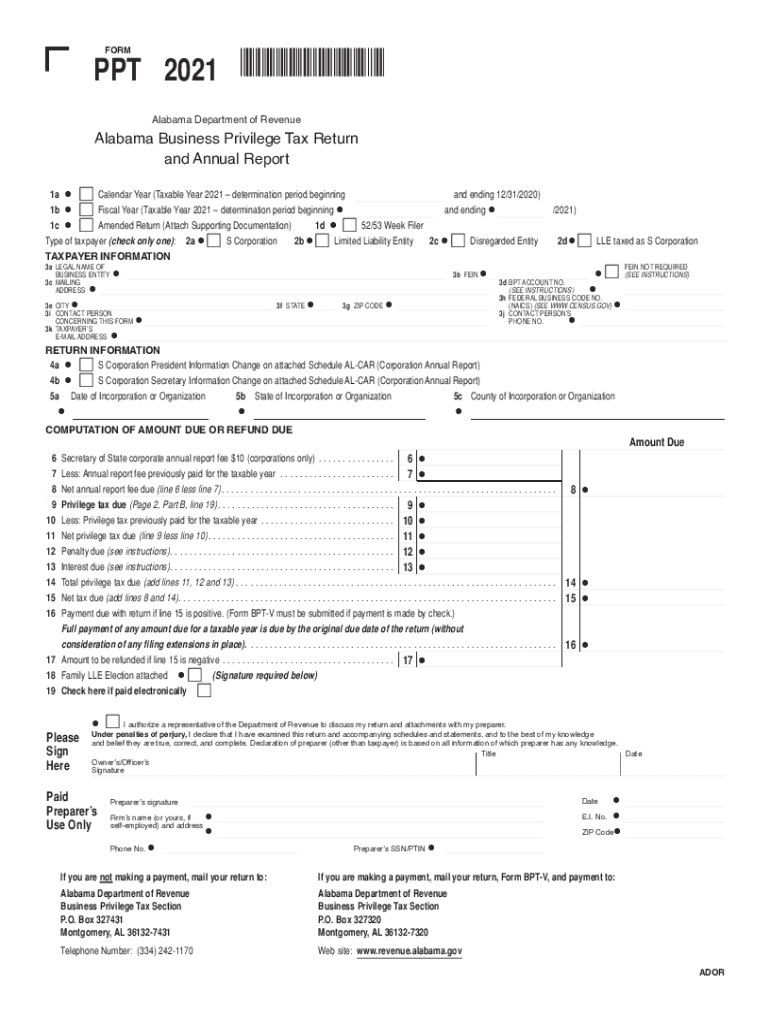

O. Box 327431 Montgomery AL 36132-7431 Telephone Number 334 353-7923 Web site www. revenue. alabama.gov ADOR BUSINESS PRIVILEGE TAXABLE/FORM YEAR PAGE 2 PPT 1a. FEIN 190002PP 1b. 17 18 Alabama enterprise zone credit see instructions. 18 19 Privilege Tax Due line 17 less line 18 minimum 100 for maximum see instructions Enter also on Form PPT page 1 line 9 Privilege Tax Due must be paid by the original due date of the return. FORM PPT 2019 190001PP Alabama Department of Revenue Alabama...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR PPT

Edit your AL ADoR PPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR PPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL ADoR PPT online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AL ADoR PPT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR PPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

01

Gather all relevant information about the project or activity.

02

Open the AL ADoR PPT template in your chosen software.

03

Start with the title slide: insert the project title and your name.

04

Fill in the introduction slide with a brief overview of the project.

05

Outline the objectives of your project in the objectives slide.

06

Include a methodology slide detailing how you conducted your work.

07

Present your findings in dedicated slides with clear headings.

08

Use charts and graphs to illustrate key points visually.

09

Summarize your conclusion in a final slide.

10

Add a slide for references and acknowledgments, if necessary.

11

Review and edit for clarity, conciseness, and presentation style.

Who needs AL ADoR PPT?

01

Project managers needing to present project updates.

02

Researchers sharing findings with stakeholders.

03

Students delivering project presentations in academic settings.

04

Team members collaborating on a project report.

05

Anyone involved in project documentation and reporting.

Fill

form

: Try Risk Free

People Also Ask about

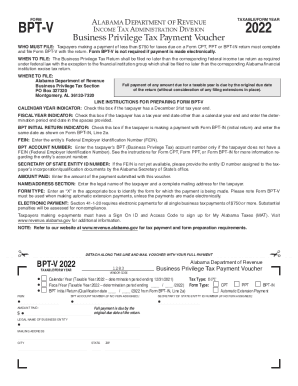

What is a PPT form in Alabama?

Form PPT is to be filed by Pass-through Entities only. BUSINESS PRIVILEGE TAX PAYMENT. Payment of the total tax due must be received on or before the original due date of the return. Form BPT-V must accompany all business privilege tax pay- ments, unless payments are made electronically.

What taxes do you pay in Alabama?

Alabama has a 6.50 percent corporate income tax rate. Alabama has a 4.00 percent state sales tax rate, a max local sales tax rate of 7.50 percent, and an average combined state and local sales tax rate of 9.24 percent. Alabama's tax system ranks 39th overall on our 2022 State Business Tax Climate Index.

Who is exempt from property taxes in Alabama?

Homestead Types Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad valorem taxes. Taxpayer is permanently and totally disabled – exempt from all ad valorem taxes. There is no income limitation.

How do I file my Alabama state taxes for free?

You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to all taxpayers filing an Alabama Individual Income Tax return.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Who has to file Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

How often is Alabama business privilege tax due?

The return is due three and a half months after the beginning of the taxpayer's taxable year or April 15, 2021. With the exception of the Business Privilege return for Financial Institutions Groups, the Business Privilege tax return due date corresponds to the due date of the corresponding federal return.

How do I file a final business privilege tax return in Alabama?

Filing The Alabama Business Privilege Tax Return. Alabama Business Privilege Tax Returns must be filed by mail. To download and print your tax return, you'll need to visit the Alabama Department of Revenue website. On the state website, click “Forms” on the top menu.

Do you pay personal property tax in Alabama?

Personal property is considered Class II property and is taxed at 20 percent of market value. Market value multiplied by twenty percent equals the assessment value, which is then multiplied by the appropriate jurisdiction's millage rates to determine the amount of tax due.

What is a business privilege license Alabama?

A business privilege license (BPL) is issued through a local county and is a fee paid by businesses for the privilege of operating a business within the state.

Who must file Alabama privilege tax?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

Does Alabama charge property tax?

Property tax assessment is the process through which the assessed value of a property is determined in order to calculate the property taxes due. In Alabama, property tax is based on property classification, millage rates, and exemptions.

How much is vehicle property tax in Alabama?

The actual assessed value of your vehicle appears on your tag and tax receipt and is estimated on your renewal mail notice. Privately owned (titled owner) passenger automobiles and pickup trucks are assessed at 15% of market value. All other vehicles are assessed at 20% of market value.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AL ADoR PPT?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the AL ADoR PPT. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in AL ADoR PPT without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing AL ADoR PPT and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit AL ADoR PPT on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing AL ADoR PPT.

What is AL ADoR PPT?

AL ADoR PPT stands for Alabama Annual Disclosure of Related Party Transactions, a reporting form used by businesses to disclose financial transactions with related parties.

Who is required to file AL ADoR PPT?

Entities engaged in related party transactions in Alabama and that meet specific criteria set by the state are required to file the AL ADoR PPT.

How to fill out AL ADoR PPT?

To fill out AL ADoR PPT, gather the necessary financial information related to transactions, complete the form accurately as per state guidelines, and submit it by the deadline determined by Alabama law.

What is the purpose of AL ADoR PPT?

The purpose of AL ADoR PPT is to ensure transparency and accountability in financial dealings between related parties within Alabama.

What information must be reported on AL ADoR PPT?

The information reported on AL ADoR PPT includes the nature of the transactions, the identities of the related parties involved, and the financial details pertinent to those transactions.

Fill out your AL ADoR PPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR PPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.