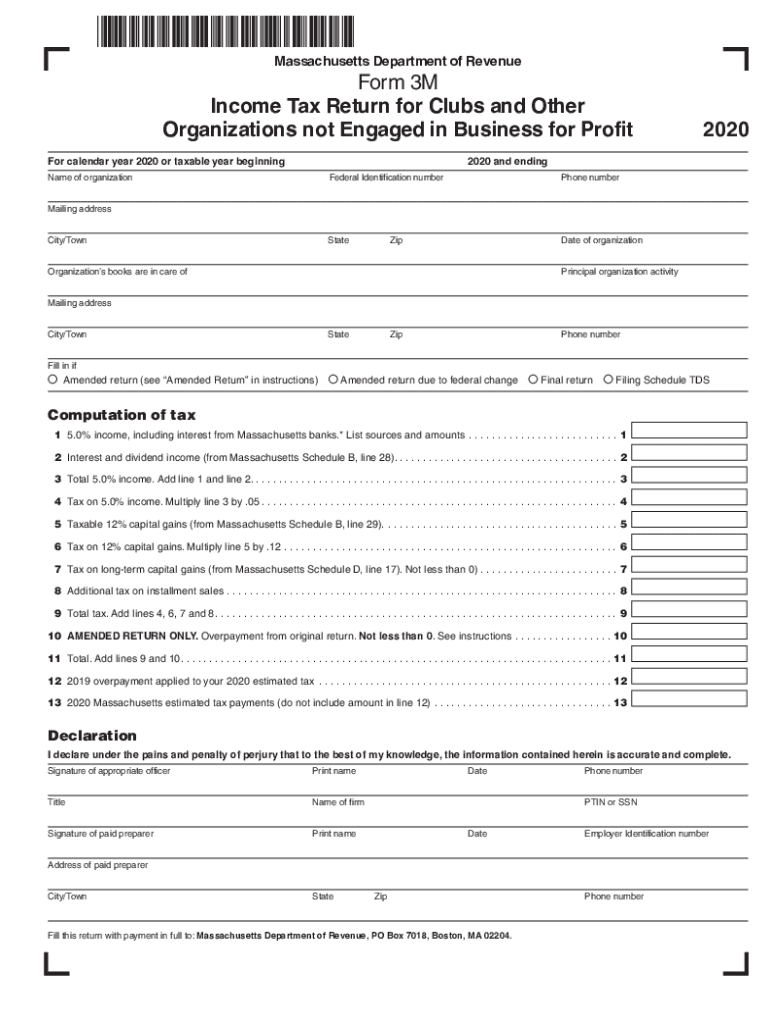

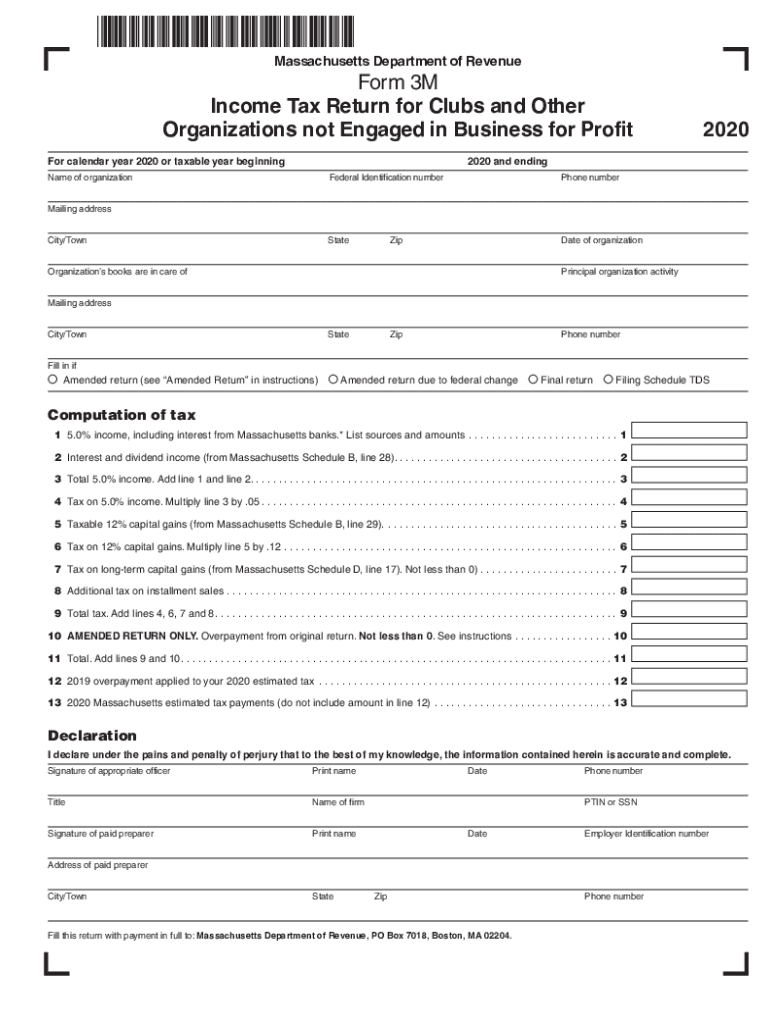

MA DoR 3M 2020 free printable template

Get, Create, Make and Sign form 3m

Editing form 3m online

Uncompromising security for your PDF editing and eSignature needs

MA DoR 3M Form Versions

How to fill out form 3m

How to fill out MA DoR 3M

Who needs MA DoR 3M?

Instructions and Help about form 3m

3M is a very big very diverse company It's primarily a manufacturer of products and consumable solutions We have more than 20 different business units Most people when they think of abrasives think of sandpaper that they would use to sand wood, or they might think of their scouring sponge in the kitchen In the industrial markets where I focus we have a very broad portfolio of abrasive solutions that are designed specifically for customers looking to make things The abrasive systems' division focuses on the use of abrasives in industrial manufacturing So anytime that yourewelding something together you're painting it, or you want to create a very specific surface finish we have industrial abrasives for that One of the big drivers of the growth in robotics for abrasive processing frankly is the inability to get skilled labor to manually process parts Whatever true in Western countries but the fastest-growingcountry in the world for robotic abrasive processing is China and the same issue is happening there Here at 3M we've been working with robots and abrasive processing for over 30 years I think we got our first robot in this facility in the late 80s Even as far back as then the abrasive folks understood that they had to have a center for customers to come in and prove out the concept To do a lot of that work on a factory floor it can be challenging to get all the abrasives there and to get everything set up right whereas here we've got the equipment to simulate it we've got all the abrasive options that could be used to do it as well as several other engineers that we can talk to try to get their input on what might be a better way to complete a task This is a giant laboratory for us, It's a giant laboratory for our customers and our industry partners as well Frankly speaking without the involvement of 3M it would be practically impossible for us at KDKA to develop the process knowledge we need to be able to satisfy the customer What 3M brings to the partnership really is a strong understanding of modes of utilization of abrasives along with the optimum abrasives to use in a given application For robotic abrasive processing the strength of KDKA is going to be in accuracy and is going to be in durability, and we know from history and engaging with customers that the KDKA robots are considered one of the most accurate robots in the industry as well as a very durable solution Whenyoure dealing with abrasive processing and generating dust and dirt durability is a big factor The ability to deal with vibration and things like that becomes critical Were seeing things out there like force torque control integrated with robot controllers There are vision systems andtemperature-sensing-type systems that can be used I like to say the hardware for that sort of thing is all out there Its available It's really the integration of all these pieces That's where the innovation is going to happen As we go forward here we see that the head that were going to use and...

People Also Ask about

What is the optional 5.85 tax rate in Massachusetts?

Why did I get a statement showing interest income from the IRS?

What are the income tax brackets for Massachusetts?

Is my interest income taxable in Massachusetts?

What is Massachusetts 5% income?

What is taxable income in Mass?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 3m online?

How do I edit form 3m online?

Can I create an electronic signature for the form 3m in Chrome?

What is MA DoR 3M?

Who is required to file MA DoR 3M?

How to fill out MA DoR 3M?

What is the purpose of MA DoR 3M?

What information must be reported on MA DoR 3M?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.