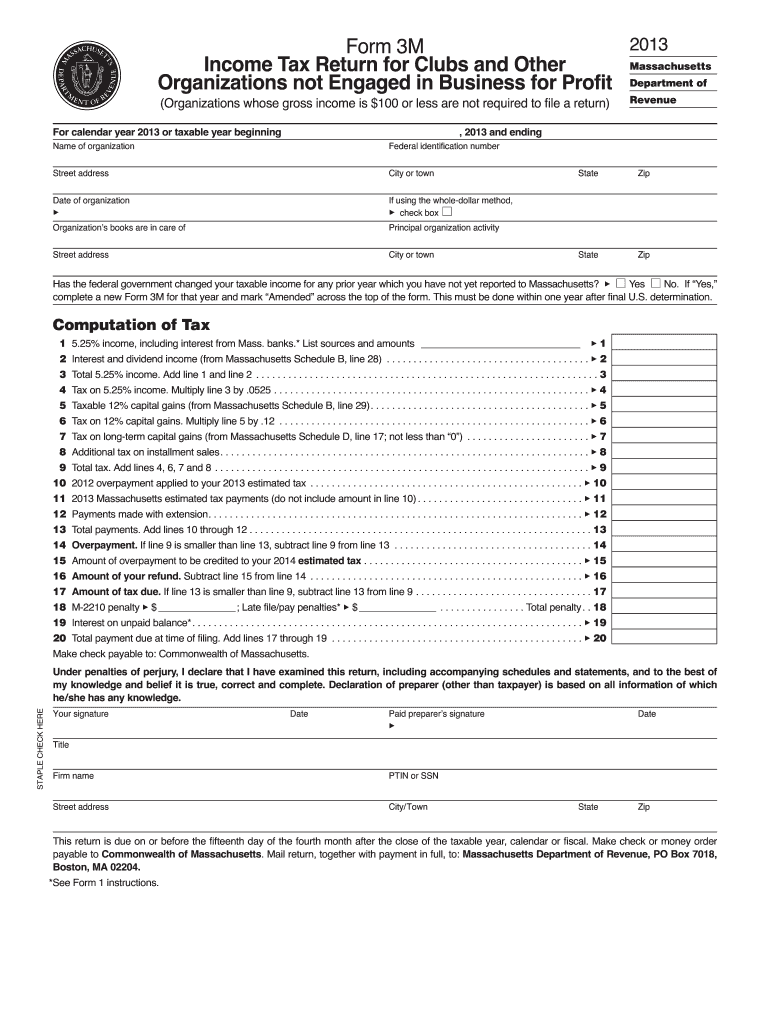

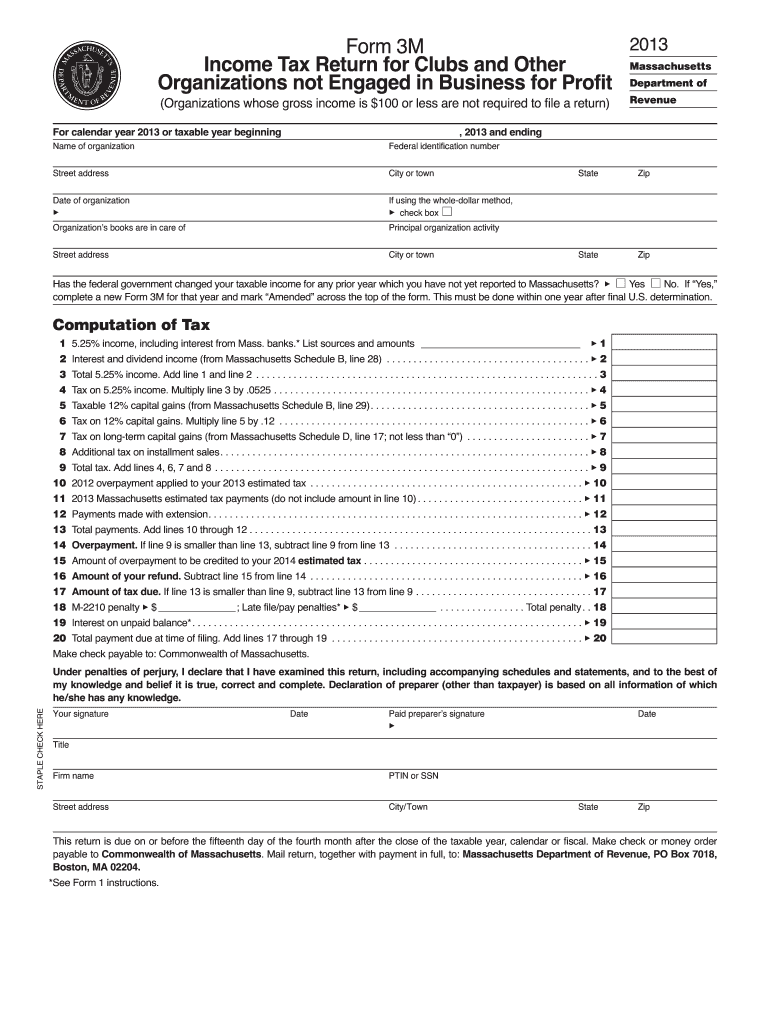

MA DoR 3M 2013 free printable template

Get, Create, Make and Sign 990t 2013 editable form

Editing 990t 2013 editable form online

Uncompromising security for your PDF editing and eSignature needs

MA DoR 3M Form Versions

How to fill out 990t 2013 editable form

How to fill out MA DoR 3M

Who needs MA DoR 3M?

Instructions and Help about 990t 2013 editable form

Okay so in the future what I'm going to follow up on what I was discussing in the prior video about drawing complex forms in terms of identifying major and minor forms now in this you Tories I'm going to give some tips on how you can shade complex forms from the perspective of thinking about major and minor forms or dominant and subordinate forms, so you're thinking about the forms that are larger and underlying the blowers are underlying masses and how do you shade something keeping that in mind so in other words the underlying dominant mass should always be the one that determines the lightening shadow pattern okay but overall it can eat you can easily get lost or tricked by what you're seeing on the surface because you may not see like okay that there's a consistent like light pattern following all the forms okay now what I mean by that is let's show you a simple example let's use a less use of block first block is very simple so let's use a block, so you have a say we have a block like so all right now we have a light source coming from this direction okay, so obviously this is going to be the lighter side because it's most directly facing the light source then this one would be second so let's leave this the color of the paper to say it is direct light this is indirect light, so it's the lightest okay this is in the middle is gray it's getting some light but not as much as this is and this side is definitely not getting much light at all because it's facing away from the light source okay now let's say we have some smaller masses let's say we have some smaller forms like this okay say we have another one like this alright and there's another one like this, so these are smaller blocks now if they are receiving the same light here as this is right then the similar value pattern is going to be found on these okay there you go and of course right here is going to be gray and gray see so what I'm illustrating here is that there's a consistent value pattern on all of these forms based on the same hat receiving the same light as from the same light source okay they receive they're being illuminated from the same light source okay same direction everything, so the value patterns are pretty much the same because they are block forms right good now let's say we had a form that looks something like this so what I'm going to show now is an example of a form that combines all of these and this can be something that relates to the head alright or any other form that you draw okay so let's say we have something like that see, so basically I've just attached these forms to this now what do I mean in terms of having you know the value pattern follow the dominant form now the first thing is when you're drawing something you always try to feel for what's the larger underlying mass what's the larger underlying mass okay and let's just say we have this in the same light here, so this is in gray this one is in deep shadow because this is facing away from the...

People Also Ask about

What is the optional 5.85 tax rate in Massachusetts?

Why did I get a statement showing interest income from the IRS?

What are the income tax brackets for Massachusetts?

Is my interest income taxable in Massachusetts?

What is Massachusetts 5% income?

What is taxable income in Mass?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 990t 2013 editable form from Google Drive?

How do I complete 990t 2013 editable form online?

Can I sign the 990t 2013 editable form electronically in Chrome?

What is MA DoR 3M?

Who is required to file MA DoR 3M?

How to fill out MA DoR 3M?

What is the purpose of MA DoR 3M?

What information must be reported on MA DoR 3M?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.