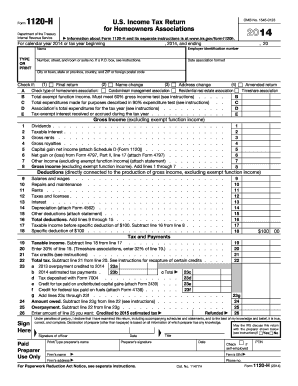

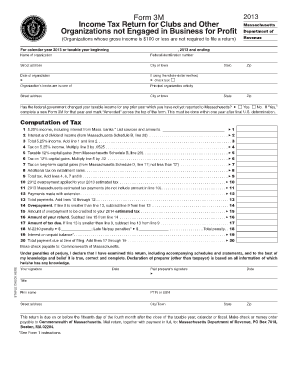

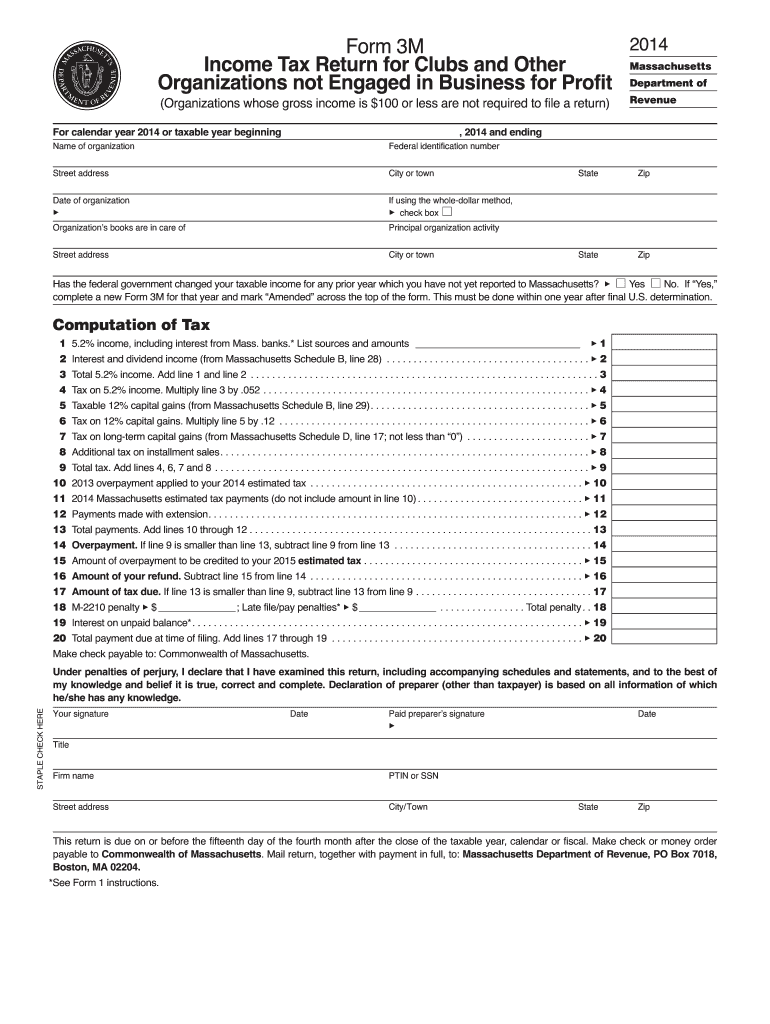

MA DoR 3M 2014 free printable template

Show details

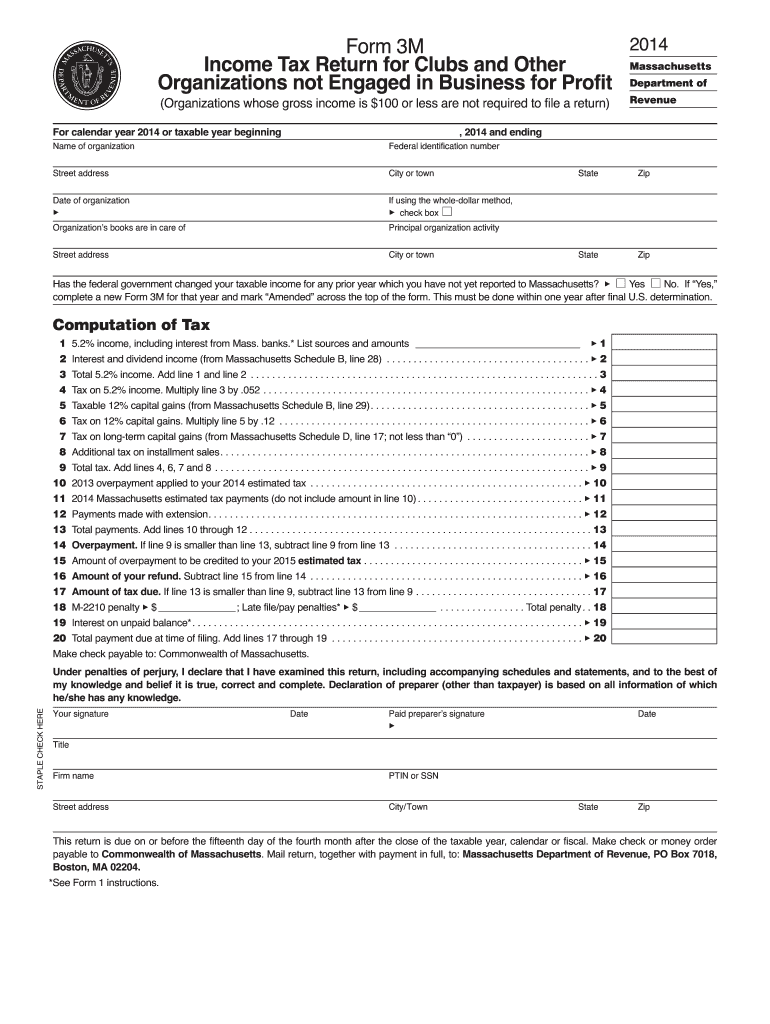

Enter this amount in line 28 and on Form 3M line 2. Omit lines 29 and 30. Otherwise complete Schedule B. 5 Short-term capital gains included in U.S. Schedule D lines 1 through 5 col. h. 6 Long-term capital gains on collectibles and pre-1996 installment sales from Massachusetts Schedule D line 11. 18 Form 3M Instructions This form is solely for the use of clubs labor unions political committees taxable fraternal organizations certain unincorporated homeowners associations and all other similar...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2 income including interest

Edit your 2 income including interest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2 income including interest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2 income including interest online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2 income including interest. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 3M Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2 income including interest

How to fill out MA DoR 3M

01

Obtain the MA DoR 3M form from the official Massachusetts Department of Revenue website.

02

Begin by entering your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Fill in the tax year you are reporting.

04

Provide details regarding income sources that are applicable to your situation.

05

Calculate your total income and other necessary figures as per the instructions provided on the form.

06

Complete any additional sections required, such as deductions or credits.

07

Review all entries to ensure accuracy and completeness.

08

Sign and date the form to certify that the information is correct.

09

Submit the completed form either electronically or by mailing it to the appropriate address.

Who needs MA DoR 3M?

01

Taxpayers in Massachusetts who need to report their income and calculate their state tax obligations.

02

Individuals and businesses seeking to claim deductions or credits associated with their income.

03

Any resident or non-resident earning income that is subject to Massachusetts taxation.

Instructions and Help about 2 income including interest

Fill

form

: Try Risk Free

People Also Ask about

What is the optional 5.85 tax rate in Massachusetts?

For about 20 years, people filing state income taxes in Massachusetts have had an opportunity to voluntarily pay a 5.85% state income tax rate as the state gradually decreased its state income tax from 5.9% to 5% thanks to a successful 2000 ballot measure.

Why did I get a statement showing interest income from the IRS?

The IRS charges underpayment interest when you don't pay your tax, penalties, additions to tax or interest by the due date.

What are the income tax brackets for Massachusetts?

The income tax rate in Massachusetts is 5.00%. That rate applies equally to all taxable income. Unlike with the federal income tax, there are no tax brackets in Massachusetts. State residents who would like to contribute more to the state's coffers also have the option to pay a higher income tax rate.

Is my interest income taxable in Massachusetts?

Interest income excluded from federal gross income under IRC Sec. 103 is generally taxable in Massachusetts. Taxpayers computing Massachusetts gross income can subtract interest received from certain government bonds and banks.

What is Massachusetts 5% income?

The state of Massachusetts has a personal income flat tax rate of 5% for everyone who made over $8,000 in 2021, regardless of their filing or residency status. If you earned less than $8,000 during the 2021 tax year, you don't have to file a Massachusetts tax return.

What is taxable income in Mass?

Your Massachusetts taxable income is your Massachusetts adjusted gross income minus the following deductions: Massachusetts deductions on Form 1 (Lines 11-14) and Form 1-NR/PY (Lines 11-16): Deductions on rent paid in Massachusetts. Social Security (FICA) and Medicare deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the 2 income including interest form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2 income including interest on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete 2 income including interest on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 2 income including interest by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete 2 income including interest on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 2 income including interest. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is MA DoR 3M?

MA DoR 3M is a tax form used in Massachusetts for reporting and remitting the Department of Revenue's income tax withholding for employees.

Who is required to file MA DoR 3M?

Employers in Massachusetts who withhold state income tax from employee wages are required to file MA DoR 3M.

How to fill out MA DoR 3M?

To fill out MA DoR 3M, employers must enter their identification details, total amount of tax withheld, and any adjustments necessary before submitting it to the Massachusetts Department of Revenue.

What is the purpose of MA DoR 3M?

The purpose of MA DoR 3M is to ensure accurate reporting and payment of state income taxes withheld from employee wages to the Massachusetts Department of Revenue.

What information must be reported on MA DoR 3M?

The information that must be reported on MA DoR 3M includes the employer's identification number, total wages paid, total tax withheld, and any adjustments or discrepancies related to the withholding tax.

Fill out your 2 income including interest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2 Income Including Interest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.