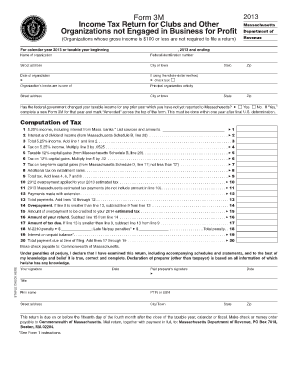

MA DoR 3M 2015 free printable template

Show details

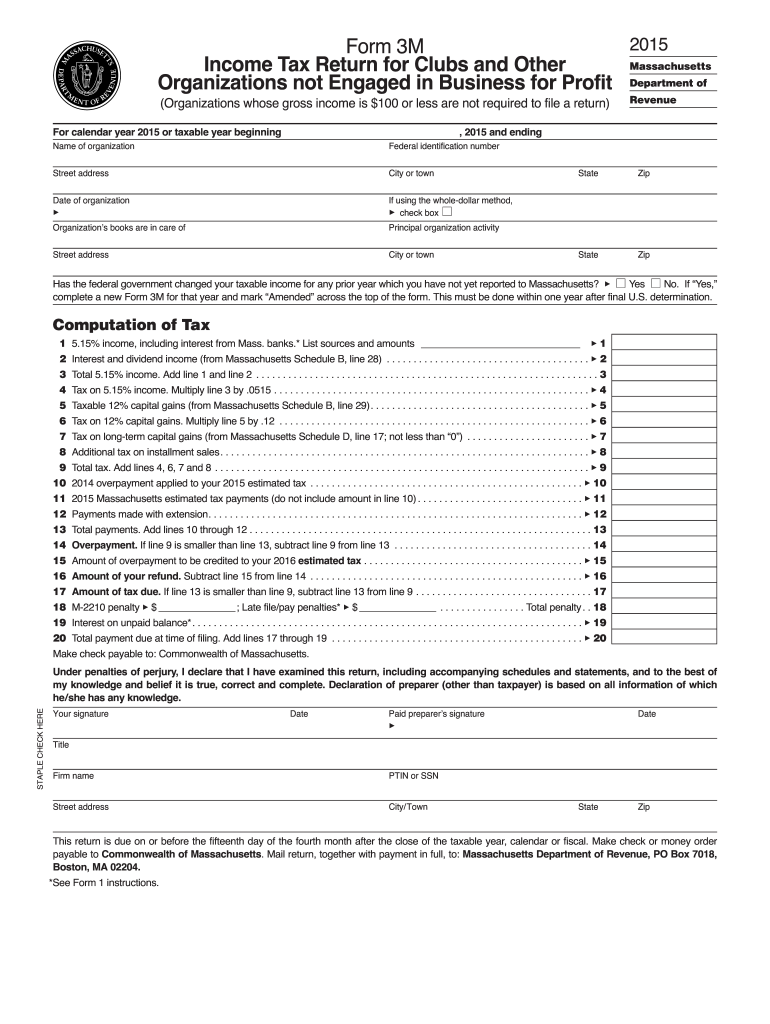

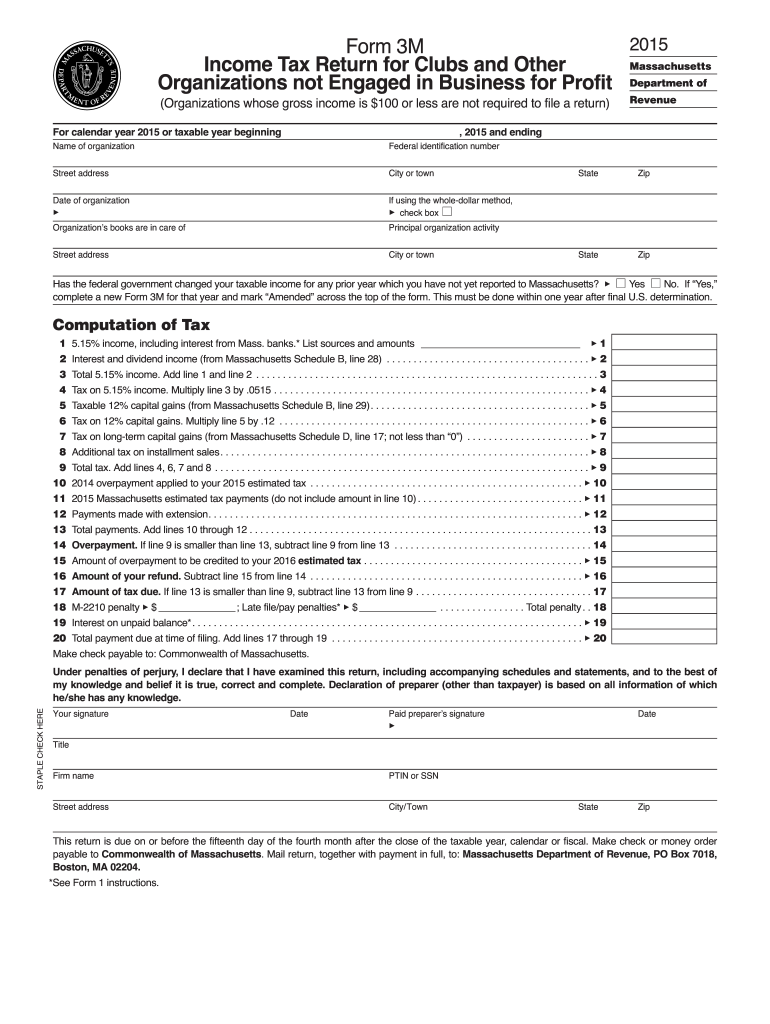

Enter this amount in line 28 and on Form 3M line 2. Omit lines 29 and 30. Otherwise complete Schedule B. If line 27 is less than line 5 enter line 27 here and on Form 3M line 2. 28 Available short-term losses for carryover in 2016. Add lines 25 and 26. Not less than 0. 27 If line 27 is greater than or equal to line 5 enter the amount from line 5 here and on Form 3M line 2. 16 Enter result here and on Form 3M line 7. 17 18 Available losses for carryover in 2016. Enter amount from Schedule D...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 3M

Edit your MA DoR 3M form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 3M form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR 3M online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA DoR 3M. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 3M Form Versions

Version

Form Popularity

Fillable & printabley

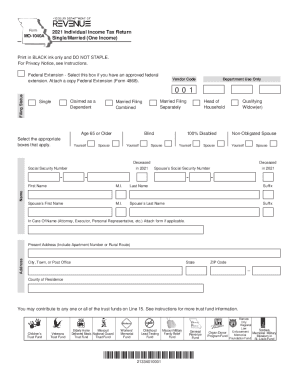

How to fill out MA DoR 3M

How to fill out MA DoR 3M

01

Obtain the MA DoR 3M form from the official Massachusetts Department of Revenue website or your local tax office.

02

Fill in your personal information including your name, address, and Social Security Number.

03

Complete the income section accurately by listing all sources of income for the given tax year.

04

Provide details on any deductions or credits you are claiming, ensuring you have supporting documentation if necessary.

05

Review the form for accuracy and completeness before signing and dating it.

06

Submit the completed form by the specified deadline through the appropriate channels, whether by mail or electronically.

Who needs MA DoR 3M?

01

Individuals or businesses who are required to report income to the Massachusetts Department of Revenue.

02

Taxpayers who need to claim deductions or credits on their Massachusetts tax returns.

03

Residents of Massachusetts seeking to comply with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the optional 5.85 tax rate in Massachusetts?

For about 20 years, people filing state income taxes in Massachusetts have had an opportunity to voluntarily pay a 5.85% state income tax rate as the state gradually decreased its state income tax from 5.9% to 5% thanks to a successful 2000 ballot measure.

Why did I get a statement showing interest income from the IRS?

The IRS charges underpayment interest when you don't pay your tax, penalties, additions to tax or interest by the due date.

What are the income tax brackets for Massachusetts?

The income tax rate in Massachusetts is 5.00%. That rate applies equally to all taxable income. Unlike with the federal income tax, there are no tax brackets in Massachusetts. State residents who would like to contribute more to the state's coffers also have the option to pay a higher income tax rate.

Is my interest income taxable in Massachusetts?

Interest income excluded from federal gross income under IRC Sec. 103 is generally taxable in Massachusetts. Taxpayers computing Massachusetts gross income can subtract interest received from certain government bonds and banks.

What is Massachusetts 5% income?

The state of Massachusetts has a personal income flat tax rate of 5% for everyone who made over $8,000 in 2021, regardless of their filing or residency status. If you earned less than $8,000 during the 2021 tax year, you don't have to file a Massachusetts tax return.

What is taxable income in Mass?

Your Massachusetts taxable income is your Massachusetts adjusted gross income minus the following deductions: Massachusetts deductions on Form 1 (Lines 11-14) and Form 1-NR/PY (Lines 11-16): Deductions on rent paid in Massachusetts. Social Security (FICA) and Medicare deduction.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MA DoR 3M online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your MA DoR 3M and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the MA DoR 3M in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MA DoR 3M.

How do I fill out the MA DoR 3M form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign MA DoR 3M and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MA DoR 3M?

MA DoR 3M refers to the Massachusetts Department of Revenue form used for reporting certain tax information, particularly related to corporate excise and income.

Who is required to file MA DoR 3M?

Corporations and entities doing business in Massachusetts, as well as those that meet specific income and corporate tax obligations, are required to file MA DoR 3M.

How to fill out MA DoR 3M?

To fill out MA DoR 3M, companies must provide detailed financial information, including income, deductions, and various tax calculations on the prescribed form.

What is the purpose of MA DoR 3M?

The purpose of MA DoR 3M is to report company income and determine the amount of corporate excise tax owed to the state of Massachusetts.

What information must be reported on MA DoR 3M?

Information that must be reported on MA DoR 3M includes gross receipts, deductions, taxable income, and credits applicable to the corporate tax.

Fill out your MA DoR 3M online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 3m is not the form you're looking for?Search for another form here.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.