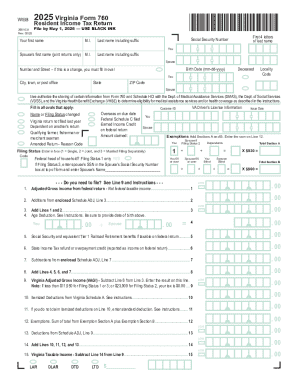

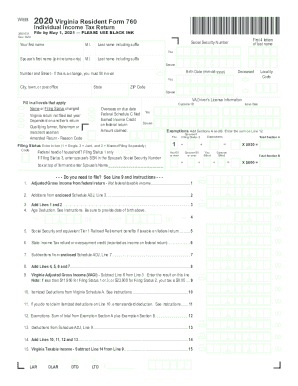

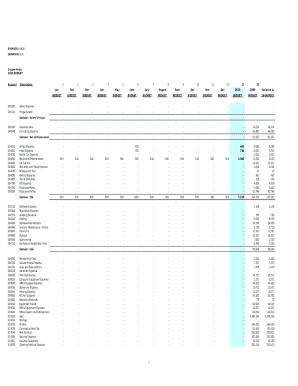

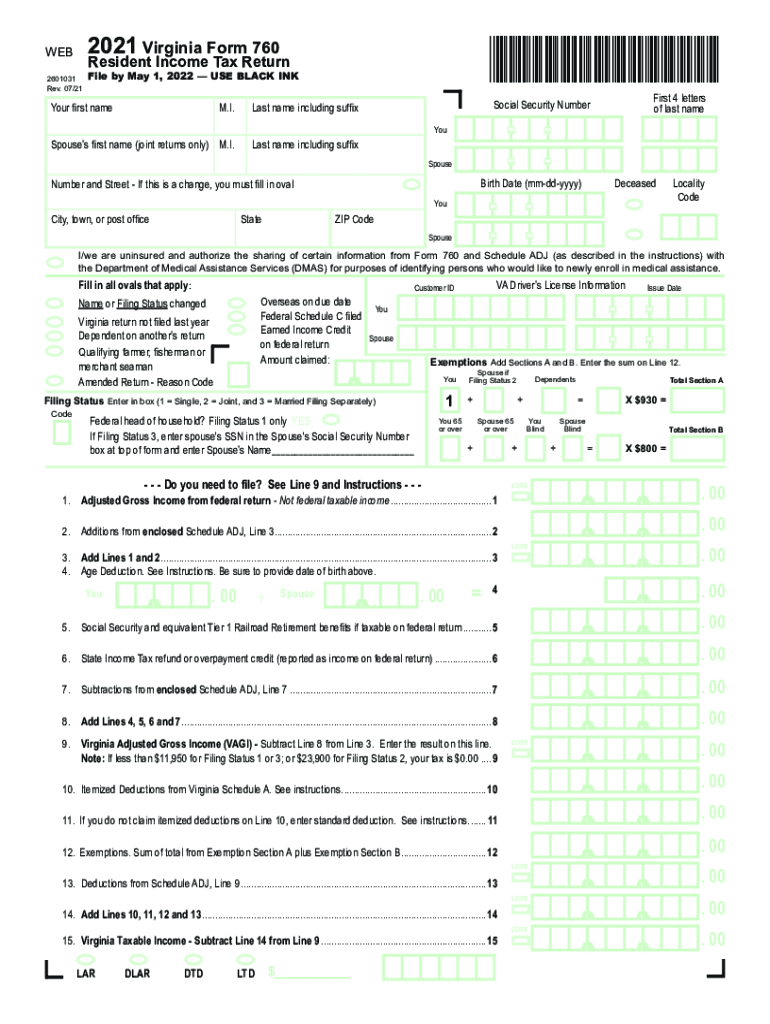

VA DoT 760 2021 free printable template

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

About VA DoT previous version

What is VA DoT 760?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about VA DoT 760

What should I do if I made a mistake on my 2021 va form 760?

If you realize an error after filing your 2021 va form 760, you can submit an amended return. This process generally involves filling out a new form and clearly marking it as amended. Be sure to provide explanations for the changes, as this can help prevent further issues with your submission.

How can I verify the status of my 2021 va form 760 after submission?

To check the status of your filing for the 2021 va form 760, you can use the online tracking system provided by the state tax agency. Additionally, if you e-filed, you may receive email notifications regarding the processing status, helping you stay informed about any updates.

What are the consequences of submitting a 2021 va form 760 without the proper documentation?

Submitting a 2021 va form 760 without the necessary documentation can result in delays or rejections of your filing. If your submission is incomplete, the tax agency may issue a notice requesting the missing information, and you may need to address these issues to avoid penalties or extended processing times.

Are there any specific technical requirements for e-filing the 2021 va form 760?

When e-filing the 2021 va form 760, ensure that you are using compatible software that meets state tax agency guidelines. It is also important to check that your internet browser is updated to prevent any technical glitches that might impede the filing process.

What should I do if I receive a notice regarding my 2021 va form 760?

If you receive a notice about your 2021 va form 760, carefully review the letter for details regarding the issue. Prepare any required documentation or explanations and respond promptly, as this will help manage any potential penalties or queries efficiently.