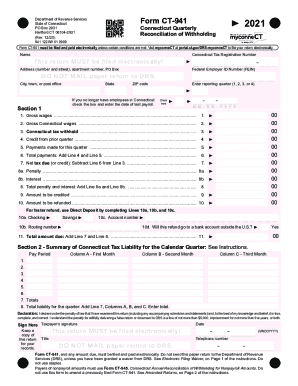

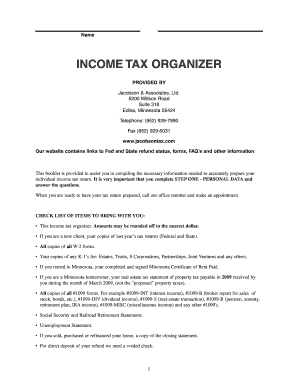

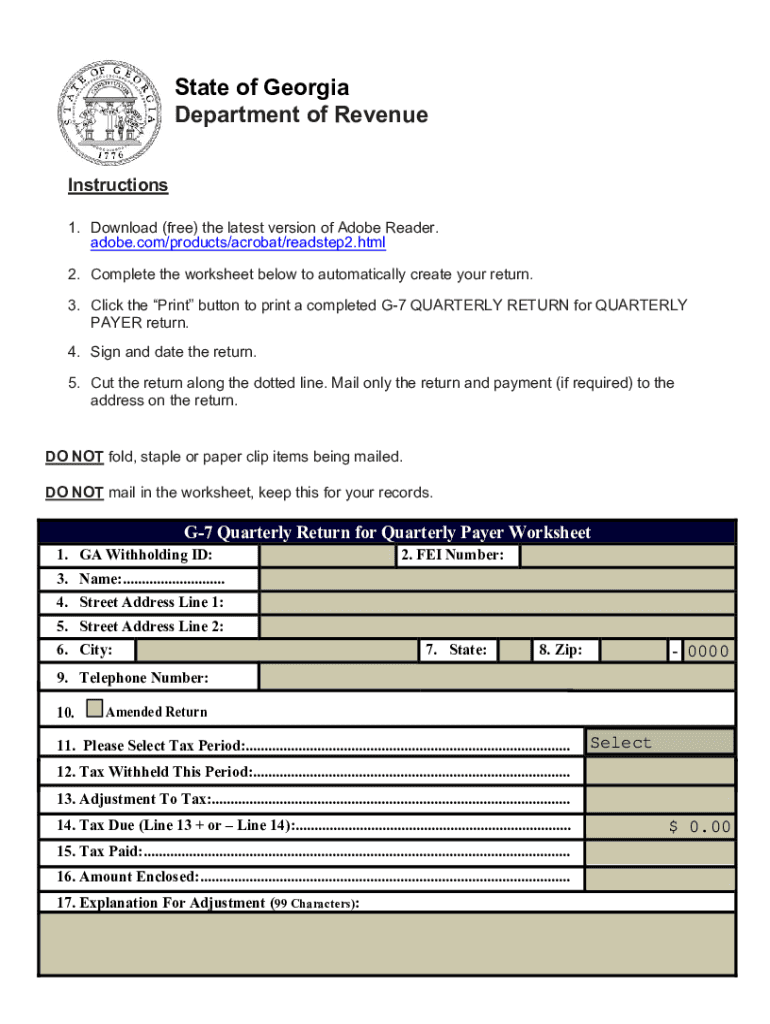

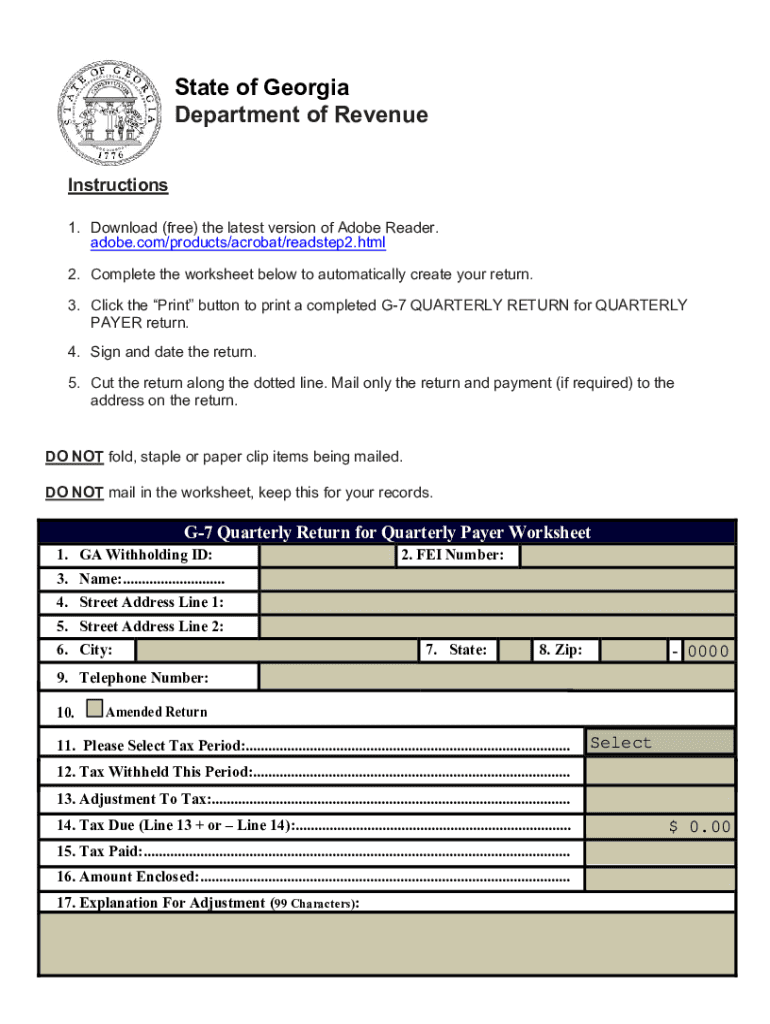

GA DoR G-7 2020 free printable template

Show details

State of Georgia

Department of Revenue

Instructions

1. Download (free) the latest version of Adobe Reader.

adobe.com/products/acrobat/readstep2.html

2. Complete the worksheet below to automatically

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR G-7

Edit your GA DoR G-7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR G-7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA DoR G-7 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit GA DoR G-7. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR G-7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR G-7

How to fill out GA DoR G-7

01

Start by obtaining the GA DoR G-7 form from the appropriate website or office.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal details, such as name, address, and contact information in the designated sections.

04

Provide any relevant identification numbers or identification documents as required.

05

Complete any sections that pertain to your specific situation, such as income, property details, or any other necessary information.

06

Review the filled-out form for any errors or omissions.

07

Sign and date the form in the designated areas.

08

Submit the completed GA DoR G-7 form to the appropriate office or online portal as per the instructions.

Who needs GA DoR G-7?

01

Individuals who are applying for financial assistance or support programs in Georgia.

02

Residents who need to report changes in their financial or personal circumstances.

03

Any person required to submit documentation for eligibility verification to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is GA Revenue?

Displays the total revenue of ecommerce transactions for Google Analytics sessions attributed to clicks on search or social objects in Search Ads 360. Only available after you link your Search Ads 360 advertiser with a Google Analytics web property.

What is GA state sales tax?

Effective January 1, 2022 Code 000 - The state sales and use tax rate is 4% and is included in the jurisdiction rates below.

When can I expect my Kemp refund?

The Department anticipates issuing substantially all the refunds by early August for returns filed by April 18, 2022. Your H.B. 1302 refund will not be issued until your 2021 tax return has been processed. For additional information, please visit this website.

What is GA withholding?

Withholding tax is the amount held from an employee's wages and paid directly to the state by the employer. This includes tax withheld from: Wages. Nonresident distributions.

How does Google Analytics track revenue?

Google analytics tracks revenue from ads, clicks, traffic, user traffic and essentially anything you tell it to track. Shipping costs, if the platform supports it, are automatically and dynamically added to your analytics statistics individually.

What are transactions in GA?

In Google Analytics, a 'transaction' is a unique purchase, and a 'conversion' is any goal you set for your website. A conversion could be a purchase or other action like signing up to a mailing list, filling out a form, or browsing multiple pages.

Who gets the Kemp tax refund?

The refund would only be paid to people who filed tax returns for both the 2020 and 2021 tax years, and no one can get back more than they paid in state income taxes in 2020. Crediting or issuing a refund will be automatic for anyone who files a 2020 and 2021 return, with no further action required.

How does Google Analytics track purchases?

You'll need to set up eCommerce metric for tracking in your Google Analytics account and add purchase data to your tracking code. Once you've done this, you'll be able to see data on purchases made on your site, including the number of items purchased, the total value of the purchase, and the average order value.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send GA DoR G-7 to be eSigned by others?

Once your GA DoR G-7 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find GA DoR G-7?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the GA DoR G-7 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the GA DoR G-7 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your GA DoR G-7 in seconds.

What is GA DoR G-7?

GA DoR G-7 is a form used for reporting certain financial information related to the Department of Revenue in the state of Georgia.

Who is required to file GA DoR G-7?

Individuals or entities that meet specific income thresholds or are involved in certain financial activities are required to file GA DoR G-7.

How to fill out GA DoR G-7?

To fill out GA DoR G-7, you need to provide personal and financial information as specified on the form, ensuring that all sections are completed accurately.

What is the purpose of GA DoR G-7?

The purpose of GA DoR G-7 is to collect financial data that helps the Georgia Department of Revenue assess taxes and ensure compliance with state tax laws.

What information must be reported on GA DoR G-7?

Georgia DoR G-7 requires reporting of income details, deductions, credits, and other relevant financial information that impacts tax liabilities.

Fill out your GA DoR G-7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR G-7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.