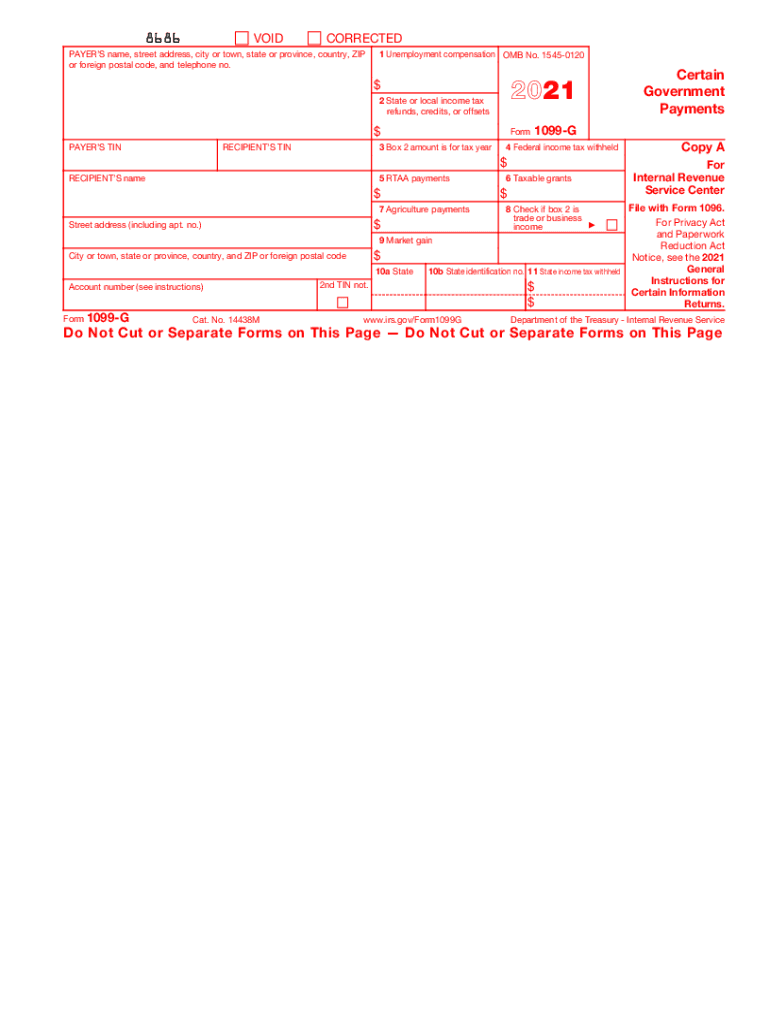

IRS 1099-G 2021 free printable template

Show details

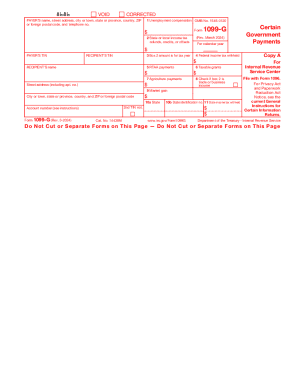

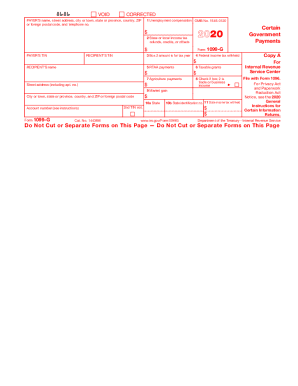

1 Unemployment compensation OMB No. 1545-0120 2 State or local income tax refunds credits or offsets PAYER S TIN RECIPIENT S TIN 3 Box 2 amount is for tax year Certain Government Payments Form 1099-G 4 Federal income tax withheld 5 RTAA payments RECIPIENT S name City or town state or province country and ZIP or foreign postal code Account number see instructions Form 1099-G Cat. No. 14438M Internal Revenue Service Center 6 Taxable grants File with Form 1096. Or you can make estimated tax...payments. For details see Form 1040-ES. If you made contributions to a governmental program and received a payment from that program the payer must issue a separate Form 1099-G to report this amount to you. However the payer may include interest of less than 600 in the blank box next to box 9 on Form 1099-G. Regardless of whether the interest is reported to you report it as interest income on your tax return. See your tax return instructions. Boxes 10a 11. State income tax withheld reporting...boxes. Future developments. For the latest information about developments related to Form 1099-G and its instructions such as legislation enacted after they were published go to www.irs.gov/Form1099G. Copy 2 To be filed with recipient s state income tax return when required. For Payer Copy C To complete Form 1099-G use the 2018 General Instructions for Certain Information Returns and the 2018 Instructions for Form 1099-G. To order these instructions and additional forms go Caution Because paper...forms are scanned during processing you cannot file Forms 1096 1097 1098 1099 3921 3922 or 5498 that you print from the IRS website. 1220. The IRS does not provide a fill-in form option for Copy A. Need help If you have questions about reporting on Form 1099-G call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. Box 1. Shows the total unemployment compensation paid to you this year. Combine the box 1 amounts from all Forms 1099-G and...report the total as income on the unemployment compensation line of your tax return. Except as explained below this is your taxable amount. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not. Do not print and file copy A downloaded from this website a penalty may be imposed for filing...with the IRS information return forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns available at www*irs*gov/form1099 for more information about penalties. Please note that Copy B and other copies of this form which appear in black may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information returns which include a scannable Copy A for filing with the IRS...and all other applicable copies of the form visit www.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-G

How to edit IRS 1099-G

How to fill out IRS 1099-G

Instructions and Help about IRS 1099-G

How to edit IRS 1099-G

To edit the IRS 1099-G form, you can use tools that allow for document editing transactions. pdfFiller offers features that allow you to fill out fields quickly, add your signature, and save your changes securely. Make sure to carefully review the form after editing to avoid any errors before submission.

How to fill out IRS 1099-G

Filling out IRS 1099-G requires accurate input of specific financial information. Follow these steps:

01

Gather necessary documents, including your tax identification number and financial records.

02

Enter your information in the designated fields accurately.

03

Review each entry to ensure correctness to avoid potential penalties.

About IRS 1099-G 2021 previous version

What is IRS 1099-G?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-G 2021 previous version

What is IRS 1099-G?

IRS 1099-G denotes the "Certain Government Payments" form. This form is issued by federal and state governments to report various types of payments made to individuals, such as unemployment compensation or tax refunds. Recipients of these payments must report the amounts on their tax returns.

What is the purpose of this form?

The purpose of IRS 1099-G is to inform taxpayers and the IRS about certain payments received. It provides taxpayers with the information they need to accurately report their income and determine eligibility for tax credits or deductions. Failure to report this income can lead to penalties or additional taxes owed.

Who needs the form?

Individuals who receive unemployment compensation, state tax refunds, or certain other government payments receive IRS 1099-G. If you have received any government benefit payments during the tax year, you may be issued this form, which you must keep for your tax records.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1099-G if you have not received any reportable government payments throughout the tax year. Additionally, if your total income falls below the minimum threshold required for filing a tax return, you may be exempt from needing to submit this form.

Components of the form

The IRS 1099-G includes several critical components, such as the payer's TIN, recipient's information, and specific payment amounts. Key boxes include those for reporting unemployment compensation, state tax refunds, and credits. Each section requires precise reporting to ensure compliance with tax regulations.

Due date

The due date for issuing IRS 1099-G forms typically falls at the end of January following the tax year in which the payments were made. Recipients should expect to receive their copy by early February, which gives them time to prepare their tax returns accurately.

What payments and purchases are reported?

Payments reported on IRS 1099-G include unemployment compensation, state tax refunds, and other government payments. It may also report certain agricultural payments. These payments must be accurately tallied as they affect the taxpayer's income reporting obligations.

How many copies of the form should I complete?

You typically need to complete multiple copies of IRS 1099-G, one for the recipient, one for the IRS, and sometimes additional copies for state agencies. Ensure you check the specific instructions attached to the form for clarity on how many copies are required based on your circumstances.

What are the penalties for not issuing the form?

Penalties for not issuing IRS 1099-G can be severe, including fines imposed by the IRS. If you fail to provide a correct form to the IRS or the recipient, you may incur fines ranging from $50 to $260 per form, depending on how late the form is submitted.

What information do you need when you file the form?

When filing IRS 1099-G, you need to provide the payer's taxpayer identification number (TIN), the recipient's name, address, and TIN, as well as the amounts paid. This information helps ensure proper crediting to the correct taxpayer accounts by the IRS.

Is the form accompanied by other forms?

IRS 1099-G may need to be submitted alongside other forms depending on individual circumstances. For instance, if you are reporting unemployment compensation, you may also need to attach federal or state tax forms that correlate with your filing status.

Where do I send the form?

Send IRS 1099-G to the IRS at the address specified in the instructions of the form. If applicable, you may need to send copies to state tax agencies, especially if the payments include state tax refunds. Make sure to check the correct destination based on your state residency.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I love every thing about this. I just wish you could also do a flip book.

This program was easy to work with; however, I misunderstood that the forms I was trying to use were copyrighted and had to be completed in another manner. Customer service was very prompt in responding to questions; and, for the right forms, this would be an awesome service.

See what our users say