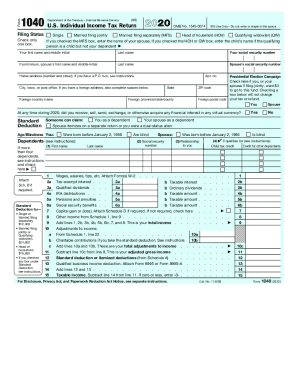

Who needs a Form 1040 (Schedule A) form?

Form 1040 and the included Schedule A (as a part of this form) are one of the main tax forms, so all citizens of the USA and resident aliens of the United States (people who passed the Substantial Presence Test or possessors of a Green Card) should file it. Non-resident aliens of the USA must file Form 1040NR-EZ and Form 1040NR. This form is also relevant for people who have changed their status during the current year.

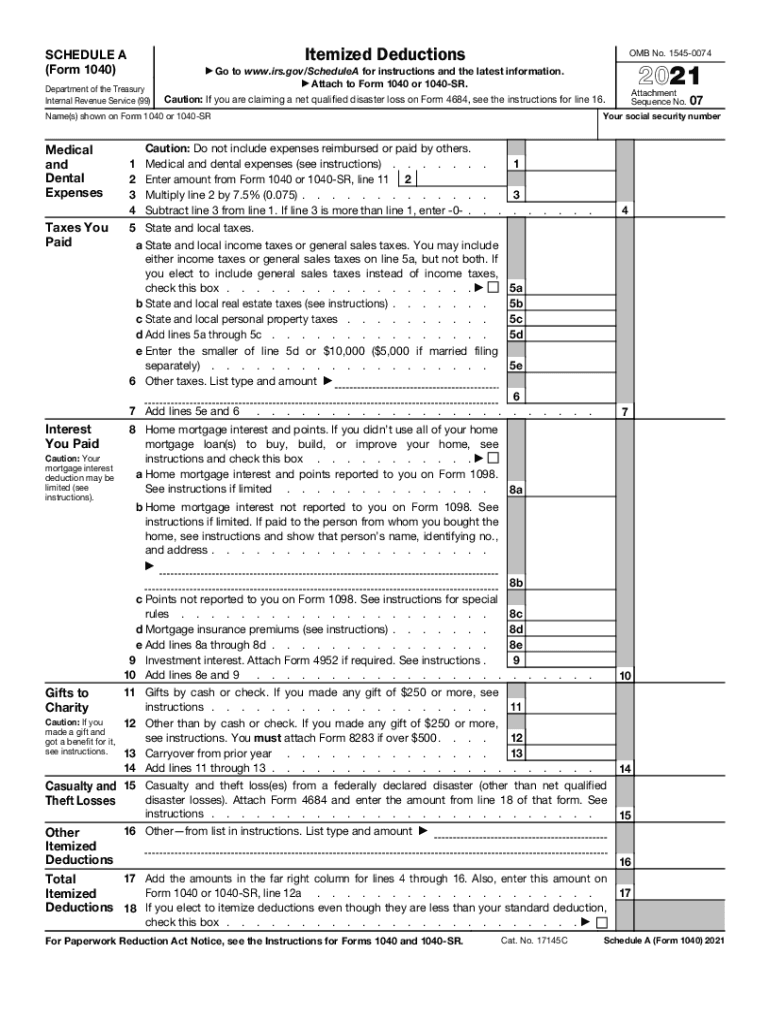

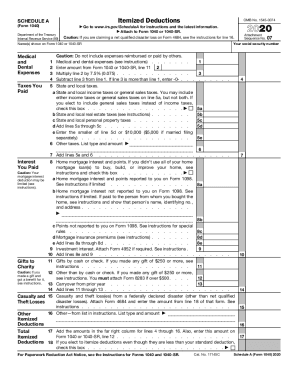

What is for Form 1040 (Schedule A)?

Form 1040 (or United States Individual Income Tax Return in official) is one of the main IRS forms needed for a tax return. It is used by individuals of the US to get a refund of paid taxes.

Schedule A must contain Itemized Deductions. Sometimes a taxpayer can choose a standard deduction of between 6300 USD and 12,600 USD. That possibility is available depending on filings' status, age, etc.

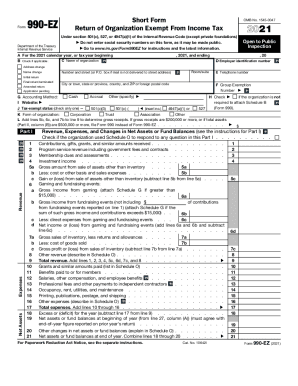

Is Form 1040 (Schedule A) accompanied by other forms?

Form 1040 accompanies the 1040-V form (Payment Voucher) and Form W-2. All other schedules of Form 1040 must be attached.

When is Form 1040 (Schedule A) due?

Returns utilizing Form 1040 should be filed on April 15 (Tax Day), except if April 15 is a Saturday, Sunday or a legal holiday in the United States.

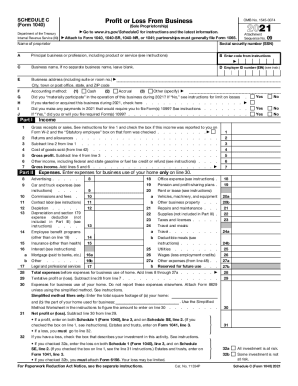

How do I fill out Form 1040 (Schedule A)?

Form 1040 (Schedule A) may be filed by paper or electronically. It should include the following information:

- Job Expenses and Certain Miscellaneous Deductions

- Total Itemized Deductions

- Gifts to Charity

- Medical and Dental Expenses

- Taxes You Paid

- Interest You Paid

- Casualty and Theft Losses

- Other Miscellaneous Deductions

Don’t forget to file other schedules of Form 1040.

Where do I send Form 1040 (Schedule A)?

The completed form must be sent to Internal Revenue Service.