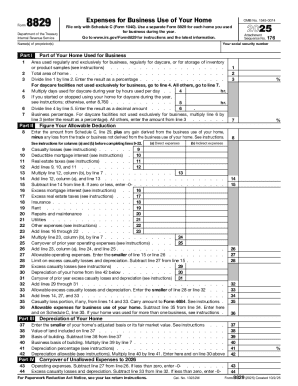

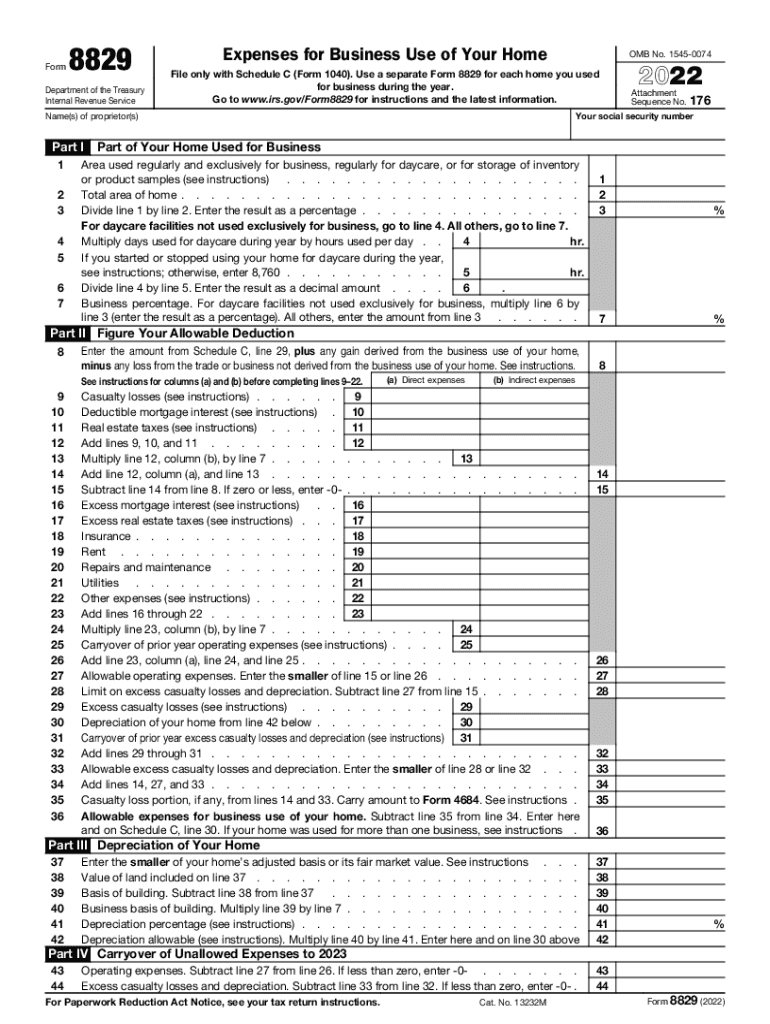

IRS 8829 2022 free printable template

Instructions and Help about IRS 8829

How to edit IRS 8829

How to fill out IRS 8829

About IRS 8 previous version

What is IRS 8829?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8829

What should I do if I realize I made a mistake on my IRS 8829?

If you discover an error on your IRS 8829 after submission, you can amend your return by filing Form 1040-X, which allows you to correct any inaccuracies. Ensure you provide accurate information for the corrected IRS 8829 and include explanations for the adjustments you're making to avoid confusion.

How can I check the status of my IRS 8829 submission?

You can verify the status of your IRS 8829 by checking the IRS 'Where's My Refund?' tool after filing, or by reviewing your e-filing history if you filed electronically. Keep track of any confirmation emails received, as these may also indicate that your submission was processed.

What should I do if I receive an audit notice related to my IRS 8829?

If you receive an audit notice regarding your IRS 8829, carefully review the notice to understand the specific concerns raised. Gather all relevant documentation supporting your claim, and consider consulting a tax professional for assistance in responding effectively to the IRS.

Are there specific common mistakes to avoid when filing IRS 8829?

Yes, common mistakes when filing IRS 8829 include failing to accurately calculate allowable expenses or misreporting the percentage of your home used for business. It’s essential to double-check your entries and ensure they align with your business use of the home to minimize errors.

What technical requirements should I be aware of for e-filing my IRS 8829?

When e-filing your IRS 8829, ensure that you are using compatible tax software that supports the latest version of the form. Also, checking that your browser is up to date can help avoid technical issues during submission. A stable internet connection is vital for a smooth filing process.

See what our users say