IRS 1040 - Schedule EIC 2022 free printable template

Show details

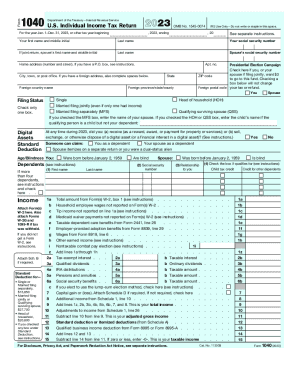

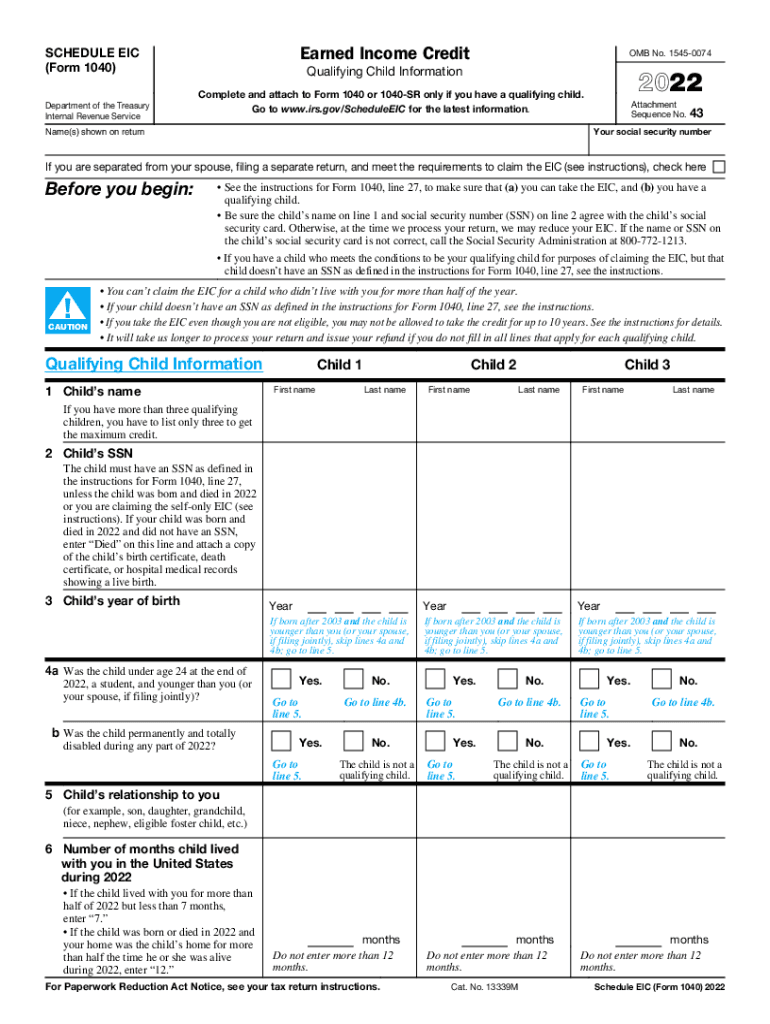

Cat. No. 13339M Schedule EIC Form 1040 2022 Page 2 Purpose of Schedule After you have figured your earned income credit EIC use Schedule EIC to give the IRS information about your qualifying child ren. Earned Income Credit SCHEDULE EIC Form 1040 Department of the Treasury Internal Revenue Service OMB No. 1545-0074 Qualifying Child Information Complete and attach to Form 1040 or 1040-SR only if you have a qualifying child. Future developments. For the latest information about developments related...to Schedule EIC Form 1040 and its instructions such as legislation enacted after they were published A qualifying child for the EIC is a child who is your. To claim the self-only EIC with a qualifying child complete and attach Schedule EIC to your Form 1040 or 1040-SR. Complete line 1 and lines 2 through 6 for Child 1. Go to www*irs*gov/ScheduleEIC for the latest information* Attachment Sequence No* 43 Your social security number Name s shown on return If you are separated from your spouse...filing a separate return and meet the requirements to claim the EIC see instructions check here Before you begin CAUTION See the instructions for Form 1040 line 27 to make sure that a you can take the EIC and b you have a Be sure the child s name on line 1 and social security number SSN on line 2 agree with the child s social security card. Otherwise at the time we process your return we may reduce your EIC. If the name or SSN on the child s social security card is not correct call the Social...Security Administration at 800-772-1213. If you have a child who meets the conditions to be your qualifying child for purposes of claiming the EIC but that child doesn t have an SSN as defined in the instructions for Form 1040 line 27 see the instructions. You can t claim the EIC for a child who didn t live with you for more than half of the year. If your child doesn t have an SSN as defined in the instructions for Form 1040 line 27 see the instructions. If you take the EIC even though you are...not eligible you may not be allowed to take the credit for up to 10 years. See the instructions for details. It will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child. 1 Child s name Child 1 First name Last name If you have more than three qualifying children you have to list only three to get the maximum credit. 2 Child s SSN The child must have an SSN as defined in the instructions for Form 1040 line 27 unless the...child was born and died in 2022 or you are claiming the self-only EIC see instructions. If your child was born and died in 2022 and did not have an SSN enter Died on this line and attach a copy of the child s birth certificate death certificate or hospital medical records showing a live birth. 3 Child s year of birth 4a Was the child under age 24 at the end of 2022 a student and younger than you or your spouse if filing jointly b Was the child permanently and totally disabled during any part of...2022 Year If born after 2003 and the child is younger than you or your spouse if filing jointly skip lines 4a and 4b go to line 5.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule EIC

How to edit IRS 1040 - Schedule EIC

How to fill out IRS 1040 - Schedule EIC

Instructions and Help about IRS 1040 - Schedule EIC

How to edit IRS 1040 - Schedule EIC

To edit IRS 1040 - Schedule EIC, begin by accessing a editable version of the form. You can use a tool like pdfFiller for modifications such as adding or removing information and updating any incorrect entries. Once you have made the necessary changes, save your revised document to preserve your edits and ensure accuracy for submission.

How to fill out IRS 1040 - Schedule EIC

Filling out IRS 1040 - Schedule EIC involves several steps. Start by gathering the required information, including your taxpayer identification number (TIN), details about your qualifying child, and your income details. Follow this structured approach:

01

Step 1: Enter your filing status and the number of qualifying children.

02

Step 2: Complete the required income sections.

03

Step 3: Calculate your earned income to determine your eligibility for the credit.

04

Step 4: Review for accuracy and completeness before submission.

About IRS 1040 - Schedule EIC 2022 previous version

What is IRS 1040 - Schedule EIC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule EIC 2022 previous version

What is IRS 1040 - Schedule EIC?

IRS 1040 - Schedule EIC is a tax form used by eligible taxpayers to claim the Earned Income Credit (EIC). This credit is designed to support low to moderate-income working individuals and families by reducing the amount of tax owed and potentially providing a refund.

What is the purpose of this form?

The purpose of Schedule EIC is to determine eligibility for the Earned Income Credit. The credit varies based on income levels and the number of qualifying children in the taxpayer's care, allowing individuals to receive tax benefits that can lead to significant refunds.

Who needs the form?

Taxpayers who work and have earned income but fall within specific income thresholds may need to use IRS 1040 - Schedule EIC. Additionally, those with qualifying children may claim a higher credit. Reviewing IRS eligibility criteria is essential to determine if the form is necessary.

When am I exempt from filling out this form?

You are exempt from filling out Schedule EIC if your earned income is above the limit for the credit or if you do not have qualifying children. Taxpayers without earnings or those who are not considered low to moderate income should also refrain from using this form.

Components of the form

The components of IRS 1040 - Schedule EIC include sections for personal information, details about qualifying children, and income calculations. Each section requires specific information that determines your eligibility and the credit amount you may receive.

What are the penalties for not issuing the form?

Failure to correctly file IRS 1040 - Schedule EIC when eligible may result in penalties. This includes the loss of potential tax credits which could significantly affect your tax refund. Additionally, incorrect claims may trigger audits or additional payments owed to the IRS.

What information do you need when you file the form?

When filing IRS 1040 - Schedule EIC, you will need your Social Security number, information about your qualifying children, and documentation of your earned income. It's also essential to have previous tax returns on hand for reference and any other necessary supporting documents.

Is the form accompanied by other forms?

IRS 1040 - Schedule EIC is typically filed alongside the main Form 1040. Depending on your tax situation, additional schedules or forms may be required, such as the Child Tax Credit form.

Where do I send the form?

The completed IRS 1040 - Schedule EIC should be mailed to the address indicated in the IRS instructions for Form 1040. For electronic filings, ensure that the EIC information is included when submitting your tax return through approved e-filing platforms.

See what our users say