IRS 5330 2022 free printable template

Show details

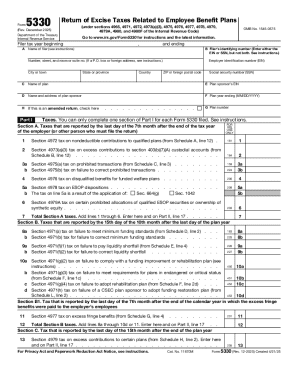

G Plan number Taxes. You can only complete one section of Part I for each Form 5330 filed see instructions. For Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 11870M 10b 10c year in which the excess Rev. 12-2013 Form 5330 Rev. 12-2013 Page Name of Filer line 3. Form Rev. December 2013 Department of the Treasury Internal Revenue Service Return of Excise Taxes Related to Employee Benefit Plans Under sections 4965 4971 4972 4973 a 3 4975 4976 4977 4978 4979 4979A 4980...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 5530

Edit your form 5330 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to fill out irs prohibited transactions under tax laws online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 5330 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 5330 form

How to fill out IRS 5330

01

Obtain IRS Form 5330 from the IRS website or a tax professional.

02

Fill in your identifying information in the top section, including your name, address, and TIN (Taxpayer Identification Number).

03

Indicate the tax year for which you are filing the form.

04

Complete Part I by checking the appropriate boxes related to the applicable excise tax you are reporting.

05

In Part II, provide a detailed explanation of the reason for the forms being filed and any events that prompted the need for excise tax.

06

Calculate the amount of tax due in Part III and ensure that you include any penalties or interest if needed.

07

Review your completed form for accuracy.

08

Sign and date the form at the bottom.

09

Submit the completed Form 5330 to the appropriate IRS address as indicated in the instructions.

Who needs IRS 5330?

01

Individuals or entities that have to report excise taxes related to employee benefit plans.

02

Plan sponsors and administrators who have made excess contributions to their retirement plans.

03

Anyone required to report and pay excise taxes on certain prohibited transactions under tax laws.

Fill

irs form 5330

: Try Risk Free

People Also Ask about can i edit form 5330 be reported on irs 5330

What is form 5330 for lost earnings?

After remitting the late deposits and making the additional contributions to cover lost earnings, plan sponsors should complete the Internal Revenue Service (IRS) Form 5330 and pay the excise tax—equal to 15 percent of the lost earnings. The excise tax cannot be paid from the plan assets.

What is IRS form 5330 used for?

This form is used to report and pay the excise tax related to employee benefit plans.

What is Form 5330 for excise tax return?

What is form 5330? The Form 5330 has one job – to accompany remittances of certain excise taxes that are associated with qualified retirement plans and 403(b) plans.

Can you electronically file form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Can you electronically file Form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Who prepares form 5330?

An employer or an individual required to file an excise tax return related to employee benefit plans can file Form 5330 electronically. All filers are encouraged to file Form 5330 electronically because it is safe, easy to complete, and you have an immediate record that the return was filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get instructions for form 5330?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form 5330 electronic filing in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the irs form 5330 instructions electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 5530 form in minutes.

Can I edit irs 5330 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute what is form 5330 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 5330?

IRS 5330 is a tax form used by plan sponsors to report and pay excise taxes related to certain retirement plan operations that do not comply with IRS rules.

Who is required to file IRS 5330?

Entities or individuals who are responsible for certain retirement plans and have incurred excise taxes for violations of the Internal Revenue Code must file IRS 5330.

How to fill out IRS 5330?

To fill out IRS 5330, taxpayers need to complete the form detailing the specific excise tax owed, including identifying information about the plan and any relevant violations, and include payment if required.

What is the purpose of IRS 5330?

The purpose of IRS 5330 is to ensure compliance with federal tax laws regarding retirement plans and to facilitate the reporting and payment of excise taxes for violations, thereby promoting adherence to retirement plan regulations.

What information must be reported on IRS 5330?

IRS 5330 requires reporting information such as the name and address of the plan sponsor, the type of plan, details of the excise tax incurred, and payment information for any taxes owed.

Fill out your IRS 5330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To File Form 5330 Electronically is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.