AL ADoR PPT 2023 free printable template

Show details

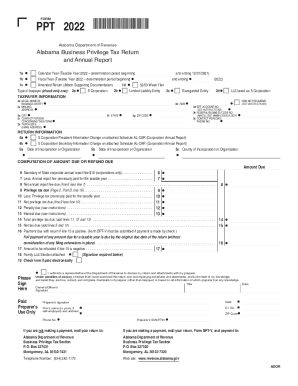

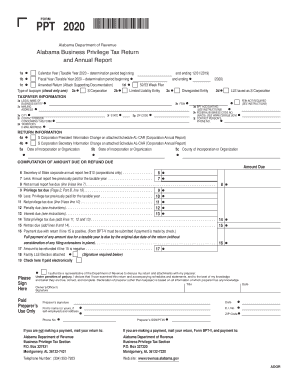

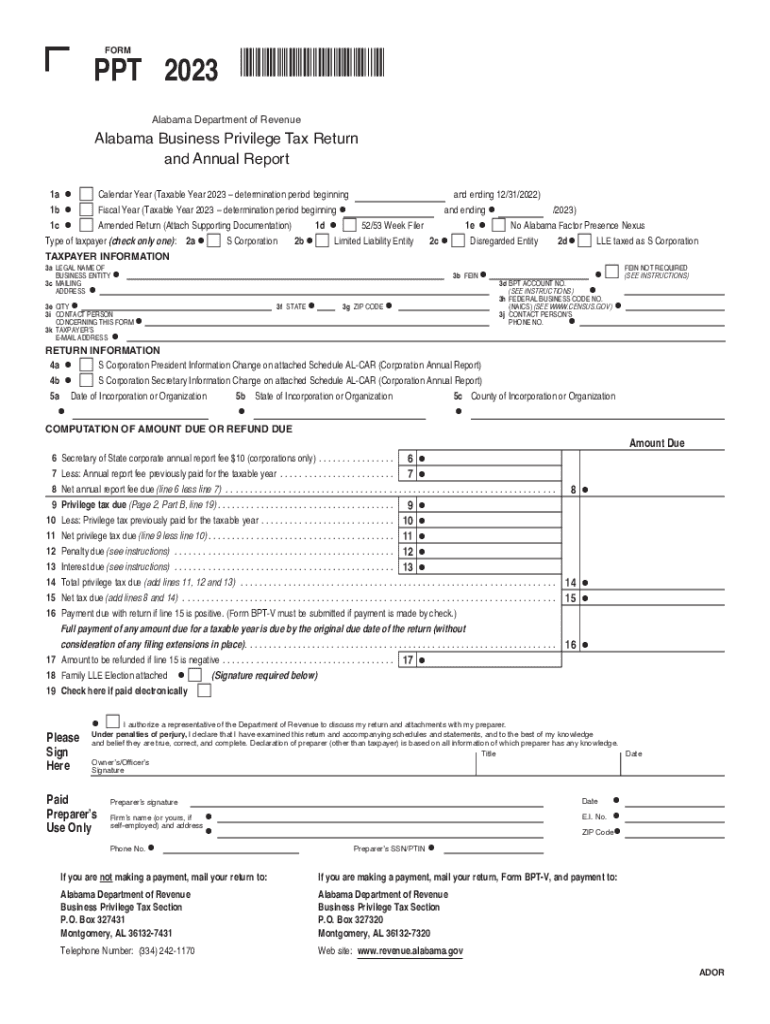

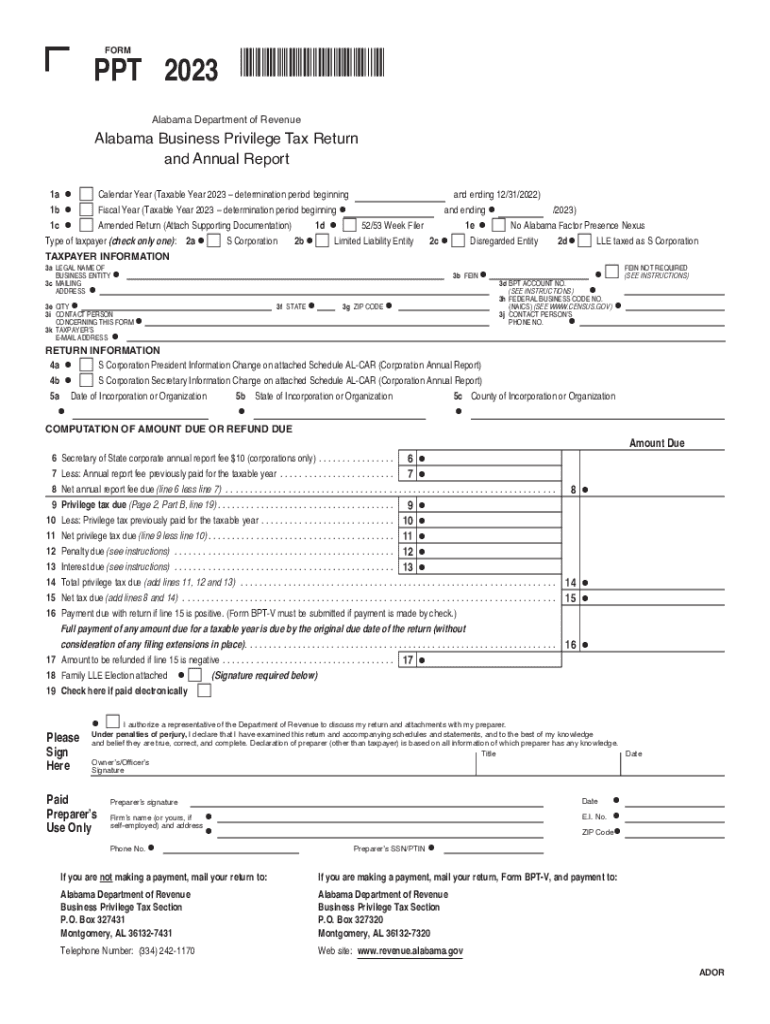

PPT 2023 230001PP FORM Alabama Department of Revenue Alabama Business Privilege Tax Return and Annual Report 1a Calendar Year Taxable Year 2023 determination period beginning and ending 12/31/2022 1b Fiscal Year Taxable Year 2023 determination period beginning and ending /2023 1c Amended Return Attach Supporting Documentation 1d 52/53 Week Filer 1e No Alabama Factor Presence Nexus Type of taxpayer check only one 2a S Corporation 2b Limited Liability Entity 2c Disregarded Entity 2d...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR PPT

Edit your AL ADoR PPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR PPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL ADoR PPT online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AL ADoR PPT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR PPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

01

Gather all necessary information relevant to your project or organization, including data and documentation.

02

Open the AL ADoR PPT template on your computer.

03

Start with the title slide and input the title of your project along with any relevant date or organization name.

04

Proceed to the introduction slide and provide a brief overview of the project purpose and objectives.

05

Fill in each section of the PPT according to the prescribed format, using bullet points for clarity.

06

Incorporate data visualizations such as charts or graphs where applicable to enhance understanding.

07

Review each slide for coherence and accuracy, ensuring all information aligns with the project goals.

08

Add any supplementary slides if necessary, such as acknowledgments or additional data.

09

Finalize the presentation by proofreading it for grammatical errors and formatting inconsistencies.

Who needs AL ADoR PPT?

01

Project managers needing to present project proposals or updates.

02

Team members collaborating on project documentation and reporting.

03

Stakeholders who require an overview of project goals, progress, and outcomes.

04

Organizations aiming to standardize their presentation formats.

05

Anyone involved in project reporting or seeking funding and support from external sources.

Fill

form

: Try Risk Free

People Also Ask about

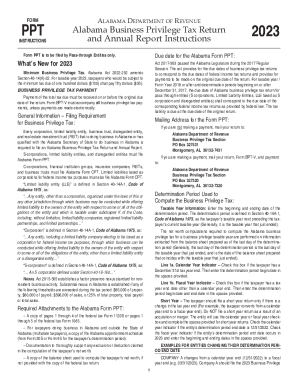

What is the privilege tax rate in Alabama?

25 to $1.75 for each $1,000 of net worth in Alabama. If taxable income of the taxpayer is: Less than $1, the tax rate shall be $0.25 per $1,000. At least $1 but less than $200,000, the tax rate shall be $1.00 per $1,000.

What is the Alabama privilege tax for 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the Alabama PPT tax?

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

What is a PPT form in Alabama?

The CPT form is filed with the Alabama Department of Revenue. PPT – S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

What is the due date for Alabama business privilege tax?

Taxable year 2021 Form CPT would be due on April 15, 2021 for a calendar year C-corporation. For C-corporations with a fiscal year of June 30, the Alabama business privilege tax return is due no later than two and a half months after the beginning of a taxpayer's taxable year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL ADoR PPT directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your AL ADoR PPT and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the AL ADoR PPT in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your AL ADoR PPT right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit AL ADoR PPT on an Android device?

You can make any changes to PDF files, such as AL ADoR PPT, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is AL ADoR PPT?

AL ADoR PPT refers to the Alabama Annual Disclosure of Related Party Transactions and Principal Prescriptions, which is a form used for reporting financial dealings and transactions that may present a potential for conflicts of interest.

Who is required to file AL ADoR PPT?

Entities and individuals involved in related party transactions, such as corporations or organizations with significant transactions with their executives, board members, or other related parties, are required to file the AL ADoR PPT.

How to fill out AL ADoR PPT?

To fill out the AL ADoR PPT, individuals must provide detailed information on related party transactions, including the nature of the transaction, parties involved, amounts, and any relevant terms or conditions. It typically involves using standardized forms provided by the state authorities.

What is the purpose of AL ADoR PPT?

The purpose of the AL ADoR PPT is to promote transparency and accountability in financial reporting by disclosing transactions that could lead to potential conflicts of interest, thereby protecting stakeholders and the integrity of the reporting entities.

What information must be reported on AL ADoR PPT?

The AL ADoR PPT must report specific information including the names of related parties involved, a description of each transaction, the amounts involved, and any terms or conditions related to those transactions to ensure comprehensive disclosure.

Fill out your AL ADoR PPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR PPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.