IRS 3800 2022 free printable template

Show details

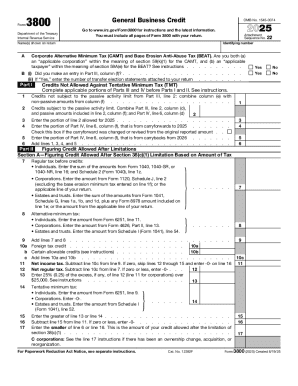

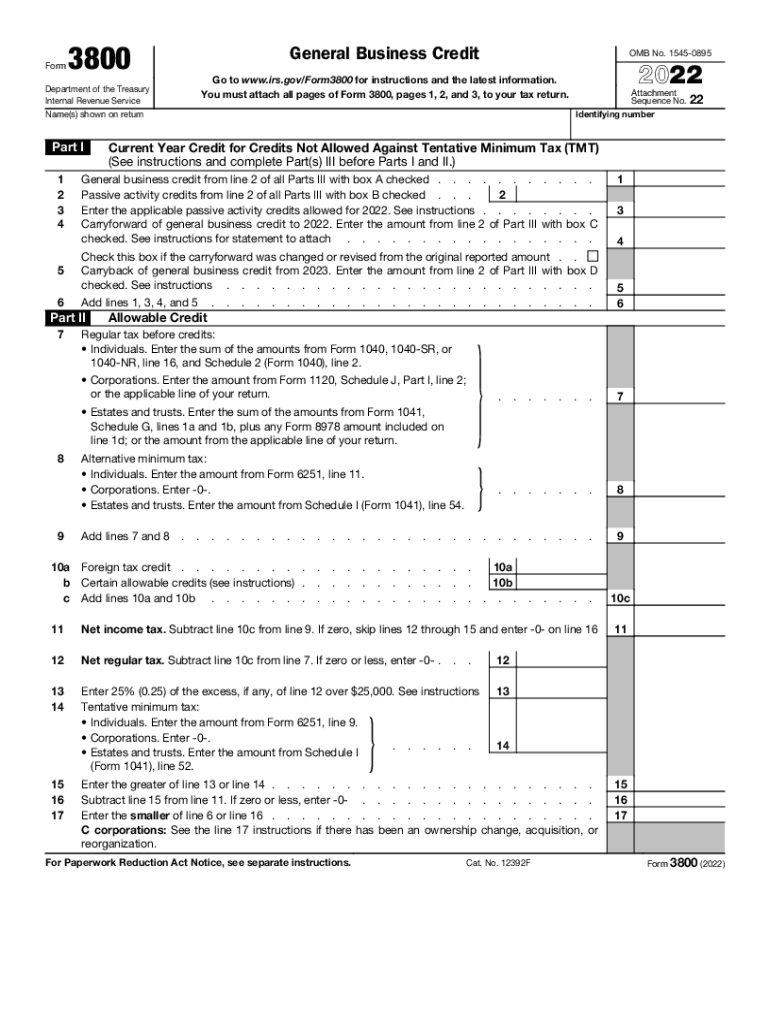

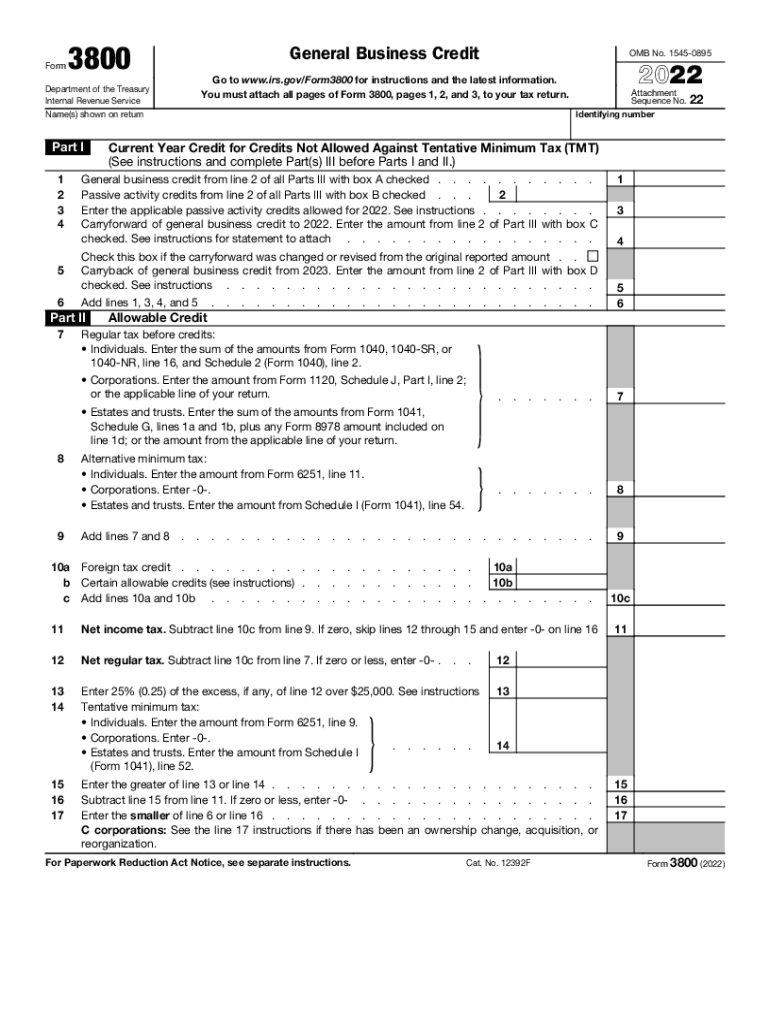

Form3800General Business Credit OMB No. 154508951

2

3

4Attachment

Sequence No. 22

Identifying cumbersome(s) shown on returner I2022Go to www.irs.gov/Form3800 for instructions and the latest information.

You

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 3800

Edit your IRS 3800 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 3800 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 3800 online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 3800. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 3800 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 3800

How to fill out IRS 3800

01

Obtain IRS Form 3800 from the IRS website or through tax software.

02

Review the instructions for Form 3800 to understand eligibility and requirements.

03

Complete Part I by selecting the credits you are claiming.

04

Fill out Part II, providing necessary details related to each credit.

05

Complete Part III if applicable, which details certain credit limitations.

06

Add any relevant additional forms or supporting documentation.

07

Review your completed Form 3800 for accuracy.

08

Submit Form 3800 with your tax return.

Who needs IRS 3800?

01

Businesses claiming certain tax credits, such as the general business credit.

02

Taxpayers who have made investments in qualified activities or industries.

03

Corporations or partnerships looking to reduce their tax liability.

04

Individuals who are eligible for certain tax credits, such as the energy credit.

Fill

form

: Try Risk Free

People Also Ask about

How is general business credit limit calculated?

Add your net income tax and your alternative minimum tax. From that sum, subtract the greater of 1) your tentative minimum tax for the tax year or 2) 25% of the amount of your regular tax liability that exceeds $25,000 ($12,500 for married taxpayers filing separately, but only if both of them qualify for the credit)6.

What happens to unused business credits?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Should I file form 3800?

If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

Do general business tax credits expire?

In the absence of an income tax liability, the business credits will build up and carry over until the corporation either generates taxable income or the credits expire.

What is 3800 general business credit?

The General Business Credit (Form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with a total tax credit amount for your business tax return.

What is the general business credit limitation?

These credit amounts are then combined and subjected to a limitation on the aggregate credit. The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry forward?

What happens to unused R&D credits? Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Who must file form 3800?

The general business credit is the total value of all tax credits a business claims for a tax year. If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

What qualifies as a general business credit?

Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. In addition, your general business credit for the current year may be increased later by the carryback of business credits from later years.

Why do I have to fill out Form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Do general business credits have to be carried back?

Most unused general business credits may be carried back one year and carried forward forward 20 years until exhausted. However, for tax years beginning after 2022, the carryover rules apply separately to applicable credit that are eligible for the IRC §6417 tax payment election.

What is an eligible small business credit?

Some small businesses can use the tax credit to offset their alternative minimum tax. To qualify, the business must be a non-publicly traded corporation, partnership or sole proprietorship with an average of $50 million or less in gross receipts over the last three years.

How long can you carry forward tax credits?

Carryback and Carryover of Unused Credit You can carry back for one year and then carry forward for 10 years the unused foreign tax.

What is the purpose of IRS form 3800?

You must file Form 3800 to claim any of the general business credits. The carryforward may have to be reduced in the event of any recapture event (change in ownership, change in use of property, etc.). If a section 1603 grant is received, the carryforward must be reduced to zero.

What is a form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Who can file Form 3800?

General Instructions Partnerships and S corporations must always complete the source credit form. All other filers whose only source for a credit listed on Form 3800, Part III, is from a partnership, S corporation, estate, trust, or cooperative can report the credit directly on Form 3800.

What is the general business credit limited to?

The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry over?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS 3800 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS 3800 in minutes.

How do I complete IRS 3800 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IRS 3800 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit IRS 3800 on an Android device?

You can edit, sign, and distribute IRS 3800 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IRS 3800?

IRS Form 3800 is the General Business Credit form used by businesses to report eligible business credits that can be claimed against their tax liability.

Who is required to file IRS 3800?

Any business that is claiming any of the general business credits must file IRS Form 3800.

How to fill out IRS 3800?

To fill out IRS Form 3800, taxpayers need to gather information about the various business credits they are eligible for, complete the required sections of the form detailing the credits being claimed, and include it with their tax return.

What is the purpose of IRS 3800?

The purpose of IRS Form 3800 is to summarize and report the general business credits a taxpayer is claiming, allowing them to reduce their overall tax liability.

What information must be reported on IRS 3800?

IRS Form 3800 requires information on the type of credits being claimed, the amounts for each credit, and any limitations or carryover of credits from previous years.

Fill out your IRS 3800 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 3800 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.