IRS 3800 2024 free printable template

Show details

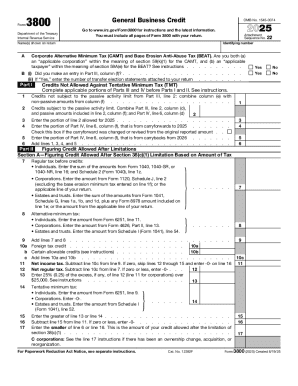

Form3800Department of the Treasury

Internal Revenue ServiceGeneral Business CreditOMB No. 154508952024Go to www.irs.gov/Form3800 for instructions and the latest information.

You must include all

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 3800 certified mail

Edit your 3800 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3800 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 3800 pdffiller online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 3800 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 3800 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 3800 edit form

How to fill out IRS 3800

01

Obtain the IRS Form 3800 from the official IRS website or through tax preparation software.

02

Review the instructions carefully to ensure eligibility for credits.

03

Complete Part I by indicating which credits you are claiming.

04

Fill out Part II for the General Business Credit, providing specific details for your business.

05

Complete Part III to summarize your credits and any carryforward amounts from previous years.

06

Double-check all figures for accuracy and ensure all required documentation is attached.

07

Sign and date the form before submitting it with your tax return.

Who needs IRS 3800?

01

Taxpayers who are claiming multiple business credits, such as the investment credit or the work opportunity credit.

02

Businesses, both sole proprietors and corporations, eligible for available tax credits.

03

Taxpayers who have previously used carryforward credits and wish to apply them in the current tax year.

Fill

3800 fill

: Try Risk Free

People Also Ask about irs 3800

How is general business credit limit calculated?

Add your net income tax and your alternative minimum tax. From that sum, subtract the greater of 1) your tentative minimum tax for the tax year or 2) 25% of the amount of your regular tax liability that exceeds $25,000 ($12,500 for married taxpayers filing separately, but only if both of them qualify for the credit)6.

What happens to unused business credits?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Should I file form 3800?

If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

Do general business tax credits expire?

In the absence of an income tax liability, the business credits will build up and carry over until the corporation either generates taxable income or the credits expire.

What is 3800 general business credit?

The General Business Credit (Form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with a total tax credit amount for your business tax return.

What is the general business credit limitation?

These credit amounts are then combined and subjected to a limitation on the aggregate credit. The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry forward?

What happens to unused R&D credits? Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Who must file form 3800?

The general business credit is the total value of all tax credits a business claims for a tax year. If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

What qualifies as a general business credit?

Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. In addition, your general business credit for the current year may be increased later by the carryback of business credits from later years.

Why do I have to fill out Form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Do general business credits have to be carried back?

Most unused general business credits may be carried back one year and carried forward forward 20 years until exhausted. However, for tax years beginning after 2022, the carryover rules apply separately to applicable credit that are eligible for the IRC §6417 tax payment election.

What is an eligible small business credit?

Some small businesses can use the tax credit to offset their alternative minimum tax. To qualify, the business must be a non-publicly traded corporation, partnership or sole proprietorship with an average of $50 million or less in gross receipts over the last three years.

How long can you carry forward tax credits?

Carryback and Carryover of Unused Credit You can carry back for one year and then carry forward for 10 years the unused foreign tax.

What is the purpose of IRS form 3800?

You must file Form 3800 to claim any of the general business credits. The carryforward may have to be reduced in the event of any recapture event (change in ownership, change in use of property, etc.). If a section 1603 grant is received, the carryforward must be reduced to zero.

What is a form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Who can file Form 3800?

General Instructions Partnerships and S corporations must always complete the source credit form. All other filers whose only source for a credit listed on Form 3800, Part III, is from a partnership, S corporation, estate, trust, or cooperative can report the credit directly on Form 3800.

What is the general business credit limited to?

The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry over?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs 3800 form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign irs 3800 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify form 3800 pdf without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like general credit, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out 1095 c form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 3800 instructions. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is IRS 3800?

IRS 3800, also known as the General Business Credit form, is a tax form used by businesses to claim various credits against their tax liability.

Who is required to file IRS 3800?

Businesses that are eligible for certain tax credits and wish to claim those credits must file IRS 3800.

How to fill out IRS 3800?

To fill out IRS 3800, taxpayers need to gather information about the credits they qualify for, calculate the credits using the appropriate worksheets, and enter the totals on the form.

What is the purpose of IRS 3800?

The purpose of IRS 3800 is to allow businesses to summarize and claim various general business tax credits that can reduce their federal tax liability.

What information must be reported on IRS 3800?

The information that must be reported on IRS 3800 includes the type of credit being claimed, the amounts for each applicable credit, and any carryforward or carryback information related to the credits.

Fill out your IRS 3800 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

i3800 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.