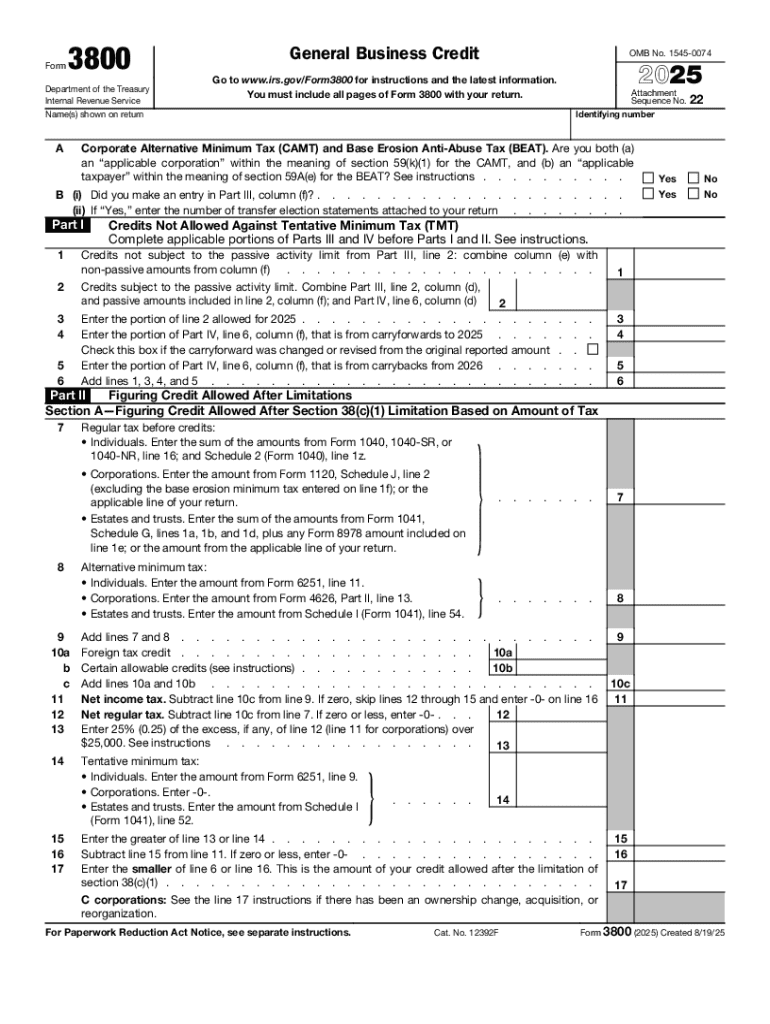

IRS 3800 2025-2026 free printable template

Get, Create, Make and Sign IRS 3800

How to edit IRS 3800 online

Uncompromising security for your PDF editing and eSignature needs

IRS 3800 Form Versions

How to fill out IRS 3800

How to fill out 2025 form 3800

Who needs 2025 form 3800?

Understanding the 2025 Form 3800 Form: A Comprehensive Guide

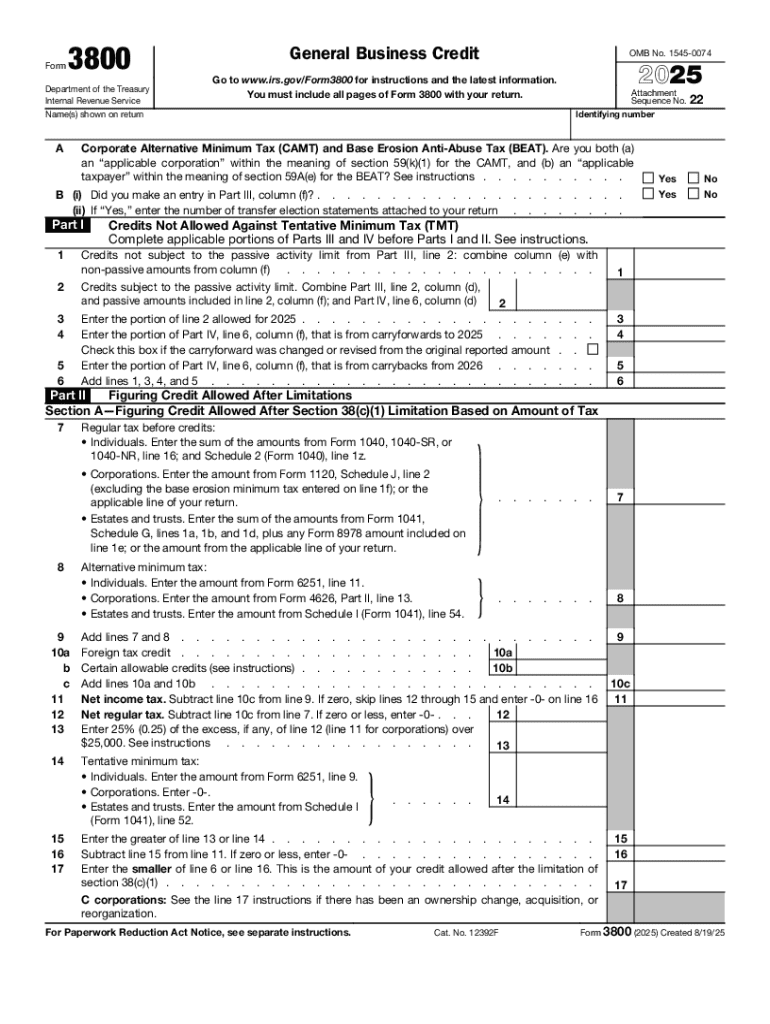

Overview of Form 3800

Form 3800, also known as the General Business Credit, is a crucial tax form designed to allow businesses to claim a variety of tax credits associated with their operations. This form consolidates several credits, making it easier for individuals and corporations to maximize their tax benefits. For the 2025 tax year, understanding Form 3800 is particularly significant as more businesses are resuming operations and looking for ways to recover financially.

Eligibility to use Form 3800 is generally open to various business entities, including sole proprietors, partnerships, corporations, and even certain tax-exempt organizations. Each business must meet the specific requirements of the various credits included in Form 3800 to qualify. This means reviewing each potential credit to determine how it applies to their specific operations.

Key features of the 2025 Form 3800

The 2025 Form 3800 features several types of business credits, including the Investment Credit, Work Opportunity Credit, and Energy Efficient Home Credit. Understanding these credits is essential as they can significantly reduce a taxpayer's liability, potentially enhancing cash flow. The form effectively categorizes these credits under the General Business Credit, offering taxpayers a streamlined way to access and claim these benefits.

In 2025, several legislative changes have impacted the structure and available credits of Form 3800. There is a notable enhancement for the Renewable Diesel Fuels Credit aimed at businesses using renewable energy sources. Comparing 2024 to 2025 shows an increase in available credits targeting sustainability, making it an important year for businesses investing in eco-friendly practices.

Step-by-step instructions for completing Form 3800

Preparation is key when filling out the Form 3800. Start by collecting all necessary documentation related to your business activities and the specific credits you intend to claim. This may include records of investments, payroll for qualified employees, and any expenses associated with energy efficiency or other qualifying activities. Understanding your credit eligibility is crucial for accurate filing.

Once your documentation is complete, begin filling out Form 3800. Start with the identifying information section, ensuring all the details match your IRS records to prevent processing issues. Next, accurately calculate your eligible credits based on your operational activities and supporting documents. Pay particular attention when reporting other income and deductions to ensure they're aligned with your claimed credits.

To maintain accuracy and compliance, be sure to cross-check your entries and consider utilizing resources available through the IRS or tax software. Common mistakes often occur in credit calculations and eligibility determinations. Utilize tools like pdfFiller to review your document prior to submission.

Interactive tools for Form 3800

pdfFiller provides several interactive tools that can enhance your experience while completing Form 3800. For example, the PDF editing and e-signing features allow for easy modifications. Filling out, editing, and signing your Form 3800 can be accomplished effortlessly online, ensuring you can make changes on the fly.

Utilizing pdfFiller for your Form 3800 encourages collaboration. You can invite team members to access and review the document, ensuring all parties are aligned before the submission deadline. The sharing features promote a smoother review process, making it easier to catch any discrepancies before filing.

E-filing options for Form 3800

E-filing has become the preferred method of submission for many taxpayers, and this extends to Form 3800. The advantages of e-filing include faster processing times, immediate confirmation of receipt, and a reduced likelihood of errors since the software often checks for common mistakes.

When e-filing your 2025 Form 3800, ensure you have the necessary platforms ready. Most tax preparation software is designed to guide you through the e-filing process. Look for trusted platforms that support direct e-filing to the IRS to streamline your experience.

Resources available for Form 3800 users

Taxpayers using Form 3800 can benefit greatly from the numerous resources available to navigate the complexities of the credits and filing process. The IRS website provides detailed guidelines and frequently asked questions specifically relating to Form 3800, which can clarify any uncertainties you may encounter.

Common issues often arise regarding filing rejections or erroneous credit claims. Knowing how to troubleshoot these problems is essential. Should issues appear, contact IRS support or consult tax professionals who specialize in business credits to get tailored advice.

General business credit: Related forms and schedules

Several other forms are associated with the General Business Credit, which may also be vital for your tax strategy. Forms such as 3468, 8844, and 8826 work in coordination with Form 3800 to provide a holistic view of available credits and deductions.

Each of these forms has its unique requirements and benefits, so understanding their interplay with Form 3800 can leverage your overall tax strategy. A quick comparison chart can help visualize these relationships and the credits they offer.

Best practices for managing business credits

Effective management of business credits starts with meticulous record-keeping. Set up a document retention policy that determines how long you keep records related to these business credits and their relevant expenses. A clear system for documentation not only aids in future tax filings but also prepares you in case of an audit.

Enhancing your tax strategy with business credits involves strategic future planning. Assess your business’s trajectory and identify potential areas for investment that could yield more credits down the line. This forward-looking approach will ensure that your business remains compliant while maximizing available tax benefits in future years.

People Also Ask about

How is general business credit limit calculated?

What happens to unused business credits?

Should I file form 3800?

Do general business tax credits expire?

What is 3800 general business credit?

What is the general business credit limitation?

Do unused tax credits carry forward?

Who must file form 3800?

What qualifies as a general business credit?

Why do I have to fill out Form 3800?

Do general business credits have to be carried back?

What is an eligible small business credit?

How long can you carry forward tax credits?

What is the purpose of IRS form 3800?

What is a form 3800?

Who can file Form 3800?

What is the general business credit limited to?

Do unused tax credits carry over?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 3800 for eSignature?

How do I execute IRS 3800 online?

Can I create an eSignature for the IRS 3800 in Gmail?

What is 2025 form 3800?

Who is required to file 2025 form 3800?

How to fill out 2025 form 3800?

What is the purpose of 2025 form 3800?

What information must be reported on 2025 form 3800?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.