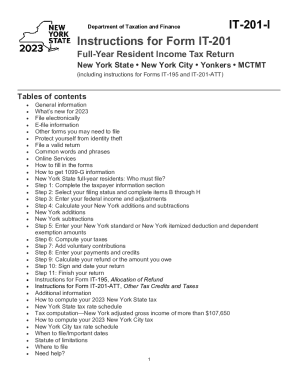

NY IT-201-I 2022 free printable template

FAQ about NY IT-201-I

What should I do if I need to amend my ny instructions tax return?

If you discover an error after submitting your ny instructions tax return, you can file an amended return. Utilize Form IT-201-X, the Amended New York State Personal Income Tax Return. Ensure that you provide all relevant documentation to support your changes and submit it according to the specific guidelines laid out by the New York State Department of Taxation and Finance.

How can I check the status of my ny instructions tax return?

To verify the status of your ny instructions tax return, visit the New York State Department of Taxation and Finance website and use their online service to check your refund status. You will need to provide the required information such as your Social Security number, date of birth, and the amount of your expected refund to access your details.

What are common mistakes to avoid when filing the ny instructions tax return?

Common errors when filing the ny instructions tax return include incorrect Social Security numbers, miscalculations on tax owed, and missing signatures. Double-check all entries for accuracy, verify that required fields are completed, and ensure that you follow through with signature requirements to avoid delays in processing.

What if my ny instructions tax return is rejected? Can I get a refund?

If your ny instructions tax return is rejected, you should promptly review the rejection reasons provided, rectify the issues, and resubmit your return. If you submitted an e-file and it was rejected before it was processed, there usually aren't any service fees involved, and you can file again without a penalty.

Are there any special filing considerations for nonresidents using the ny instructions tax return?

Nonresidents must carefully follow specific guidelines when filing their ny instructions tax return. They should use Form IT-203, the Nonresident and Part-Year Resident Income Tax Return, and ensure that they correctly report only the income sourced from New York, keeping in mind the distinctions in deductions and credits available to them.