IL ST-556 (1) Instructions 2023 free printable template

Show details

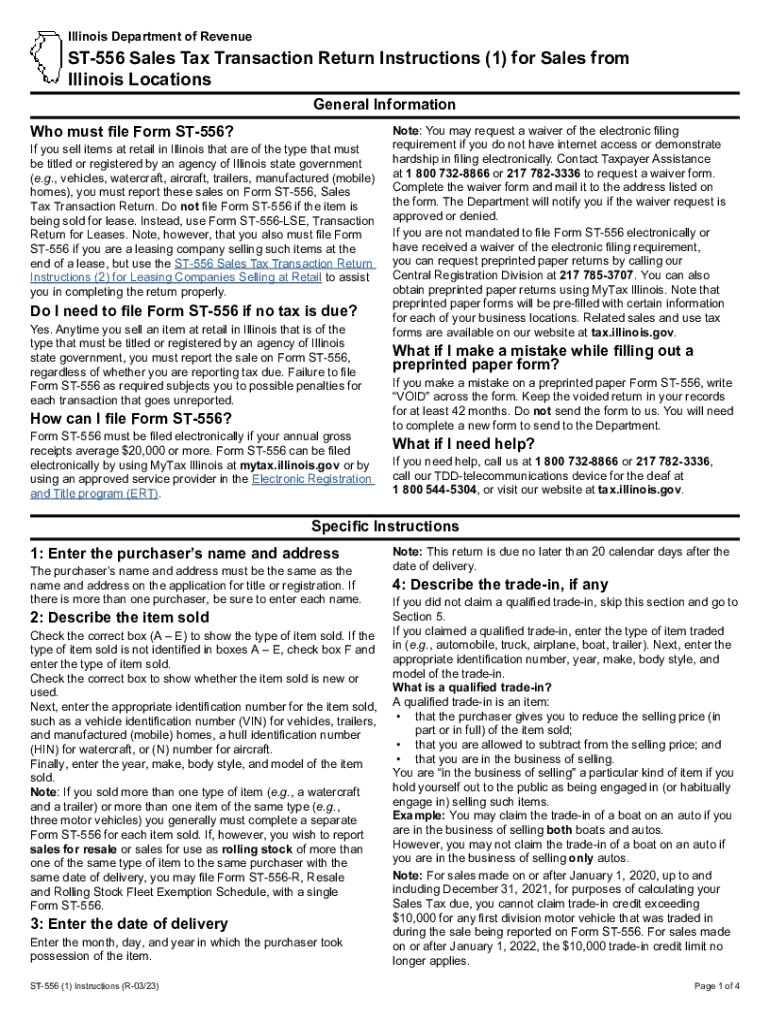

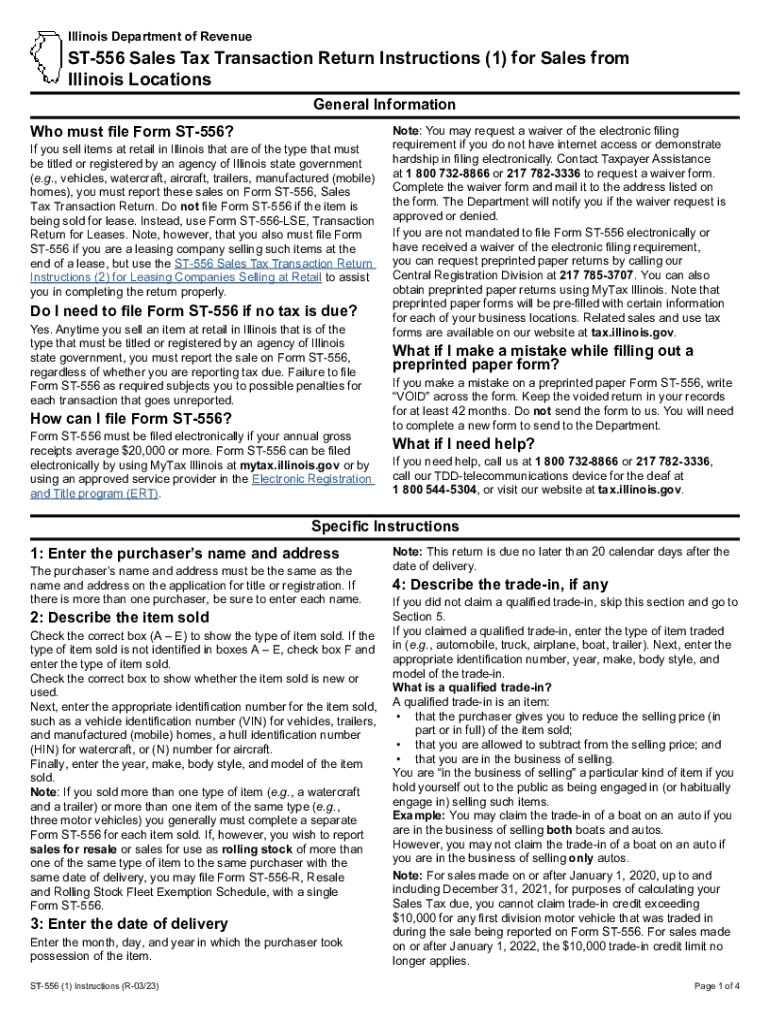

Do I need to file Form ST 556 if no tax is due Yes. Anytime you sell an item at retail in Illinois that is of the type that must be titled or registered by an agency of Illinois state government you must report the sale on Form ST 556 regardless of whether you are reporting tax due. Failure to file Form ST-556 as required subjects you to possible penalties for each transaction that goes unreported. How can I file Form ST-556 Form ST-556 must be filed electronically if your annual gross...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL ST-556 1 Instructions

Edit your IL ST-556 1 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL ST-556 1 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL ST-556 1 Instructions online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL ST-556 1 Instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ST-556 (1) Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL ST-556 1 Instructions

How to fill out IL ST-556 (1) Instructions

01

Obtain IL ST-556 (1) form from the official website or your local tax office.

02

Fill in your name, address, and contact information in the designated sections.

03

Provide details of the property being transferred, including the legal description and its address.

04

Indicate the reason for the transfer in the appropriate box.

05

Enter the date of the transfer.

06

Include any applicable exemptions or deductions you may qualify for.

07

Review all entered information for accuracy.

08

Sign and date the form where indicated.

Who needs IL ST-556 (1) Instructions?

01

Anyone transferring property in Illinois who is required to disclose information regarding the transaction.

02

Real estate professionals and attorneys involved in property transfers.

03

Individuals claiming exemptions from certain taxes related to property transfers.

Fill

form

: Try Risk Free

People Also Ask about

Are sales taxes collected from customers and remitted to the state by seller?

Sales taxes are considered “trust taxes” where the seller collects the tax from the customer and remits the collected tax to the appropriate taxing jurisdiction. There are different types of sales taxes imposed by the states. Some states are Seller Privilege Tax states while others are Consumer Tax states.

What is the sales tax remittance threshold in Illinois?

The tax remittance thresholds are: $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois; or. 200 or more separate transactions for the sale of tangible personal property to purchasers in Illinois.

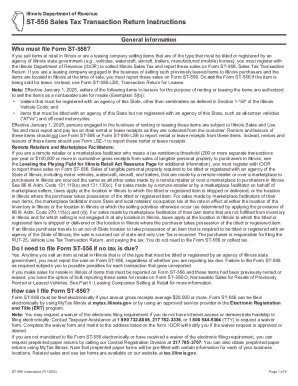

What is Illinois Form ST 556 for?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Is Illinois sales tax accrual or cash?

Payment of sales tax is on an accrual basis and not on a cash basis. Sales tax must be reported and paid with the return for the period in which the sale occurs.

What is ST 556 form for Illinois?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

What is an st1 form Illinois?

What is an st1 form Illinois? You must file Form ST-1, Sales and Use Tax and E911 Surcharge. Return, if you are making retail sales of any of the following in Illinois: general merchandise, qualifying foods, drugs, and medical appliances, and/or prepaid wireless telecommunications service.

How do I file local sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL ST-556 1 Instructions?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IL ST-556 1 Instructions and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit IL ST-556 1 Instructions in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IL ST-556 1 Instructions, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete IL ST-556 1 Instructions on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IL ST-556 1 Instructions. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL ST-556 (1) Instructions?

IL ST-556 (1) Instructions provide guidance on how to complete the form used for the state of Illinois to report the sale or transfer of ownership of tangible personal property subject to sales tax.

Who is required to file IL ST-556 (1) Instructions?

Any seller or transferor of tangible personal property in Illinois, who is required to collect or report sales tax, must file IL ST-556 (1) Instructions.

How to fill out IL ST-556 (1) Instructions?

To fill out IL ST-556 (1) Instructions, you need to provide the date of sale, type of property, purchase price, buyer's name and address, and your business details, ensuring all required fields are accurately completed.

What is the purpose of IL ST-556 (1) Instructions?

The purpose of IL ST-556 (1) Instructions is to provide a standardized method for reporting sales transactions of taxable goods, helping to ensure compliance with Illinois tax laws.

What information must be reported on IL ST-556 (1) Instructions?

The information that must be reported on IL ST-556 (1) Instructions includes the seller's name and address, buyer's name and address, description of the property sold, sale date, purchase price, and the reason for exemption if applicable.

Fill out your IL ST-556 1 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL ST-556 1 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.