NM Personal Income Tax (PIT) Form Packet 2022 free printable template

Show details

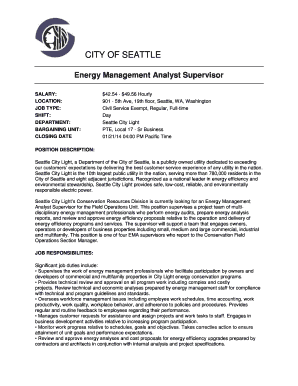

New MexicoTaxation and Revenue Department 186628529962022Personal Income Tax Form Packet DUE Dateline by Paper: April 18, 2023, File and Pay Electronically: May 1, 2023Packet Contents:Forms/Instructions

pdfFiller is not affiliated with any government organization

Instructions and Help about NM Personal Income Tax PIT Form

How to edit NM Personal Income Tax PIT Form

How to fill out NM Personal Income Tax PIT Form

Instructions and Help about NM Personal Income Tax PIT Form

How to edit NM Personal Income Tax PIT Form

To edit the NM Personal Income Tax PIT Form, users can utilize pdfFiller's editing tools. This allows filers to easily modify any information, ensuring all data is accurate before submission. Make sure to save the updated version after making changes.

How to fill out NM Personal Income Tax PIT Form

To fill out the NM Personal Income Tax PIT Form, follow these steps:

01

Gather all necessary information, including your Social Security number, income details, and deductions.

02

Complete each section of the form, ensuring that you provide accurate and up-to-date information.

03

Review the form for any errors or omissions before finalizing it.

About NM Personal Income Tax PIT Form 2022 previous version

What is NM Personal Income Tax PIT Form?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NM Personal Income Tax PIT Form 2022 previous version

What is NM Personal Income Tax PIT Form?

The NM Personal Income Tax PIT Form is a document used by residents to report their income and calculate their personal income tax liabilities to the state of New Mexico. It serves as an essential tool for the state to assess tax responsibility based on the filer’s financial information.

What is the purpose of this form?

The purpose of the NM Personal Income Tax PIT Form is to gather comprehensive financial data from individuals who earn an income within New Mexico. This information is critical for determining the amount of state income tax owed or any potential refunds that are due to the taxpayer.

Who needs the form?

Individuals who earn income within New Mexico are required to file the NM Personal Income Tax PIT Form. This includes residents, part-time residents, and non-residents earning income sourced from New Mexico. Failing to file when required may lead to penalties.

When am I exempt from filling out this form?

Taxpayers may be exempt from filing the NM Personal Income Tax PIT Form if their total income is below a certain threshold established by the state. Specific scenarios, such as age, disability, or specific income types, may also qualify for exemption. It is advisable to consult state guidelines to confirm eligibility for exemption.

Components of the form

The NM Personal Income Tax PIT Form consists of various sections including personal information, income details, deductions, and credits that the taxpayer is eligible for. Each section must be accurately completed to ensure the form is valid for processing by the state tax authority.

What are the penalties for not issuing the form?

Failing to file the NM Personal Income Tax PIT Form can result in penalties, including interest on unpaid taxes, late fees, or even legal action from the state. It is crucial for taxpayers to file the form on time to avoid these costly consequences.

What information do you need when you file the form?

When filing the NM Personal Income Tax PIT Form, taxpayers must have key financial information ready. This includes their Social Security number, total income from all sources, details of any exemptions, and documentation of applicable deductions or credits. These details help ensure an accurate calculation of tax liability.

Is the form accompanied by other forms?

In certain cases, the NM Personal Income Tax PIT Form may need to be accompanied by additional forms. For example, taxpayers claiming specific deductions or credits might need to submit supporting documentation or related tax forms to substantiate their claims.

Where do I send the form?

After completing the NM Personal Income Tax PIT Form, taxpayers must send it to the New Mexico Taxation and Revenue Department at the designated address found in the form instructions. It is critical to send the form to the correct location to ensure timely processing of the tax return.

See what our users say