NM Personal Income Tax (PIT) Form Packet 2023 free printable template

Show details

New MexicoTaxation and Revenue Department

186628529962023Personal Income Tax

Form Packet

DUE Dateline by Paper: April 15, 2024,

File and Pay Electronically: April 30, 2024Packet Contents

Forms/Instructions

PIT1

pdfFiller is not affiliated with any government organization

Instructions and Help about NM Personal Income Tax PIT Form

How to edit NM Personal Income Tax PIT Form

How to fill out NM Personal Income Tax PIT Form

Instructions and Help about NM Personal Income Tax PIT Form

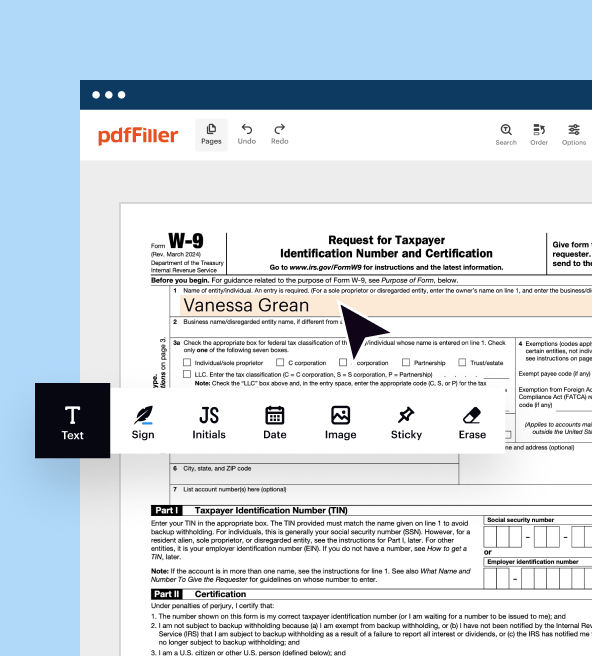

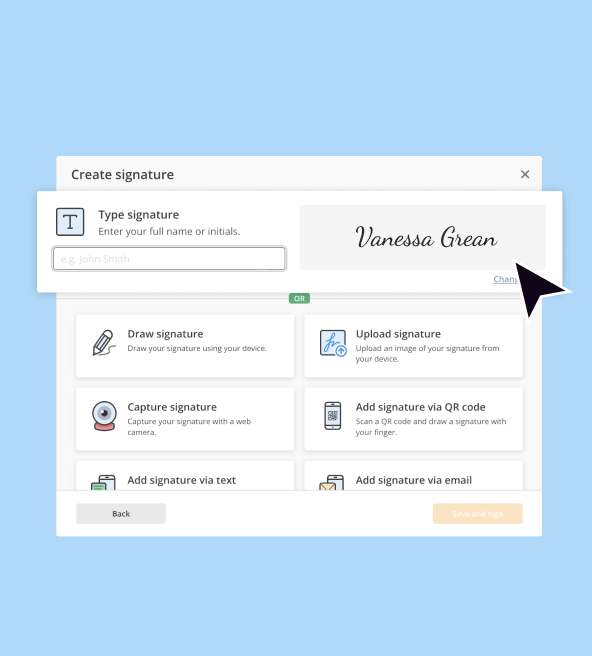

How to edit NM Personal Income Tax PIT Form

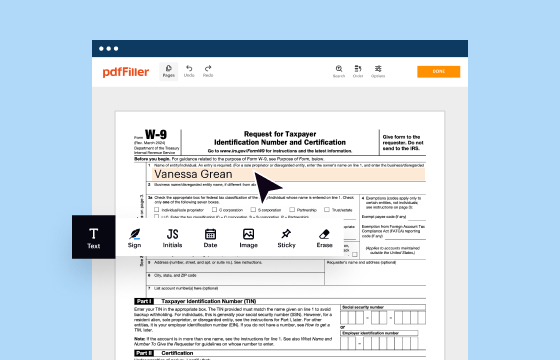

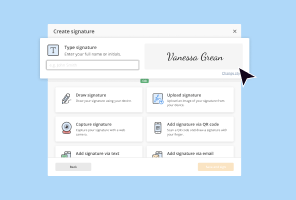

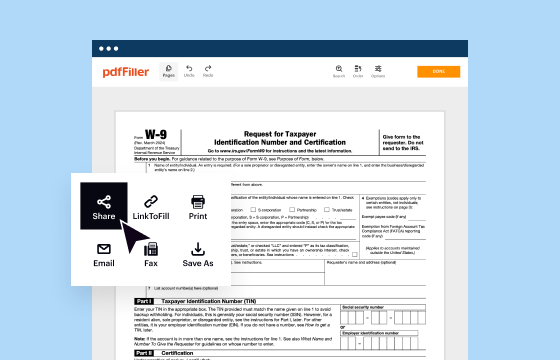

To edit the NM Personal Income Tax PIT Form, you can use online editing tools such as pdfFiller. This platform provides a user-friendly interface that allows you to upload your form, make necessary changes, and save your updates quickly. Ensure all financial information is accurate, as errors could lead to complications in your tax filing.

How to fill out NM Personal Income Tax PIT Form

Filling out the NM Personal Income Tax PIT Form involves several straightforward steps. First, gather all relevant financial documents, including your W-2s, 1099s, and other income records. Next, follow these steps:

01

Begin with your personal information, including your name, Social Security number, and address.

02

Report your income sources in the appropriate sections.

03

Calculate your adjustments and deductions as per the guidelines.

04

Review all entries for accuracy before submission.

Double-check calculations to prevent mistakes that could delay the processing of your return.

About NM Personal Income Tax PIT Form 2023 previous version

What is NM Personal Income Tax PIT Form?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NM Personal Income Tax PIT Form 2023 previous version

What is NM Personal Income Tax PIT Form?

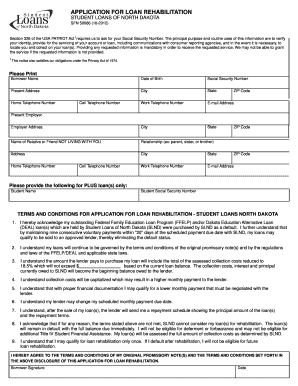

The NM Personal Income Tax PIT Form is a state tax form used by residents of New Mexico to report their income and calculate the amount of state income tax owed. This form must be completed and submitted annually by individuals earning income in New Mexico.

What is the purpose of this form?

The primary purpose of the NM Personal Income Tax PIT Form is to ensure compliance with state tax laws and to facilitate the collection of income tax. It collects information about the taxpayer’s income, deductions, and tax liabilities, enabling the New Mexico Taxation and Revenue Department to assess the appropriate tax owed.

Who needs the form?

Residents of New Mexico who earn income and are required to file a tax return must complete the NM Personal Income Tax PIT Form. This includes individuals who have a variety of income sources, such as wages, self-employment income, and investment earnings.

When am I exempt from filling out this form?

You may be exempt from filing the NM Personal Income Tax PIT Form if your income is below a certain threshold as determined by state guidelines. Additionally, individuals who qualify for specific tax exemptions or are below the age of 18 and have no independent income may not need to file.

Components of the form

The NM Personal Income Tax PIT Form consists of several key sections, including personal information, income reporting, deductions, and tax calculation. Each section requires specific information, and accurate reporting is essential for proper tax assessment.

What are the penalties for not issuing the form?

Failing to file the NM Personal Income Tax PIT Form by the due date can result in penalties, including fines and interest charges on the unpaid tax. Continued non-compliance may lead to further legal repercussions, including wage garnishments or liens on property.

What information do you need when you file the form?

When filing the NM Personal Income Tax PIT Form, you need the following information:

01

Your personal identification details, including Social Security number.

02

Income sources and amounts for the tax year.

03

Details of any exemptions, deductions, or credits you plan to claim.

Collecting accurate and complete information beforehand will streamline the filing process and reduce errors.

Is the form accompanied by other forms?

The NM Personal Income Tax PIT Form may require additional forms depending on the sources of income and specific deductions claimed. Common supplements include schedules for itemized deductions or credits associated with state-specific programs. Be sure to review instructions for additional form requirements.

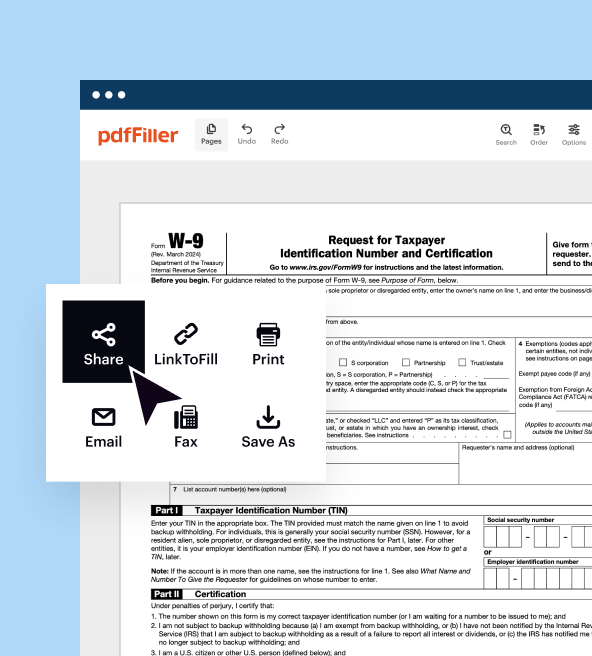

Where do I send the form?

Once completed, the NM Personal Income Tax PIT Form can be mailed to the New Mexico Taxation and Revenue Department at the specified address on the form. It's advised to send the return via certified mail or another trackable method to ensure it is received by the due date.

See what our users say