NM Personal Income Tax (PIT) Form Packet 2024-2025 free printable template

Show details

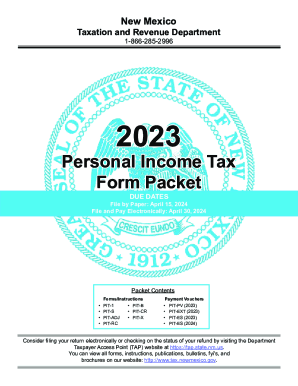

New Mexico Taxation and Revenue Department 1-866-285-2996 2024 202 4 Personal Income Tax Form Packet DUE DATES File by Paper: April 15, 2025 File and Pay Electronically: April 30, 2025 Scan to go

pdfFiller is not affiliated with any government organization

Instructions and Help about NM Personal Income Tax PIT Form

How to edit NM Personal Income Tax PIT Form

How to fill out NM Personal Income Tax PIT Form

Instructions and Help about NM Personal Income Tax PIT Form

How to edit NM Personal Income Tax PIT Form

To edit the NM Personal Income Tax PIT Form, utilize pdfFiller's editing tools. Upload the form to your pdfFiller account, and use the available features to make necessary changes. Ensure all edits maintain the accuracy required for proper tax filing.

How to fill out NM Personal Income Tax PIT Form

Filling out the NM Personal Income Tax PIT Form involves several key steps. Begin by gathering all necessary financial documents such as W-2s and 1099s. Then, follow these steps:

01

Open the NM Personal Income Tax PIT Form.

02

Enter personal information including your name and Social Security number.

03

Input your income details and applicable deductions.

04

Review all information for accuracy.

05

Sign and date the form before submission.

Latest updates to NM Personal Income Tax PIT Form

Latest updates to NM Personal Income Tax PIT Form

Stay informed on any changes to the NM Personal Income Tax PIT Form by regularly checking the official New Mexico taxation website. Updates may include changes in tax rate, deduction limits, or filing procedures, which can significantly impact your tax obligations.

All You Need to Know About NM Personal Income Tax PIT Form

What is NM Personal Income Tax PIT Form?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About NM Personal Income Tax PIT Form

What is NM Personal Income Tax PIT Form?

The NM Personal Income Tax PIT Form is the official document used by residents of New Mexico to report their personal income and calculate state tax liability. This form is essential for individuals earning income within the state to comply with local tax laws.

What is the purpose of this form?

The purpose of the NM Personal Income Tax PIT Form is to facilitate the reporting of income earned by individuals and to ensure the correct amount of state income tax is assessed and collected. This form helps the New Mexico Taxation and Revenue Department evaluate tax obligations accurately.

Who needs the form?

All residents and part-year residents who earn income in New Mexico are required to complete the NM Personal Income Tax PIT Form unless specified otherwise. This includes individuals who are self-employed, work for an employer, or receive income from various sources.

When am I exempt from filling out this form?

You may be exempt from filling out the NM Personal Income Tax PIT Form if your total income falls below New Mexico's filing threshold, typically based on the number of dependents you claim. Additionally, certain categories of income and specific groups, such as those covered by military benefits, may also be exempt.

Components of the form

The NM Personal Income Tax PIT Form consists of several components, including sections for personal information, income details, deductions, credits, and tax calculations. Each section must be filled out carefully to ensure compliance with state tax regulations.

Due date

The due date for filing the NM Personal Income Tax PIT Form typically aligns with federal tax deadlines, which is usually April 15. However, it is advisable to verify deadlines as they can change or vary annually based on specific circumstances.

What are the penalties for not issuing the form?

Failing to file the NM Personal Income Tax PIT Form by the deadline can result in penalties and interest on unpaid taxes. Penalties may vary based on how late the form is submitted and whether taxes owed remain unpaid.

What information do you need when you file the form?

When filing the NM Personal Income Tax PIT Form, gather information including your Social Security number, income documentation (W-2s, 1099s), details of deductions and credits, and prior year tax information to ensure accurate reporting and compliance.

Is the form accompanied by other forms?

Depending on individual circumstances, you may need to submit additional forms alongside the NM Personal Income Tax PIT Form, such as schedules for itemized deductions or credits. Verify the requirements based on your tax situation to ensure complete filing.

Where do I send the form?

The completed NM Personal Income Tax PIT Form should be sent to the New Mexico Taxation and Revenue Department. Make sure to check the mailing address on the state’s official website, as it may differ based on your filing method or the form version.

See what our users say