IRS W-2GU 2013 free printable template

Show details

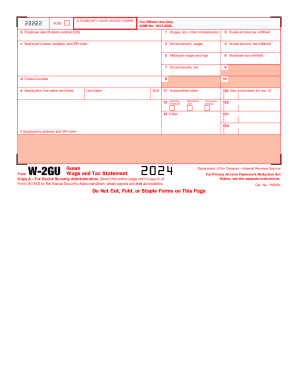

Do Not Cut Fold or Staple Forms on This Page Cat. No. 16026K 12a Copy 1 For Guam Department of Revenue and Taxation Copy B To Be Filed With Employee s Guam Tax Return Guam Department of Revenue and Taxation. Notice to Employee Do you have to file Refer to the Form 1040 Instructions to determine if you are required to file a tax return. Even if you do not have to file a tax return you may be eligible for a refund if box 2 shows an amount or if you are eligible for any credit. See IRS Publications...1141 1167 1179 and other IRS resources for information about printing these tax forms. 22222 a Employee s social security number Void For Official Use Only OMB No. 1545-0008 b Employer identification number EIN 1 Wages tips other compensation 2 Guam income tax withheld c Employer s name address and ZIP code 3 Social security wages 5 Medicare wages and tips 6 Medicare tax withheld d Control number e Employee s first name and initial Last name Suff. 11 Nonqualified plans Statutory employee...Retirement plan 12a See instructions for box 12 C o d e Third-party sick pay 14 Other 12b 12c 12d f Employee s address and ZIP code Form W-2GU Guam Wage and Tax Statement Copy A For Social Security Administration Send this entire page with Copy A of Form W-3SS to the Social Security Administration photocopies are not acceptable. Attention This form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* Do not file copy A downloaded from this website...with the SSA. The official printed version of this IRS form is scannable but the online version of it printed from this website is not. A penalty may be imposed for filing forms that can t be scanned* See the penalties section in the current General Instructions for Forms W-2 and W-3 for more information* To order official IRS forms call 1-800-TAX-FORM 1-800-829-3676 or Order Information Returns and Employer Returns Online and we ll mail you the scannable forms and other products. You may file...Forms W-2 and W-3 electronically on the SSA s website at Employer Reporting Instructions Information* You can create fill-in versions of Forms W-2 and W-3 for filing with SSA. You may also print out copies for filing with state or local governments distribution to your employees and for your records. See IRS Publications 1141 1167 1179 and other IRS resources for information about printing these tax forms. 22222 a Employee s social security number Void For Official Use Only OMB No* 1545-0008 b...Employer identification number EIN 1 Wages tips other compensation 2 Guam income tax withheld c Employer s name address and ZIP code 3 Social security wages 5 Medicare wages and tips 6 Medicare tax withheld d Control number e Employee s first name and initial Last name Suff* 11 Nonqualified plans Statutory employee Retirement plan 12a See instructions for box 12 C o d e Third-party sick pay 14 Other 12b 12c 12d f Employee s address and ZIP code Form W-2GU Guam Wage and Tax Statement Copy A For...Social Security Administration Send this entire page with Copy A of Form W-3SS to the Social Security Administration photocopies are not acceptable.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-2GU

How to edit IRS W-2GU

How to fill out IRS W-2GU

Instructions and Help about IRS W-2GU

How to edit IRS W-2GU

To edit IRS W-2GU, ensure you have access to the correct version of the form. You can utilize pdfFiller's tools to adjust any details required, such as correcting names, addresses, or amounts. Simply upload the form into the platform, make the necessary changes, and save the updated document. This approach guarantees you maintain compliance with IRS requirements while accurately reporting your tax information.

How to fill out IRS W-2GU

Filling out IRS W-2GU requires specific information regarding income, taxes withheld, and personal details. Follow these steps to complete the form:

01

Begin by entering your employer's name, address, and Employer Identification Number (EIN).

02

Provide your personal information, which includes your name, address, and Social Security number.

03

Report total wages, tips, and other compensation received during the tax year.

04

Indicate any federal income tax withheld from your paychecks.

05

Complete other necessary sections as they apply to your specific tax situation.

About IRS W-2GU 2013 previous version

What is IRS W-2GU?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-2GU 2013 previous version

What is IRS W-2GU?

IRS W-2GU is a tax form designed for reporting wages earned by employees in U.S. territories. It is primarily used by employers to provide their employees with tax-related information for the Internal Revenue Service. This specific version of the form was used during a certain tax year and may still be pertinent for historical purposes or for individuals needing to clarify past income reports.

What is the purpose of this form?

The purpose of IRS W-2GU is to report income and employment taxes withheld for individuals working in U.S. territories. It serves as a record of wages and taxes for the employee and enables the IRS to track tax obligations accurately. Additionally, this form helps employees file their tax returns properly by providing essential income information.

Who needs the form?

Employers who have employees working in U.S. territories are required to issue IRS W-2GU forms to their workers. Employees receiving wages from these employers must use this form to accurately report their income and taxes withheld when filing their federal tax returns. If you are an employee who did not receive a W-2GU but worked in a U.S. territory, you should contact your employer for a copy.

When am I exempt from filling out this form?

You may be exempt from filling out IRS W-2GU if you did not earn any wages during the year or if your employer qualifies for a different tax reporting provision. Additionally, certain exemptions may apply based on your specific employment situation, such as independent contractors who receive different tax documents instead of a W-2GU.

Components of the form

IRS W-2GU consists of several key components, including employer information, employee details, and wages earned. The form typically includes boxes that indicate total wages, federal income tax withheld, and other necessary positions for reporting relevant tax information. Understanding these components is crucial for accurate form completion.

What are the penalties for not issuing the form?

Employers who fail to issue IRS W-2GU forms to their employees may face penalties from the IRS. These penalties can include fines for late filing, incorrect information, or failure to file altogether. It is crucial for employers to comply with filing requirements to avoid costly penalties and ensure employees have the necessary forms for tax filing.

What information do you need when you file the form?

When filing IRS W-2GU, gather essential information such as your total wages earned, federal taxes withheld, and personal identification details like your Social Security number. Ensure that all information matches the records provided by your employer to avoid discrepancies during the filing process.

Is the form accompanied by other forms?

IRS W-2GU can be accompanied by additional forms depending on the employee's specific tax situation. For instance, if you are reporting other income or claiming specific deductions, you may need to attach forms like Schedule A or Schedule C alongside your W-2GU. It is essential to review IRS requirements for filing to ensure all necessary forms are included.

Where do I send the form?

Completed IRS W-2GU forms should be sent to the IRS at the address specified in the IRS instructions for filing. Typically, employers will also provide copies to their employees to retain for their records. Ensure you follow the mailing guidelines to guarantee your form is processed correctly.

See what our users say