SSA Electronic W-2/W-2C Filing 2013 free printable template

Get, Create, Make and Sign SSA Electronic W-2W-2C Filing

Editing SSA Electronic W-2W-2C Filing online

Uncompromising security for your PDF editing and eSignature needs

SSA Electronic W-2/W-2C Filing Form Versions

How to fill out SSA Electronic W-2W-2C Filing

How to fill out SSA Electronic W-2/W-2C Filing

Who needs SSA Electronic W-2/W-2C Filing?

Instructions and Help about SSA Electronic W-2W-2C Filing

If you want to prepare one or a few payroll forms the online application enables you to enter the information directly in your account to generate PDF copies and e-file the forms to the government after you have logged into your account select the forum you want to prepare under the online application for example you can click the online application 1099 mi SE e file two people one or a few 1099 mi SE forms select an existing company in your account or create a new company as the payer review the company information click next select the tax year our system can back file up to three tax years you can then choose a recipient from a list of available recipients you can also create new recipients for this company click Add to e-file to prepare a 1099 for the particular recipient the payer and the recipient information are already on the phone enter the amount to the appropriate box is needed for example three thousand dollars in box 749 employee compensation enter other information as needed click continue you can see the available actions for this recipient are now modify or remove you can continue to prepare more forms for different recipients once you are done with forms click Next to review the summary and proceed to checkout the summary page shows the payer information the 1099 form tax year as well as the details of the phones you have prepared click Next you have the option to have a spring to mail the form for you or select to create and print PDF copies by yourself you can also be filed to the state add to cart to continue the submission choose payment method and complete the e-file submission once you have submitted the forms for evil you can check the e-file status or print PDF copies from the main menu the e-file status shows order received by us over the next few bits stays the status will progress to processing accepted or rejected the View button takes you back to the preparation steps the print button takes you to a page to download PDF copies of the forms you can also click the plus sign for more details of this e file submission in summary online preparation in a file is easy and convenient enter all information online you have the option for getting PDF copies printer mail service and stay filings you can also check evil status our revise and resubmit the forms as needed

People Also Ask about

What is W-2 form with W2c?

Can I file W2c electronically?

How do I file W2c after filing?

What do I do with corrected W2c?

Do I file my W-2 and W2c?

How do I submit my W2c to the IRS?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SSA Electronic W-2W-2C Filing?

How do I make edits in SSA Electronic W-2W-2C Filing without leaving Chrome?

How do I complete SSA Electronic W-2W-2C Filing on an iOS device?

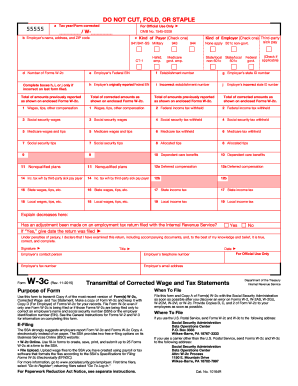

What is SSA Electronic W-2/W-2C Filing?

Who is required to file SSA Electronic W-2/W-2C Filing?

How to fill out SSA Electronic W-2/W-2C Filing?

What is the purpose of SSA Electronic W-2/W-2C Filing?

What information must be reported on SSA Electronic W-2/W-2C Filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.