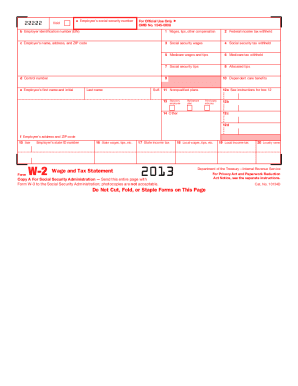

SSA Electronic W-2/W-2C Filing 2011 free printable template

Show details

BUSINESS SERVICES ONLINE ELECTRONIC W-2 FILING User Handbook for Tax Year 2011 Social Security Office of Systems Electronic Services 6401 Security Boulevard Baltimore, Maryland 21235 February 2012

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA Electronic W-2W-2C Filing

Edit your SSA Electronic W-2W-2C Filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA Electronic W-2W-2C Filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA Electronic W-2W-2C Filing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SSA Electronic W-2W-2C Filing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA Electronic W-2/W-2C Filing Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA Electronic W-2W-2C Filing

How to fill out SSA Electronic W-2/W-2C Filing

01

Log into the SSA's Business Services Online (BSO) portal.

02

Select the 'W-2/W-2C Upload' option from the dashboard.

03

Review the specifications for file formatting and data requirements.

04

Prepare your W-2/W-2C files in the required format (typically ASCII text).

05

Upload your formatted W-2/W-2C files through the portal.

06

Review any error messages or warnings if they occur.

07

Confirm that the submission is successful and save the confirmation for your records.

Who needs SSA Electronic W-2/W-2C Filing?

01

Employers who need to report employee wage information to the Social Security Administration (SSA).

02

Entities that need to file corrected W-2 forms (W-2C) to correct previously submitted wage data.

03

Payroll service providers filing on behalf of employers.

04

Any business that meets the SSA's e-filing requirements for W-2 forms.

Fill

form

: Try Risk Free

People Also Ask about

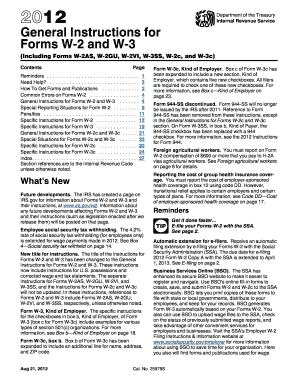

How do I create a EFW2 file?

How do I create a EFW2 file? You can manually create an EFW2 file through the following steps: Go to the Employees menu, Choose Payroll Tax Forms & W-2s, and then create State W-2 E-file. Click Continue twice, then select your state from the drop-down, then select Get QuickBooks Data. Select OK.

Do employers need to send a W-2 form or can I just use online?

Federal law requires employers to send all employees whom they paid any form of remuneration, including non-cash payments, of $600 or more for the year a W-2 Form.

What is the penalty for not filing W-2 electronically?

Charges for Each Information Return or Payee Statement Year DueUp to 30 Days Late31 Days Late Through August 12024$60$1202023$50$1102022$50$1102021$50$1106 more rows • Feb 2, 2023

How can I get my w2 form online for free?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How do I file a W-2 electronically?

To file W-2s electronically, register with the SSA's Business Services Online (BSO) website. If you are filing 100 or more 2021 W-2s, you must file them electronically; you can't send paper copies. You don't need to file the W-3 transmittal form with W-2s you file online.

Do you have to file W-2 electronically?

Employers filing 250 or more Forms W-2 must file electronically unless granted a waiver by the IRS. All employers are encouraged to file Forms W-2 electronically. The due date is January 31.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit SSA Electronic W-2W-2C Filing in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing SSA Electronic W-2W-2C Filing and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the SSA Electronic W-2W-2C Filing in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SSA Electronic W-2W-2C Filing in seconds.

How do I fill out SSA Electronic W-2W-2C Filing on an Android device?

Use the pdfFiller app for Android to finish your SSA Electronic W-2W-2C Filing. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is SSA Electronic W-2/W-2C Filing?

SSA Electronic W-2/W-2C Filing refers to the electronic submission of Wage and Tax Statements (W-2) and Corrected Wage and Tax Statements (W-2C) to the Social Security Administration (SSA) by employers. This process helps ensure accurate reporting of income and tax withholding for employees.

Who is required to file SSA Electronic W-2/W-2C Filing?

Employers who file 250 or more W-2 forms are required to submit their W-2/W-2C filings electronically to the SSA. However, employers can voluntarily file electronically regardless of the number of forms.

How to fill out SSA Electronic W-2/W-2C Filing?

To fill out SSA Electronic W-2/W-2C Filing, employers must complete the W-2 or W-2C forms with accurate employee information, including Social Security numbers, wages, taxes withheld, and any corrections needed. Employers use the SSA's Business Services Online (BSO) platform to file electronically.

What is the purpose of SSA Electronic W-2/W-2C Filing?

The purpose of SSA Electronic W-2/W-2C Filing is to ensure accurate reporting of employee wages and taxes withheld to the Social Security Administration, which is crucial for determining benefits eligibility and maintaining correct earnings records.

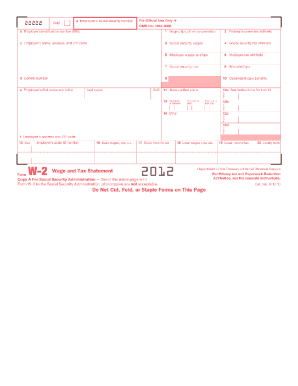

What information must be reported on SSA Electronic W-2/W-2C Filing?

SSA Electronic W-2/W-2C Filing must include employee identification details (such as name and Social Security number), employer information (such as EIN), total wages paid, taxes withheld (federal, state, local), and any necessary corrections for prior submissions.

Fill out your SSA Electronic W-2W-2C Filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA Electronic W-2w-2c Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.