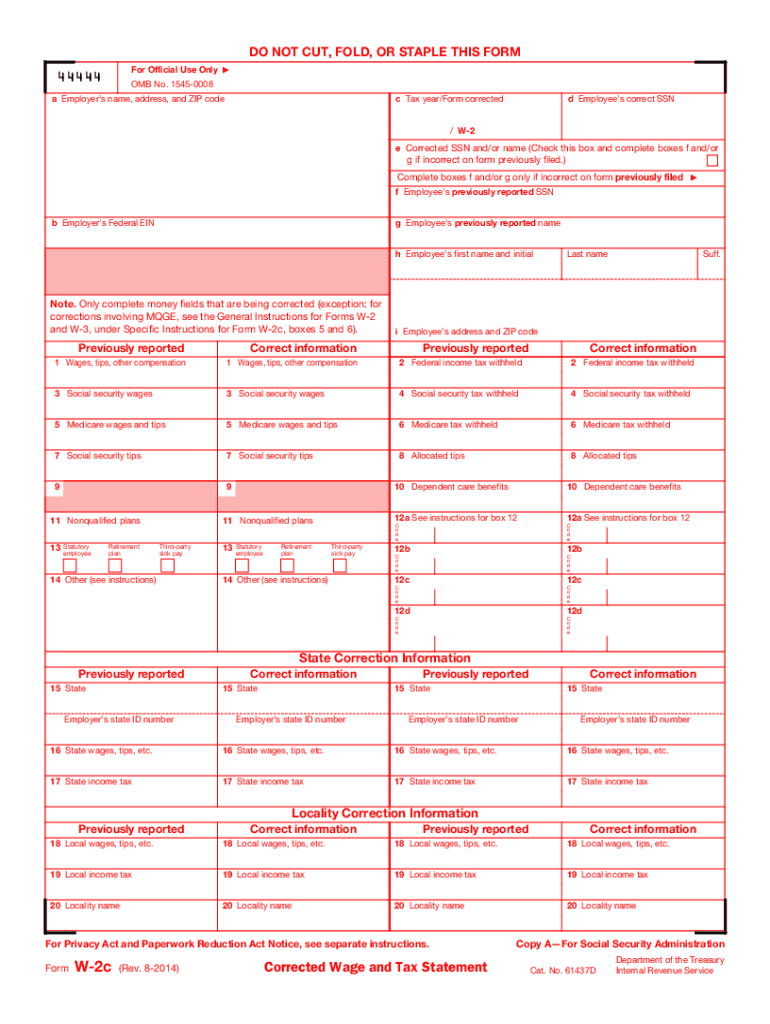

What is a W2c form?

W2c is an IRS form that employers complete to correct any errors made on an employees’ Wage and Tax Statement. The IRS and SSA provide this document to allow employers to address any mistakes in previously filed W-2, W-2AS, W-2CM, W-2GU, W-2VI forms. The W2c meaning is important as an employee's IRS and SSA tax refunds, tax bills, and benefit payments rely on the information provided in the aforementioned documents.

Who should file the W2c 2014?

Employers are responsible for completing and filing the W2c 2014 to the Internal Revenue Service and Social Security Administration. Also, employers must provide a copy of these corrections to the employee.

What information do I provide in the W2c form?

The W2c form consists of several similar pages that serve different purposes: for SSA, the state, local, or city tax department, the employee's federal tax return, the employee's records, and the employer’s records. When completing the fields for the employer's details, you should provide their valid Identification Number (EIN), name, full address, state ID number, state wages/tips, state income tax, local wages/tips, and local tax.

To fill out the employee's information, you should provide the following details:

- Their valid name, address, and social security number

- Their correct wages, tips, and other compensations

- Medicare tax, federal income tax, and social security tax withheld

- Retirement plan indicator

- Social security wages

- Dependent care benefits

The template contains two columns for previously reported details containing errors and the corresponding corrections.

How do I fill out the W2c in 2015?

You have the option of filling out the W2c sample on paper or electronically, but doing so electronically is faster and more reliable. With pdfFiller, you can get an up-to-date template of the W2c form and complete and submit it online quickly.

Follow these simple instructions:

- Click Get Form to upload the W2c fillable form to the editor.

- Click on each fillable field and type in the required information.

- Use the Clear or Uncheck options to remove any data you incorrectly added to the form.

- Click on the next open field or use the Enter button on your keyboard.

- Click Done when you have completed the form and download your copy, send the W2c to your employee via email, or file it to the SSA via USPS service right from the editor.

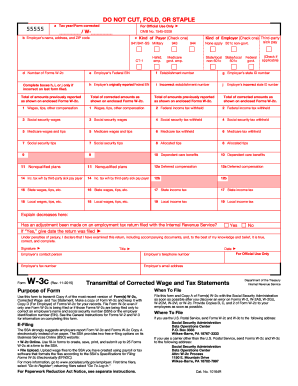

Is W2c accompanied by other documents?

A W2c form aims to submit the corrected wages and tax statements for the tax year in which the employer reported inaccurate information. The employer must file the corrected report, attaching Copy B of the original W-2 with the separate W-3c form for the revised period.

When is the W2c form due?

Unlike the W2 that must be filed by January 31, there's no strict deadline for filing the W2c. According to the IRS instructions, you must complete and send this document as soon as you find any errors in the W2 report in order to make the corrections.

Where do I send the W2c form?

According to the IRS’ official instructions, you can file your W2c online via the SSA's website or send paper copies of the form via the US Postal Service to the following address:

Social Security Administration

Direct Operations Center

P.O. Box 3333

Wilkes-Barre, PA 18767-3333

pdfFiller allows users to request USPS mail delivery for their documents right from the editor. Simply provide your mailing address and that of the recipient on the virtual envelope to send your W2c form in just one click.