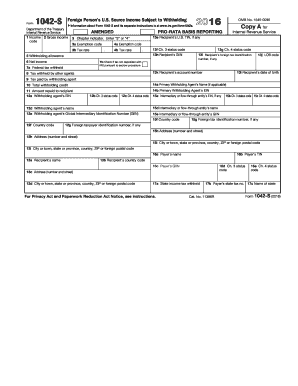

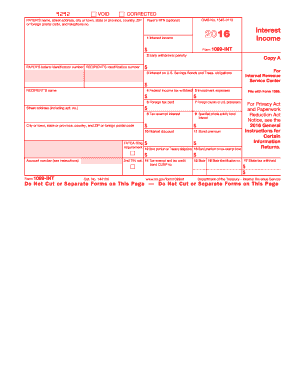

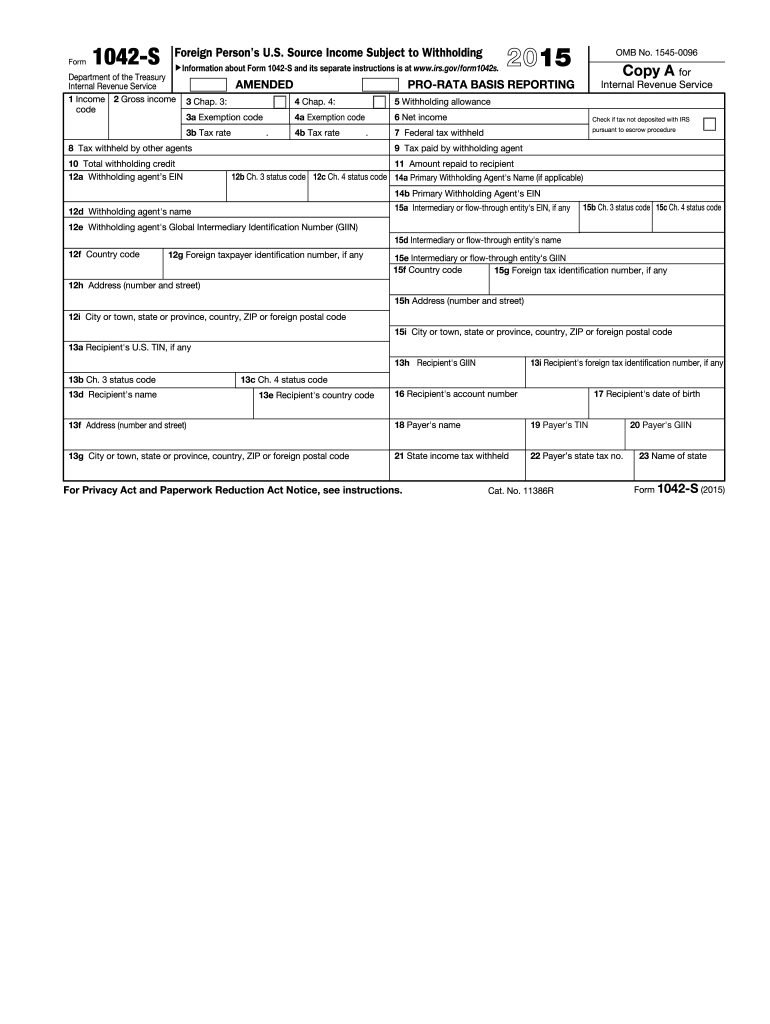

IRS 1042-S 2015 free printable template

Instructions and Help about IRS 1042-S

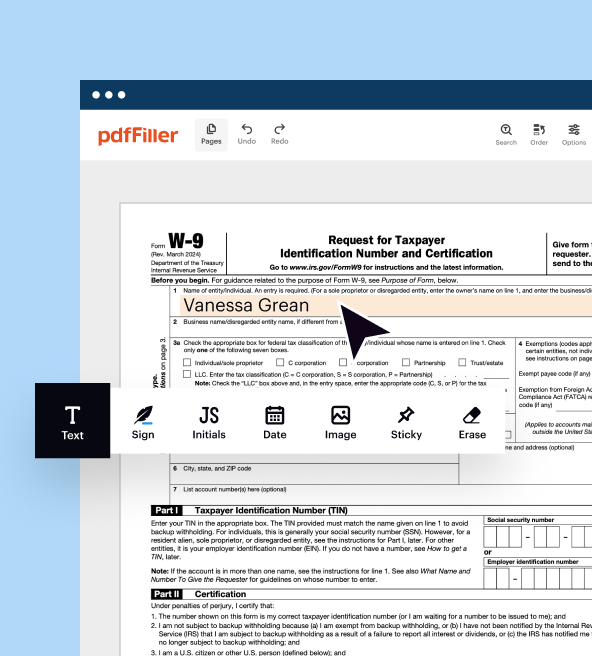

How to edit IRS 1042-S

How to fill out IRS 1042-S

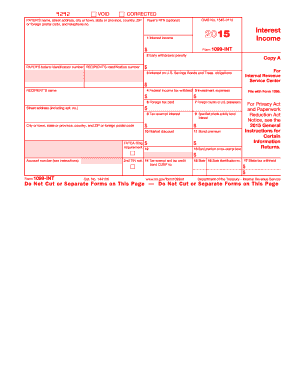

About IRS 1042-S 2015 previous version

What is IRS 1042-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

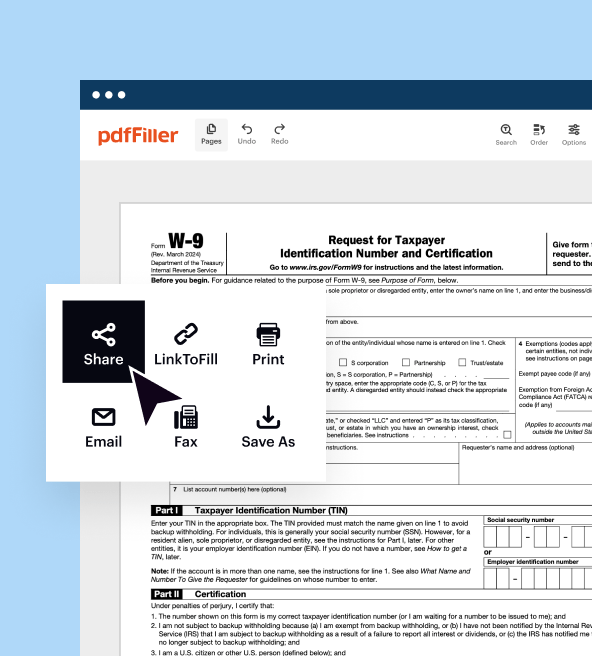

Where do I send the form?

FAQ about IRS 1042-S

What should I do if I realize I've made a mistake on my form 1042 2015 after submitting?

If you discover an error on your form 1042 2015 after submission, you can submit a corrected form to address the mistake. It’s important to file the amended version as soon as possible to avoid potential penalties. Ensure you indicate that it's a corrected form to avoid confusion with the original submission.

How can I verify that my form 1042 2015 has been received and processed by the IRS?

To verify receipt of your form 1042 2015, you can call the IRS or check online, depending on the submission method. If filed electronically, you may receive confirmation directly. Keep track of any acknowledgment receipts you get to facilitate the inquiry.

Are there any special considerations for nonresidents filing form 1042 2015?

Nonresidents must be particularly careful when filing form 1042 2015 to ensure compliance with U.S. tax regulations. They should be aware of withholding obligations and may need to provide additional documentation to support their tax status, such as a valid ITIN.

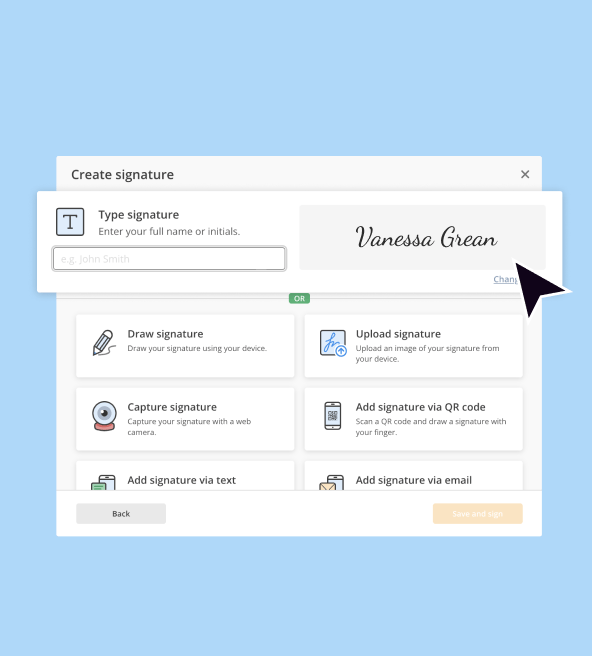

What should I know about e-signatures when submitting form 1042 2015?

E-signatures are generally acceptable when submitting form 1042 2015 electronically. However, ensure your method of e-signature meets the IRS standards to ensure compliance. Retaining a record of your electronic submission will also help maintain proper documentation.

What common errors should I watch out for when completing form 1042 2015?

Common errors on form 1042 2015 include incorrect taxpayer identification numbers and failing to report all required payments. To avoid these mistakes, double-check all information for accuracy before submission. Reviewing instructions carefully is crucial to ensuring all fields are correctly filled out.