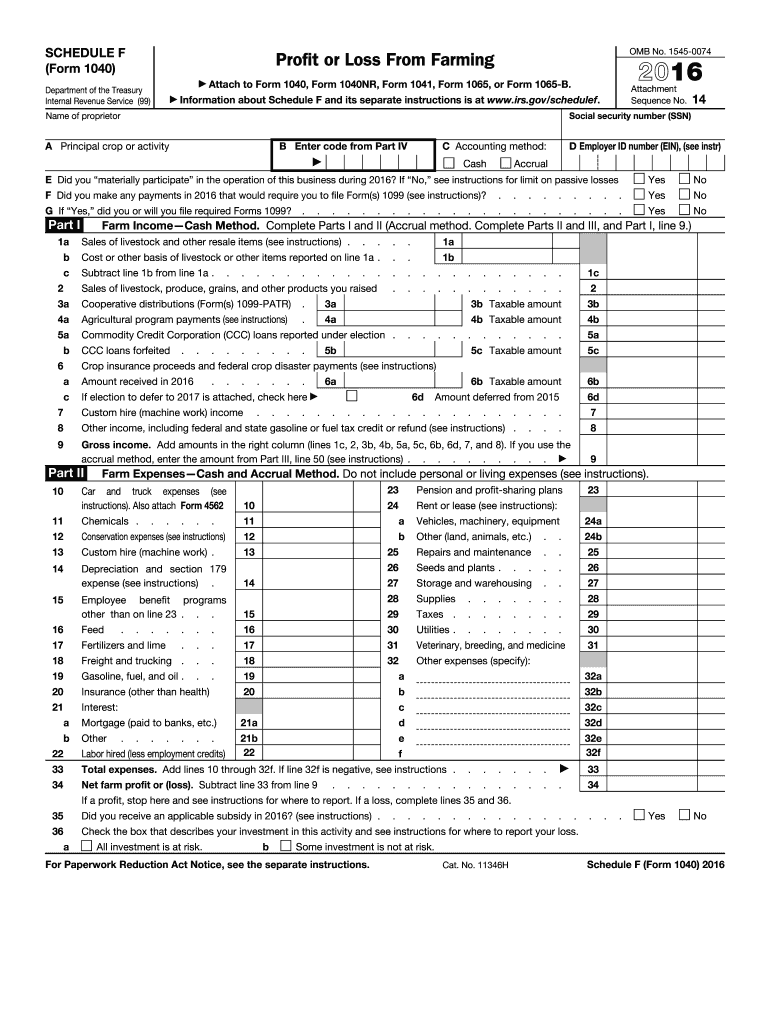

What is 1040 Schedule F 2016?

1040 Schedule F is used to report the profit or loss from farming activity. It applies only to businesses that are considered sole proprietors. The form needs to be submitted along with your tax return to IRS.

Who should file IRS 1040 Schedule F 2016?

If you run farming as a business (under sole proprietorship conditions) and receive profit from it, you’re required to file the Form Schedule F 1040. Please note not all involved in this type of activity are considered self-employed farmers. To learn who falls under this category and needs Schedule F Form 1040 to report income from farming activity, check the latest version of the IRS Farmer’s Tax Guide. You can also find exclusions in Part IV of the document.

What information do you need to file 1040 Schedule F?

Schedule F 1040 consists of a few components. The form starts with the section requiring essential information, including name, SSN, Principal Agricultural Activity code, etc. Depending on the accounting method your business uses, you need to complete either Income Part I (for cash method) or Income Part III (for accrual method). Part II, deductable expenses, is suitable for both methods.

How do I fill out Schedule F 1040 in 2017?

You can fill out Schedule F form 1040 electronically using pdfFiller. Here’s what you need to do to get started.

- Open the form by clicking the Get Form button.

- Follow the green pointer to identify the fillable fields.

- Use the checkmarks, cross icons, and other annotation tools that allow you to manipulate text and protect your file.

- Review the document for errors and typos.

- Complete your IRS Form 1040 Schedule F.

Do other forms accompany IRS 1040 Schedule F?

You need to file 1040 Schedule F with Form 1040 (regardless of whether your farming business is a primary or secondary source of income), 1040-SR, 1040-NR, 1041, or 1065.

When is the 1040 Schedule F due?

File Schedule F 1040 with Form 1040 (annual income tax return). Generally, the deadline is April 18th, unless you request an extension or the deadline is moved to a different date. Make sure to stay updated on the latest deadline changes.

Where do I send IRS 1040 Schedule F?

File Form 1040 Schedule F along with 1040, 1040-SR, 1040-NR, 1041, or 1065 to IRS.