IRS 1120-REIT 2016 free printable template

Show details

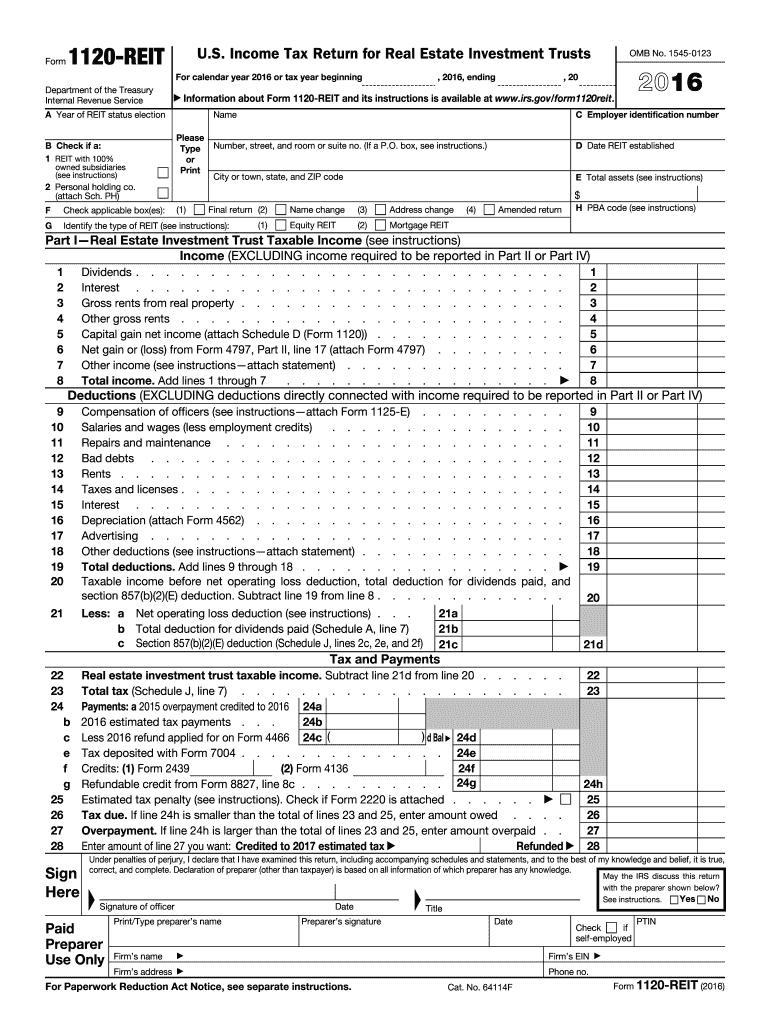

Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts For calendar year 2016 or tax year beginning Department of the Treasury Internal Revenue Service owned subsidiaries (see instructions),

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-REIT

How to edit IRS 1120-REIT

How to fill out IRS 1120-REIT

Instructions and Help about IRS 1120-REIT

How to edit IRS 1120-REIT

To edit the IRS 1120-REIT tax form, access it in pdfFiller's platform. You can easily add or remove information by using the form editing tools available. Ensure all information is accurate and complete before finalizing your form.

How to fill out IRS 1120-REIT

Filling out the IRS 1120-REIT involves several key steps:

01

Gather necessary financial information related to real estate investment trusts (REITs).

02

Complete sections detailing income, deductions, and shareholder distributions.

03

Review all entries for accuracy before submission.

Ensure compliance with IRS guidelines when reporting your financials and allocations for investors. Use pdfFiller to foster ease of filling by incorporating data from past filings if necessary.

About IRS 1120-REIT 2016 previous version

What is IRS 1120-REIT?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-REIT 2016 previous version

What is IRS 1120-REIT?

IRS 1120-REIT is the tax form specifically designed for Real Estate Investment Trusts (REITs) to report their income and certain tax attributes. This form helps the IRS track and assess taxes relevant to entities structured as REITs.

What is the purpose of this form?

The primary purpose of the IRS 1120-REIT is to ensure that REITs report their income accurately, particularly income derived from real property. This form also helps in determining whether a REIT meets tax obligations and requirements to maintain favorable tax statuses.

Who needs the form?

IRS 1120-REIT must be filed by any corporation that qualifies as a REIT under the Internal Revenue Code. This includes entities that derive at least 75% of their gross income from real estate investments, operate for the benefit of investors by distributing earnings, and adhere to specific asset and income tests.

When am I exempt from filling out this form?

An entity may be exempt from filing IRS 1120-REIT if it does not meet the criteria of a REIT outlined in the Internal Revenue Code. Additionally, corporations that operate as regular C corporations rather than REITs are not required to use this form.

Components of the form

The IRS 1120-REIT includes various sections that require detailed information such as revenue from property rentals, operational costs, and distributions made to shareholders. Each section is crucial for accurately reflecting the financial status of the REIT.

Due date

The IRS 1120-REIT form is typically due on the 15th day of the fourth month following the end of the REIT’s tax year. For most REITs that operate on a calendar year basis, this means that the form is due by April 15 each year.

What payments and purchases are reported?

This form reports all payments received as rents or dividends as preferred by investors in the REIT. Additionally, the IRS 1120-REIT captures any other income associated with real estate holdings, including gains from property sales.

How many copies of the form should I complete?

Generally, you are required to submit one copy of IRS 1120-REIT to the IRS. However, keep additional copies for your records and any specific requests from state authorities, if applicable.

What are the penalties for not issuing the form?

Failing to file IRS 1120-REIT, or filing it late, can result in significant penalties imposed by the IRS. These penalties can accrue based on the length of delay and the overall tax liability, making timely submission essential.

What information do you need when you file the form?

When preparing to file the IRS 1120-REIT, gather essential financial documents, including income statements, balance sheets, and existing tax records. Make sure to have all relevant data regarding real estate transactions and distributions to shareholders.

Is the form accompanied by other forms?

The IRS 1120-REIT may need to be accompanied by additional forms, such as Schedule A for dividends paid and other relevant forms based on specific tax situations. Ensure to consult IRS guidelines to verify what additional documentation is necessary.

Where do I send the form?

The completed IRS 1120-REIT must be sent to the appropriate IRS office based on your tax jurisdiction. You can typically find the specific address on the IRS website or on the form's instruction page.

See what our users say