Canada T5 2023-2025 free printable template

Show details

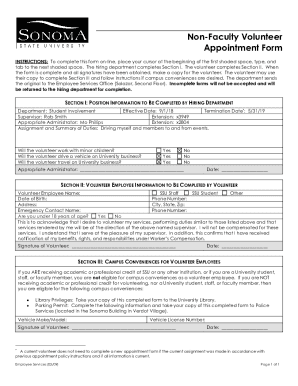

T5Statement of Investment Income

tat des revenus de placementDividends from Canadian corporations Dividendes de socits canadiennes24Actual amount of eligible dividendsMontant rel des dividendes dtermins10Actual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ca t5 summary online form

Edit your canada t5 summary online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2023 ca t5 summary online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T5 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada T5. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T5

How to fill out Canada T5

01

Gather all necessary documents related to income such as interest and dividends.

02

Obtain the Canada T5 form, which can be found on the Canada Revenue Agency (CRA) website or from your financial institution.

03

Fill in your name, address, and social insurance number at the top of the form.

04

Complete the information about the payer, including their name and address, in the appropriate sections.

05

Input the amounts of interest and other income earned in the designated boxes.

06

Double-check the figures for accuracy to avoid any discrepancies.

07

Sign and date the form, if required, and keep a copy for your records.

08

Submit the completed T5 to the CRA by the deadline, usually by the end of February of the following year.

Who needs Canada T5?

01

Individuals and entities who have received investment income, such as interest, dividends, or certain foreign income.

02

Financial institutions or corporations that issue T5 slips to report income to recipients and to the Canada Revenue Agency.

03

Anyone who needs to report income from various sources as part of their annual tax return.

Fill

form

: Try Risk Free

People Also Ask about

Where to download T5?

How to Get a T5 Online? The easiest way to get a T5 taxpayer slip is online through the financial institution that manages your investment or savings account. You can also get the T5 slip directly from your CRA account. Go to CRA's official website and log in to your account.

How do I create a T5 slip?

Steps to preparing the T5 slip Fill in the recipient's full name and address. Indicate the payer's (the name of your corporation) name and address. Specify the year in which the dividend or payment was received. Establish whether or not the dividend paid is eligible or non-eligible.

How do I get a T5 form?

Steps to access your T5 through online banking Under the 'My Accounts' list in the left hand column, click 'View e-Documents' Under the 'Documents' listing, locate your T5 and click the related link. Reference the warning and click the 'Continue' button. View, print or save your T5 as required.

How do I file a T5 summary?

Filing the T5 Summary If you file 1 to 50 T5 slips, we encourage you to file over the Internet using Web Forms or Internet file transfer. However, you can file up to 50 T5 slips on paper. If you file more than 50 T5 slips for a calendar year, you must file the T5 information return over the Internet.

WHO issues T5?

A T5 slip must be prepared by a bank or a financial institution, and issued to you (the taxpayer) and to the Canada Revenue Agency (CRA). You use it to report any investment income you have on your tax return.

Why didn't I get a T5?

Not everyone receives a T5 T5's are only issued in situations where you've earned at least $50 of interest income throughout the year. Additionally, interest earned within registered investments (RRSP, TFSA, etc.) won't trigger a T5 since that interest is tax sheltered and doesn't need to be reported as income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada T5 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Canada T5 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send Canada T5 for eSignature?

Once your Canada T5 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit Canada T5 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share Canada T5 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is Canada T5?

Canada T5 is a tax form used to report various types of investment income, including interest, dividends, and certain other types of income earned by individuals or entities.

Who is required to file Canada T5?

Payers of investment income, such as banks, investment firms, and corporations, are required to file a T5 slip for individuals or entities who received reportable investment income during the tax year.

How to fill out Canada T5?

To fill out the Canada T5, you need to enter the recipient's information, including their name, address, and identification number, along with the type and total amount of investment income paid during the year on the appropriate boxes in the form.

What is the purpose of Canada T5?

The purpose of Canada T5 is to provide the Canada Revenue Agency (CRA) with information about the investment income earned by individuals, ensuring proper taxation and compliance under Canadian tax laws.

What information must be reported on Canada T5?

Canada T5 must report the recipient's name, address, and identification number, the type of income earned (such as interest or dividends), the amount of income paid, and any applicable tax withheld, if any.

Fill out your Canada T5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.